Part I: Supply Chain Clog Continues as Companies Look Back & Beyond 2021

By Ulos Anderson, Senior Managing Director, Commercial & Industrial

Key Takeaways

- The ongoing COVID-19 pandemic has shed new light on supply chain challenges, and, in many cases, made them more acute.

- The U.S. manufacturing sector continues to rebound from the initial shock caused by spring 2020 lockdowns. As manufacturing rebounds, the ongoing pandemic has had a significant effect on the shipping component of supply chains, which comes at a time of significant consolidation in the industry.

- Already stressed supply chains could face even more pressure with shipping priority given to the distribution of COVID-19 vaccines.

- Carriers have cautioned Gordon Brothers it’s still too early in 2021 to evaluate freight trends from the West Coast. They’re seeing a slight dip in rates from the second and third quarter 2020 but not at typical pre-pandemic levels.

- With e-commerce and online shopping at all-time highs, more drivers are needed to meet the growing demand for freight.

- Gordon Brothers expects the seasonal inventory product backlog to continue as it has been for the last year as companies continue to work through their overstock to repair any damage and improve their supply chain networks.

The COVID-19 pandemic has weighed on the global economy, created volatile indexes, clogged supply chains, shuttered factories, disrupted shipping and limited the sale and movement of goods worldwide. Since supply chains are complex systems of manufacturing, transportation, equipment, personnel and processes to move products from one location to the next within a strict time frame, the past year has created major bottlenecks and bubbles.

The economic impacts of the pandemic became more severe and widespread with each new outbreak in 2020. With more shutdowns imminent in 2021 as new, more contagious strains of the coronavirus spread, supply chain and economic challenges will continue, hurting earnings and further destabilizing struggling retailers. At the same time, these challenges have created paths to profitability for those who have the capacity to operate. Retailers and consumers alike will likely continue to experience delays, an uneven supply of goods, elevated prices for certain items and discounts on others.

In this article, Gordon Brothers’ inventory and valuation expert Ulos Anderson reviews past and current supply chain stresses, manufacturing and shipping irregularities and the pandemic’s continued ramifications on supply and demand across industries and asset types for those in the banking, lending and restructuring industries.

A follow-up article will cover trade with China and demand for Chinese goods, which have soared amid pandemic lockdowns and holiday shopping. To learn more about the headwinds discussed in this article and China’s influence, Anderson will be participating in SFNet’s Crucial conversations webinar titled Supply Chain Disruption: Implications and Workarounds on February 19.

U.S. Manufacturing Rebounds Amid Ongoing Supply Chain Stress

The U.S. manufacturing sector continues to rebound from the initial shock caused by spring 2020 lockdowns. The December 2020 Institute for Supply Management® (ISM) Manufacturing Report On Business® (ROB) registered 60.7%, up 3.2 percentage points from the November reading of 57.5%, indicating expansion in the overall U.S. economy for the eighth month in a row after contracting in March, April and May[1].

While companies and suppliers continue to operate, short-term shutdowns to sanitize facilities and difficulties in hiring or rehiring workers are causing strains and limiting manufacturing growth potential, according to Timothy R. Fiore, CPSM, C.P.M., Chair of the ISM Manufacturing Business Survey Committee in the December ROB[2].

Already stressed supply chains could face even more pressure with the shipping priority given to the distribution of COVID-19 vaccines. Even current vaccine supply chains and required refrigerated carriers may not be adequate to meet demand. The availability and cost to move freight will be affected, and price increases are expected throughout the chains.

Shipping Volumes Soared Despite Fewer Options

As manufacturing rebounds, the ongoing pandemic has had a significant effect on the shipping component of supply chains, which comes at a time of significant consolidation in the industry.

