- Trade Credit Insurance – More than Insurance

- Anatomy of a Deal: Distilling the Right Financial Solution for a Whiskey Business

- Armstrong Flooring Bankruptcy: The Alchemy of Creating Value from Accounts Receivable

- Interview with Gene Martin, CEO, and Mark Forti, Managing Director, Head of Origination at Callodine Commercial Finance

- The Best of Both Worlds: How Community Banks and Asset-Based Lenders Partner to Serve SMEs

How Can Companies Deal with Labor Shortages?

By Juanita Schwartzkopf

As of March 31, 2021 the US Bureau of Labor Statistics reported 8.1 million job openings, with 3.1 million open jobs in the south, 1.8 million jobs in the west, 1.3 million jobs in the northeast and 1.8 million jobs in the Midwest. Private job openings are 7.3 million of the total job openings, with 0.8 million government jobs open. The private job openings are across all industries.

The unemployment rate by state varies dramatically from 2.9% in Nebraska, South Dakota, Utah and Vermont to 8.3% in California, Connecticut, and New Mexico, 8.5% in New York and 9.0% in Hawaii. The overall unemployment rate is 6.1%.

With 9.8 million people unemployed and 8.1 million job openings, it would be reasonable to expect businesses to be able to find employees. However, with the enhanced and extended unemployment rates and with potential mismatches between jobs available and people available by state or locality, many businesses are expressing concerns about hiring and maintaining a necessary work force.

Creativity is key!

Businesses have been forced to be creative to entice new hires and maintain existing staff members. Some of these ideas have been:

- Hiring bonuses.

- Stay bonuses at periodic increments such as 30 days or 90 days.

- Increased hourly rates.

- Reduced employee contribution to benefits.

- Increased benefits offerings, including education benefits.

Higher hourly bonus rates for less desirable shifts, days of the week, or locations.

Employee referral bonuses.

As an example of this trend, Chipotle recently announced wage increases to provide an average hourly rate of $15.00 by the end of June, with starting wages ranging from $11 to $18 per hour. In addition, a program to fast track employees to the highest general manager position, known as the Restaurateur, in as quickly as 3.5 years would result in an employee earning an average compensation level of $100,000 – a clear career path. Chipotle also offers a crew bonus program that gives employees the opportunity to earn an extra month of pay each year they meet performance criteria. Chipotle also established a debt free education program providing up to $5,250 per year for degree programs. Other benefits include 401k matching, mental health benefits and free Chipotle food.

What does this mean to the cost structure?

With labor costs being a significant portion of a company’s cost structure, even minor changes to hourly rates and benefit structures can have a material impact on the financial performance of the company.

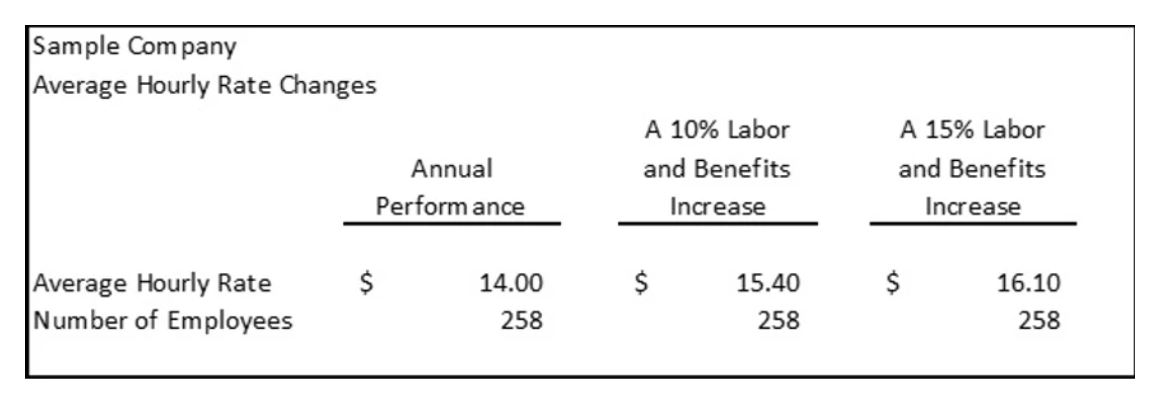

Consider a company with 258 employees with an average hourly rate of $14.00. A 10% increase in labor costs would allow the company to achieve the $15.00 average hourly rate often referred to in the news. A 15% increase in labor costs would bring the average hourly rate to $16.10.

A benefit increase such as a tuition reimbursement program of $5,250 would increase the hourly rate for an individual by $2.52, which for a $14.00 average hourly rate represents an 18% labor cost increase. An average family health insurance premium of $1,500 per month changing from a split from 80/20 to 100/00 would result in an annual employee increase in cost of $3,600 or $1.73 per hour, which for a $14.00 average hourly rate represents a 12% labor cost increase.

Clearly, changes in pay rates and benefit structures have a material impact on the financial performance of a company.

Let’s consider the example of a company with $50 million in annual revenue, expending approximately 15% of revenues for labor and benefits. The company has a strong EBITDA performance of $3.5 million and a fixed charge coverage ratio of 1.32.

A 10% labor and benefits increase would reduce EBITDA to $2.75 million and the fixed charge coverage ratio becomes 1.04. The company would be able to continue to service its debt with this level of increase in costs. Key to this FCCR performance is that no other costs would be able to increase as a percent of revenue.

A 10% labor and benefits increase would reduce EBITDA to $2.75 million and the fixed charge coverage ratio becomes 1.04. The company would be able to continue to service its debt with this level of increase in costs. Key to this FCCR performance is that no other costs would be able to increase as a percent of revenue.

A 15% labor and benefits increase would change the performance of this company dramatically and it would not be able to service its debt based on current lending terms.

Businesses are feeling considerable pressure to find and retain employees, which puts pressure to increase hourly rates and benefit plans at the top of mind. If management does not understand how minor changes can impact performance, the company and the lender could be surprised.

What can a company do?

Companies need to explore all the tools they may have at their disposal. To improve performance and offset increased labor costs, the company could:

- Increase sales prices.

- Reduce nonlabor related costs.

- >Reduce locations for example.

- Increase automation.

- >Evaluate return on investment, and additional debt requirements.

- Analyze a trade-off between hourly rate changes, benefit increases, and overtime dollars.

- Outsource labor or materials to a lower cost producer .

- Improve the operating cycle to reduce the need for debt, and related interest expense.

The labor market is going to continue to be a challenge for companies. Financial performance impacts will be felt by the company and by its lenders. To help evaluate cost structures and operating decisions, contact us. Solving the labor issues is going to be one of the most important projects businesses undertake this year.