A Closer Look at Retailer Resilience During the COVID-19 Pandemic

By \Rick Edwards and Liz Sarhaddi-Blue

Published October 2020.

Retail has taken a huge hit from COVID-19. What sectors are expected to survive, even thrive? What areas are likely to be hardest hit as the pandemic continues?

Much has been written about the significant impact of the COVID-19 pandemic on the retail sector, as policymakers encourage consumers to wear masks and remain vigilant when leaving home, e-commerce sales have soared, and supply chain concerns persist. Retailers have been challenged to maintain operations and attract current “homebody” consumers, more than 68 percent of whom planned to continue their at home habits after restrictions were lifted, according to a study by management consulting firm McKinsey & Company.1

The COVID-19 pandemic is having a more deleterious effect on retailers that were already facing pre-pandemic hurdles such as high debt loads, sector shifts away from core offerings, and slow progress toward digital sophistication. By contrast, companies that entered 2020 with strong e-commerce channels, favorable product sentiment, and stable cash flows with the ability to meet four-wall expenses2 and other obligations, are better managing the pandemic. In addition, certain parts of the retail landscape—mainly essential services and home-related items—have been growing throughout the crisis, as demand in these areas has jumped.

Advantage to Essential Services Retailers

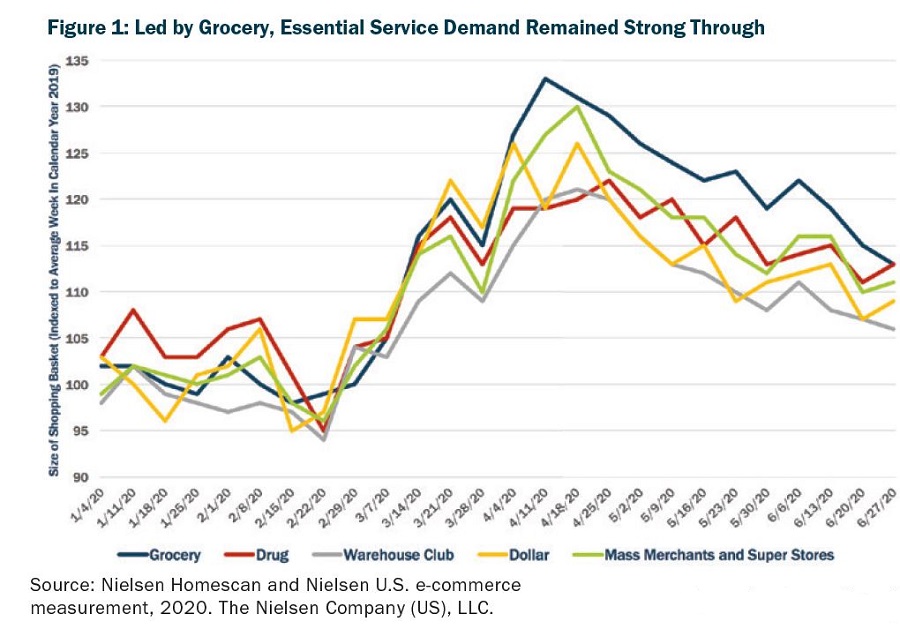

A principal theme is that demand for essential services such as food, nonalcoholic beverages, and healthcare has remained robust throughout the pandemic (Figure 1). Sales at grocery stores, convenience stores, and broadline retailers have soared as consumers have stocked up on items considered indispensable. By contrast, from early April to mid-June, Americans reported less and less intent to return to spending on “discretionary” categories in the near term, according to the McKinsey study.

Looking specifically at grocers, the groundswell of consumers forced to shift away from restaurants toward eating at home due to nationwide closures also increased sales. According to Goldman Sachs survey data, in mid-March, less than half of U.S. consumers said they cook at home, but by the end of March this figure had risen to more than 75 percent.3

For their most recent fiscal quarters, large grocers Albertsons Companies Inc., The Kroger Co., and Publix Super Markets Inc. reported hefty same store sales growth (excluding fuel) of 26.5 percent, 19 percent, and 20 percent, respectively. By the end of May, smaller grocers were typically posting revenues more than 20 percent higher than in 2019, versus 5-percent revenue declines at other small business retailers, according to JP Morgan.4

Of course, essential service retailers with efficient delivery, curbside pickup, and buy-online-pick-up-in-store (BOPIS) platforms have been best positioned to weather the crisis (Figure 2). Companies weaker in these offerings had to swiftly expand them; for example, Bed Bath and Beyond rolled out and expanded its BOPIS and curbside pickup offerings to help meet 100-percent growth in digital sales in April and May. Smaller retailers without robust delivery platforms partnered with firms like San Francisco-based Instacart to meet rising demand. For the first week of April 2020, Instacart reported a 300-percent rise in customer volume year-over-year.5

Even the largest retailers had to adjust or further develop their supply chains, digital offerings, or BOPIS services this year—adjustments that came at a cost. For example, Target Corporation reported blockbuster same-store sales growth of 24.3 percent in its second fiscal quarter ending August 1, 2020, comprising 10.9-percent in-store growth, 270-percent same-day delivery or BOPIS services growth, and 195-percent digitally originated growth. However, operating margin for the first two quarters of 2020 fell 30 basis points versus the same period in 2019. Still, Target and many of its peers have been nimble enough to meet the dramatic rise in activity that occurred very quickly, helping to build loyalty from new and existing customers that will likely last well beyond the pandemic.

