- Avid Technology Announces Closing of Debt Refinancing Resulting in Expected $10 Million Annual Interest Savings

- Webster Announces Chief Risk Officer Transition

- U.S. Bancorp (NYSE:USB) Names Adam Graves Senior Executive VP in Strategic Role Expansion

- Mayer Brown Continues Growth of Leading Structured Finance Practice in Chicago and New York With Finance Duo From Kirkland & Ellis

- Saks OFF 5TH Closes ABL and Term Loan Facilities to Further Enhance Liquidity

Garrington Group of Companies Announces its Formation and Launch

By Garrington Group of Companies

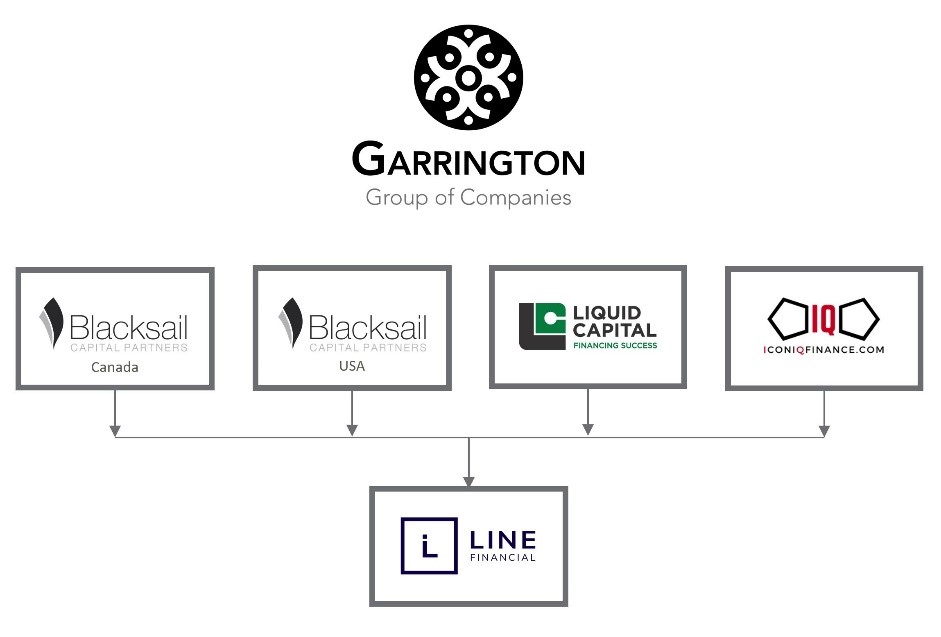

Garrington was established in January 2019 as part of a greater blueprint to develop a leading North American loan origination, underwriting and operations platform; handling asset-based lending, factoring, and specialty finance loans ranging from $1 million to $30 million. Garrington’s creation comes from its acquisition of Liquid Capital at the start of the year.

Garrington’s collective vision is to become the premier alternative SME lender in North America, supporting entrepreneurial companies with creative and optimal lending solutions, while providing a source of capital to support SME business development in North America.

Garrington recognizes the under-served market for small businesses attempting to secure working capital from traditional funding sources, based on the ever-increasing banking regulations governing the lending of money to smaller private and public companies. In addition, Garrington has identified, and is looking to capitalize from, the shift by alternative lenders away from smaller funding needs. Understanding the landscape of commercial financing in North America, Garrington has set in motion a plan to create a niche market to fund smaller borrowers on a large scale by adding further resources to its already large origination platform, in an attempt to reach borrowers right across North America.