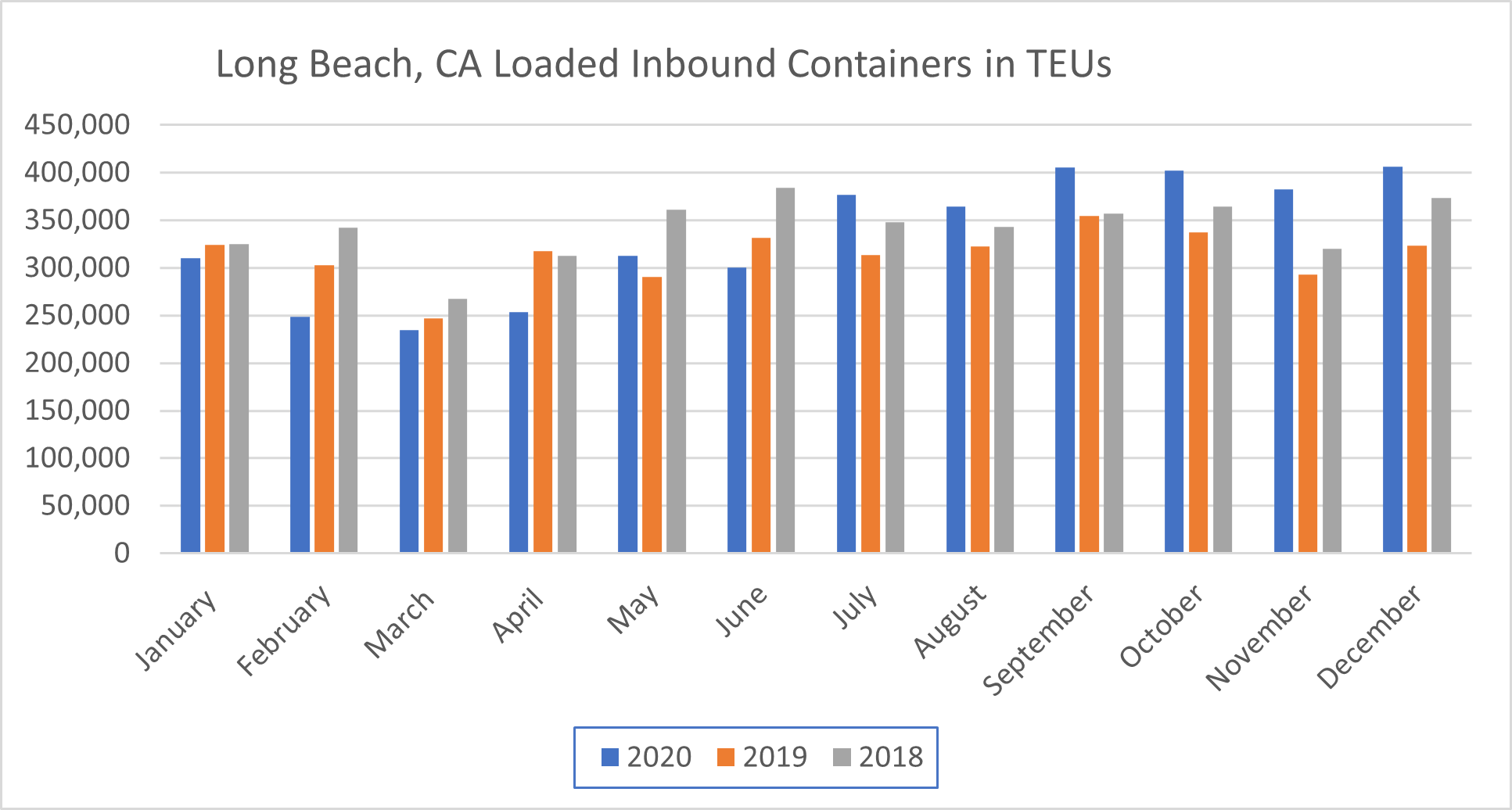

Amid the peaks and valleys in U.S. consumer demand, larger ports in Long Beach, CA experienced corresponding surges and lulls. This demand led to unusually high volume in 2020 as companies replenished their inventory depleted from shipping disruptions during China’s pandemic and ahead of the holidays, which caused backlogs and delays.

September, October and December were among Long Beach’s busiest months in the past three years, breaking carrier records. Shipping levels for 2020 were up 4.7% year over year (YoY) despite drops of 18% in February during China’s factory closures and 20% in April during U.S. lockdowns[3].

TEUs: 20-foot-equivalent unit or 20-foot-long cargo container

Source: Port of Long Beach statistics

At the nation’s largest port in Los Angeles, volume was down by nearly 3% in 2020 YoY with declines every month from January through July. Volume was off by about 30% in March and May, but was up 22% in November.[4]

Carriers have cautioned Gordon Brothers it’s still too early in 2021 to evaluate freight trends from the West Coast. They’re seeing a slight dip in rates from the second and third quarter 2020, but not at typical pre-pandemic levels. There’s still a substantial backlog of cargo at the major West Coast ports, and in the near term, Gordon Brothers believes there will be little change in a tight shipping supply.