Retailers Well-Positioned In Digital

In June 2020, U.S. online sales reached $73.2 billion year to date, up 76.2 percent from the same period a year earlier, according to credit rating agency Standard & Poor’s. Overall, four out of five consumers have shifted their in-store shopping online, according to an April survey from global research and advisory firm 451 Research.6 U.S. Census Bureau data for the second quarter of 2020 showed e-commerce growth of 44.5 percent over 2019, while total retail sales decreased 3.6 percent in the same period. Additionally, e-commerce as a percentage of total sales jumped to 16.1 percent as compared to 11.8 for the first quarter 2020.

Data shows that companies with bold digital strategies have had higher sales and operating profit over the past few years,7 and the COVID-19 pandemic has continued that trend. The increase in e-commerce demand has led to better performance from retailers with well-built, efficient digital platforms in place before the pandemic. In 2019, nearly half of businesses surveyed by 451 Research did not have a formal digital transformation strategy and were not actively digitizing business processes and technologies.8 For companies that 451 Research deemed “digitally delayed” prior to the pandemic, 46 percent stated that digital transformation was still not in the plan.9Meanwhile, larger retailers like Walmart Inc. and Target Corporation entered the pandemic with strong online platforms and fared better in consumers’ shift online. That said, even companies with years of progress in digitization were forced to expand their platforms rapidly in recent months, with a quarter of “digitally driven” companies reporting an acceleration in according to 451 Research.10

Focus on Value-Oriented Retailers

The pandemic has prompted greater price consciousness from U.S. consumers. As consumers have sought value in their purchases, some consumer demands have shifted. While lower discretionary income typically helps value-focused retailers (as seen in the global financial crisis), dollar stores and other discount retailers have faced social distancing challenges to manage the influx of new business. Per company financial reporting, Dollar Tree Inc. and Dollar General Corp. both generated strong sales growth during the pandemic.

For example, Dollar Tree reported comp store sales growth of 7.1 percent for the first half of 2020 on top of positive growth over the same period in 2019, with a gross margin increase of 1.8 points for the 13 weeks ended August 1, 2020. Similarly, Dollar General posted year-to-date comp stores sales growth of 21.7 percent over 2019 as of July 31, 2020. In April 2020, Five Below Inc. announced that it would continue its store expansion plans, but at a lower level, with an intent to open 100 to 120 stores versus the 180 stores originally targeted. The company has since furloughed employees and canceled or delayed orders to manage inventory levels.

That said, during the summer months promotional activity lessened, as many essential items became hot commodities. Only 21 percent of fast-moving consumer goods were sold on promotion in June 2020 versus 30 percent in June 2019.11 However, basket sizes have come down from peak pandemic levels,12 and as scarcity wanes for some of the most sought-after products, stores will need to reset and be attuned to price elasticity.

Home-Centric Products Prevail

Travel restrictions, work-from-home policies, and business closures have kept consumers at home and elevated demand for domestic products. In the U.S., more than three quarters of businesses implemented policies including travel bans (81 percent) and expanded work-from-home policies (75 percent)13 some of which extend into 2021. Companies offering home-centric products have exhibited resilience due to ongoing needs from consumers.

Home Improvement

Home confinement spawned a rash of do-it-yourselfer commencing small home-improvement projects, leading to increased demand at companies such as The Home Depot Inc. and Lowes Companies Inc. These companies had advanced digital platforms before the pandemic, allowing them to meet the boom in online orders. For the second fiscal quarter of 2020, Home Depot reported a comparable store sales increase of 23.4 percent, while Lowe’s reported an increase in U.S. comps of 35.1 percent for the same period.

Home Office

Office equipment has also increased in demand, given new requirements for home office setups, leading to resilience at stores like Staples Inc. and The ODP Corporation (Offi ce Depot). Office Depot reported a 17-percent sales decline in the second quarter of 2020, but this topline contraction included double-digit growth in e-commerce sales.

Sporting Goods

The broad shift to working out at home has kept sporting goods stores afloat, especially those with rich online platforms. Throughout the pandemic, people have been encouraged to be outside, which has expanded the demand for outdoor fitness equipment. Without team sports, demand for individual fitness equipment has ratcheted higher and boosted online sales at stores like Dick’s Sporting Goods Inc. Dick’s online revenues shot up 110 percent in the first fiscal quarter ending May 2, 2020, though overall same-store sales fell 30 percent due to brick and- mortar store closures and reduced customer foot traffic. However, sales rebounded as stores reopened in June, with comps increasing 20.7% for the second quarter ended August 1.