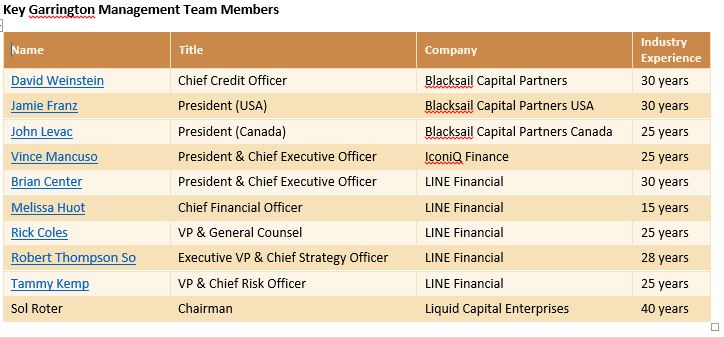

Throughout the last few years, Garrington structured a plan to attract professionals with a deep knowledge and understanding of commercial lending to help shore up an already strong commercial finance organization. Garrington has rapidly expanded over the last year few years, by adding industry professionals and establishing offices outside of the Canadian and US head offices (Toronto and Dallas, respectively), and by creating satellite offices in Montreal, Austin, Buffalo and Westport. Today, Garrington consists of three unique loan origination teams branded as Blacksail Capital Partners, IconiQ Finance and Liquid Capital, each with its own unique value proposition, and made up of a collective team of over 50 experienced loan originators.

Garrington has also created a support platform for its loan origination network by expanding our industry leading credit and administrative group at Liquid Capital via the newly created LINE Financial, providing the three origination firms with the ability to maximize client performance and retention by providing industry-leading portfolio and risk management.

Blacksail Capital Partners

Launching in September 2019, Next Edge Commercial Finance (In North East USA and Canada) rebranded the company name to Blacksail Capital Partners to better reflect the change in ownership and becoming a member of the Garrington Group of Companies. Blacksail was established to complement Liquid Capital’s factoring business to focus on Asset Based Loans ranging from $1 million to $30 million.

A popular phrase taken from the yachting world, “If your sails aren’t black, you’re wearing a polyester leisure suit”. The meaning of this reference is that black sails are made up of carbon fibre typically associated with strength. In lending, with our brand “Blacksail”, we want to project strength and speed in which we work with companies to help fund their needs for business development.

Blacksail will focus its expertise on providing working capital solutions to the underserved small to the mid-sized middle market sector in North America. Serving many industries including; manufacturing, transportation and logistics, staffing, digital media and consumer goods, amongst others, we strive to provide quick access to capital which would typically be more flexible than banks.

With offices in Toronto, Westport and Buffalo, Blacksail’s experienced team can handle inquiries wherever you are in North America.

www.blacksailcapitalpartners.com

IconiQ Finance

At IconiQ Finance, we believe entrepreneurship is the lifeblood of the American economy, and we exist to empower entrepreneurs. In other words, we’re experts at breaking through the unique barriers to sustainable growth emerging companies face. Operating out of Austin, TX we provide revolving lines of credit and equipment term loans from $500,000 to $30 million lending on eligible accounts receivable, inventory and other tangible assets.

Flexible and customized financing solutions from a partner you can trust.

• Asset-Based Revolving Lines of Credit

• Accounts Receivable financing

• Lender Financing to eligible commercial and consumer finance companies

• Term Loans (as an accommodation to a revolving line of credit)

LINE Financial

In 2019, as a part of a corporate restructuring and streamlining, LINE Financial was spun out of Liquid Capital with the sole purpose of providing third party due diligence, portfolio management and back-office services to the Liquid Capital system amongst others. The goal is to be the premier provider of comprehensive commercial finance infrastructure for entrepreneurial and visionary factoring and asset-based lending companies by creating, implementing and fostering premier commercial finance disciplines and processes with and for our clients.

The LINE Financial operations team support loan origination teams with:

• Underwriting & Due Diligence

• Client Asset Management through our risk management team

• Collection & Verification

• Collection & Litigation

• Relationship Management

• Treasury Management

Liquid Capital

Liquid Capital was founded by Canadians – Sol Roter, Barnett Gordon and Brian Birnbaum – who all originally hailed from Montreal, Quebec and moved to Toronto, Ontario in the 1970s. While working in the financial sector during the 70’s and 80’s, the three collectively came to realize how underserved the small and medium-sized business sector was from a banking and lending perspective. From that insight came the dream of Liquid Capital – a company specializing in providing small and medium sized businesses with working capital advances with a twist. The delivery of those lending products and services came through a franchise network of lending and factoring professionals deploying their own funds as key decision-makers – a true rarity in the lending space of "business people truly working with business people".

Over the last 20 years, Liquid Capital has grown to become one of the largest factors in Canada, as well as North America, as measured by factoring volume. Liquid Capital has the largest footprint of factoring and lending professionals in North America.