- Citizens Announces Leadership Transition in New Hampshire and Vermont, Names Marc Lubelczyk Market President

- Managing C&I Risk in a Time of Pandemic

- CIBC Welcomes New Business Development Officer to US Asset-Based Lending Team

- CIT Northbridge Provides Financing to Mohawk Fine Papers

- Gordon Brothers Welcomes Joe Massaroni as Conrad Lauten Retires

Context Business Lending Announces New Co-Chief Credit Officers and Risk Management Executive Talent to Support Their Exponential Growth and New Approach to Specialty Finance Asset-Based Lending (ABL)

Context Business Lending (“CBL”), a leading family office-backed specialty finance company focused on asset-based lending (“ABL”), announced today new executive talent hires to support its rapid growth during this unprecedented time for the lending market and for small businesses. CBL has developed rapidly the past 24 months into an emerging market leader by investing in technology; data analytics; and human capital. The addition of these four senior executives was needed to support CBL’s exponential portfolio growth over the past two years, nearly quadrupling the size of its portfolio as more middle-market businesses look to asset-based lending as an alternative financing solution.

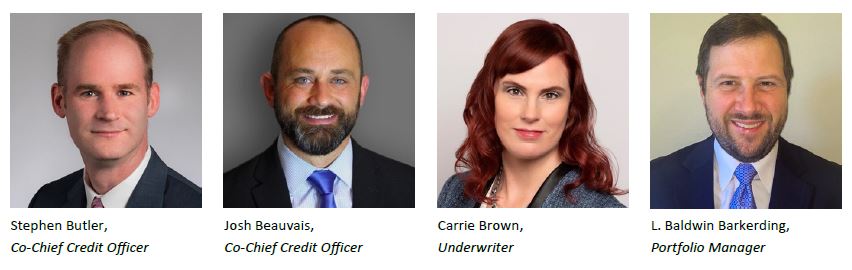

Today’s announcement showcases CBL’s continued investment in people with the addition of Josh Beauvais to the management team and the promotion of Stephen Butler, both serving as Co-Chief credit officers for Context. Through the promotion of Stephen Butler to Co-Chief and a long, selective search process to find his Co-Chief Partner Josh Beauvais, CBL has taken a unique approach to its internal decision-making framework. Stephen Butler has spent the previous three years with CBL and has decades of experience in ABL, having worked for a number of well-known bank and non-bank ABL groups across the country. Josh Beauvais comes to CBL with a long history at Crestmark Bank, most recently as Special Assistant to the Chief Credit Officer, and has over fifteen years of financial service experience, 13 of which are in the asset-based lending space. Josh will co-lead CBL’s new loan review process as well as ongoing borrower relationship management alongside Stephen. Stephen will be based out of CBL’s home office outside of Philadelphia, PA and Josh will be based out of Detroit, MI.

Meredith L. Carter, CEO of Context Business Lending commented, “We believe that having two experienced, creative minds at the helm of credit optimizes our ability to create flexible working-capital solutions and lower our risk.” Carter continued, “Even beyond our co-chiefs, every member of our credit team is empowered to independently analyze risk and challenge long-held ABL practices. We believe that through a collaborative decision-making framework, we can better maximize creativity and manage risk.”

In addition, CBL recently hired two additional experienced members of its credit team: Carrie Brown as Underwriter and L. Baldwin Barkerding as Portfolio Manager. Carrie Brown spent the previous twelve years of her career with Sterling Commercial Credit and brings her experience to enhance CBL's Underwriting team. Baldwin comes to CBL with over a decade of experience in banking, and spent the last six years as a portfolio manager at Crestmark Bank. Carrie will be based out of Detroit, MI and Baldwin will be based out of New Orleans, LA.

CBL's team and portfolio growth cement its position as a vibrant, creative entrant to the national non-bank asset-based lending industry. Carter added, “as Albert Einstein wisely pointed out, ‘the definition of insanity is doing the same thing over and over again, but expecting different results.’” CBL sees the largely unchanged asset-based lending world in a similar light. By creating good decision-making frameworks and attracting experienced talent with a shared desire to do better than the status quo, CBL vows to innovate the industry. As its tagline succinctly puts it - Consider ABL Disrupted ®.

About Context Business Lending, LLC

Context Business Lending is a family office-backed specialty finance company focused on providing flexible working capital for lower middle market businesses that do not qualify for traditional bank financing. For companies that are liquidity strapped, have tripped covenants, require additional flexibility and/or are in seasonal businesses, CBL leverages accounts receivable, inventory, machinery and equipment and owner-occupied commercial real estate companies to provide $1MM-$50MM asset-based loans. During this period where COVID-19 is having a profound impact on working capital needs of many businesses, Context Business Lending is increasingly flexible and continuing to take a holistic view of a businesses’ challenges and opportunities. CBL national in scope and sector agnostic and works with businesses in the manufacturing, distribution, wholesaling, consumer products, firearms, e-Commerce and service industries. To learn more, please visit www.ContextBL.com.