Weights, personal fitness trackers, and other home fitness gear have been highly sought after, and big-ticket exercise equipment has also become more in demand due to lockdowns. Recreational services provider Peloton Interactive Inc.’s revenue increased 66 percent and paid subscribers rose 64 percent in its third fiscal quarter ending March 31, 2020. Peloton also raised its fiscal 2020 guidance on strong performance. Of course, sporting goods stores with more developed direct-to-consumer platforms, such as Nike Inc., have been better able to offset topline weakness from store closures. For its fourth fiscal quarter ending May 31, 2020, Nike revenues fell 38 percent, as approximately 90 percent of Nike brand stores across major geographies were closed for about eight weeks. However, this sales decline included 79-percent growth in Nike digital, representing about 30 percent of total revenue. The company had previously targeted reaching 30-percent digital penetration by 2023, but the timeline has accelerated due to the pandemic, as company management now expects to reach 50-percent digital penetration in the foreseeable future.

Overall in the U.S., sporting goods and leisure year-over-year sales growth was 17.8 percent in July 2020, according to the U.S. Census Bureau, as lockdowns eased and consumers could return to stores. However, like all brick-and-mortar retailers, sporting goods stores have had to fund additional labor and safety costs and prepare for the removal of lease relief. Dick’s was one of many retailers shoring up liquidity due to pandemic-related costs; Dick’s expanded its revolving credit facility by $255 million and drew down $1.4 billion in response to the pandemic. Nike issued $6 million of senior unsecured notes, increased its commercial paper program by $2 billion, and entered a new $2 billion revolving credit facility.

Looking ahead to a COVID-19-influenced holiday season, consumers can look to projections for guidance on what to expect. Research organization The Conference Board offers an optimistic scenario in which the U.S. gross domestic product growth momentum seen from May through August is sustained for the remainder of the year, albeit at a slower pace. This outlook contemplates a swoosh-shaped recovery for the U.S. economy, which projects a strong rebound of 6.9 percent in 2021. In this scenario, U.S. monthly economic output recovers completely to pre-pandemic levels by January 2021. Although 2021 will likely come in below 2019 in absolute dollars, these numbers reflect a recovery all hope to see.14

1 McKinsey & Company survey based on data collected in the U.S. from July 30 through August 2, 2020, sampled and weighted to match the U.S. general population age 18+, www.mckinsey.com/business-functions/marketing-and-sales/our-insights/survey-us-consumer-sentiment-duringthe-coronavirus-crisis.

2 The term four-wall expenses refers to direct costs required to operate a brick-and-mortar store, such as rent, utilities, and wages.

3 Remarks from Katherine Fogertey, Restaurants Research Analyst, Goldman Sachs Global Investment Research on a Launch with GS podcast data April 8, 2020.

4 Small Business Financial Outcomes during the COVID-19 Pandemic, JP Morgan Chase & Co., July 2020, institute.jpmorganchase.com/institute/research/small-business/report-small-business-financial-outcomes-during-the-covid-19-pandemic.

5 Erika Adams. “Instacart Adds More Flexible Delivery Options As Customers Struggle to Place Orders,” April 8, 2020, ny.eater.com/2020/4/8/21213463/instacart-grocery-delivery-app-updates.

6 451 Research’s Macroeconomic Outlook, Consumer Spending Survey, dated April 2020 based on 1,151 complete responses from consumers in the U.S. and Canada between April 1, 2020, and April 13, 2020.

7 Simon Blackburn, Laura LaBerge, Clayton O’Toole, and Jeremy Schneider, “Digital Strategy in a Time of Crisis,” McKinsey & Company, April 22, 2020, www.mckinsey.com/business-functions/mckinsey-digital/our-insights/digital-strategy-in-a-time-of-crisis.

8 451 Research’s Voice of the Enterprise: Customer Experience and Commerce, Digital Transformation survey based on 636 respondents.

9 451 Research’s Voice of the Enterprise: Digital Pulse, Coronavirus Flash Survey dated June 2020 conducted between May 26, 2020, and June 11, 2020, based on 575 complete responses from pre-qualified IT decision-makers.

10 Ibid.

11 “Predicting the COVID-19 Behavioral Reset,” Nielsen CPG, FMCG & Retail, August 6, 2020, www.nielsen.com/us/en/insights/report/2020/predicting-the-covid-19-behavioral-reset (data for period ending June 14, 2020).

12 Ibid.

13 451 Research’s Voice of the Enterprise Digital Pulse Coronavirus Flash Survey dated March 2020 based on 820 responses from IT decision makers from organizations in a range of sizes, geographies, and markets.

14 The Conference Board Economic Forecast for the US Economy, September 9, 2020, www.conference-board.org/research/us-forecast.