More broadly, the global pandemic continues in a market with far fewer shipping options. Previously, as many as 20 carriers competed in the east-west maritime shipping business. This has been reduced to just three major shipping alliances. The diminished competition enables carriers to manage capacity, effectively giving them stronger pricing power.[5]

At the same time, shipping volatility and consolidation have led to sharp price increases. The land link of the supply chain has seen price increases as well.

Most Chinese goods imported into the U.S. are shipped to destination regions via freight haulers. A significant number of trucks were taken off the road in 2020, following scores of trucking company bankruptcies. Comcar, which had nearly a thousand drivers, and the Celadon Group, which had 2,880 drivers, filed in May and December, respectively.

The shortened holiday week made truckload capacity more difficult to source for shippers looking to move freight before closing the books on 2020. Higher load-to-truck ratios for each segment led to higher rates to end the year[6].

With e-commerce and online shopping at all-time highs, more drivers are needed in 2021 to meet the growing demand for freight. Although more than 100,000 trucking jobs were lost in 2020, Gordon Brothers has already seen half of these jobs come back this year, which will take a little pressure off capacity. Traditional inbound freight weights increased 45%, which will eventually increase consumer pricing and affect companies’ bottom lines.

Additionally, Gordon Brothers saw full truck load freight costs rise from $5,000 to $11,000 for cross-country shipments last year. In one instance, a freight forwarder quoted $9,000 for a California to Mississippi shipment that cost $3,500 in early spring 2020 but eventually settled for $6,900 later in the year.

Sector Disruptions Continue & Companies Consider What’s Next

In total, 94% of Fortune 1000 companies are seeing supply chain disruptions from COVID-19 [7]. Pandemic-related factors, like surging and contracting demand cycle and carrier disruption, have had the greatest impact on the supply chain.

There’s been a moderate increase of input prices while the selling prices of final goods rose at a slight to modest pace in December, according to the Federal Reserve. COVID-19 cases continue to cause ongoing disruptions and delays among short-staffed producers and shippers, which have raised transportation costs that are then passed through to buyers.[8]

Gordon Brothers is hearing of major labor shortages from warehouses that were already short-staffed because of the pandemic with the recent surge in COVID-19 cases in Southern California located near the major ports.

The pandemic has changed how consumers buy goods, what essential goods they spend their money on and shifted their spending preferences fueling strong revenues for retailers that support at-home habits. Household goods including dinnerware, cookware and bakeware have experienced supply-demand imbalances amid a rise in sales with lockdowns. Demand for accent furniture and home decor has risen, but supply is limited. Home fitness equipment and a surge in home improvement projects have led to higher prices and a tight supply of related items.

The electronics sector was particularly hard hit. After 2020 shutdowns, suppliers across Asia struggled to keep up as orders poured in for digital gear to equip home offices and students’ distance learning. Items like webcams that were suffering from declining interest prior to the pandemic were suddenly in high demand and short supply. Although this sector continues to have tailwinds from the pandemic, business growth in China is back on track fueled by the U.S. consumer demand of stay-at-home shoppers.

As we passed the one-year mark since the first COVID-19 outbreak reports, there’s a renewed urgency to fill the supply chain gaps the pandemic exposed. Companies are looking to minimize risk, build resilience and connect with consumers through various means. Artificial intelligence, global demand supply matching technology, omnichannel, updated direct-to-consumer models, lag time reduction and the introduction of supply networks are helping to fill the gaps.

Typically, January through March is known as the quiet season when volume is down. However, with inventory stalled in ports during the pandemic, when new shipments of inventory arrive it’s depleted as soon as it’s restocked. Looking ahead 90 to 120 days, Gordon Brothers expects the seasonal inventory product backlog to continue as it has been for the last year as companies continue to work through their overstock to repair any damage and improve their supply chain networks.

Shipment delays from factories and suppliers affect the mix of inventory on hand. Even if a company’s total sales are up, appraisal values can be negatively impacted if the inventory in the warehouse is not the same mix as the items generating the sales.

Since banks don’t want to lend on high-value items, packaway merchandise might help mitigate inventory fluctuations since it’s purchased with the intent of being stored in warehouses until a later date or the beginning of the same selling season the following year. Packaway purchases could be an effective way to increase the percentage of prestige and national brands at competitive savings within merchandise assortments.

Shedding New Light on Old Challenges

The pandemic has shed new light on supply chain challenges, and, in many cases, made them more acute. In the near term, resiliency, flexibility, visibility, disruption improvements and change management may help mitigate current supply chain stressors.

Longer term, there are signs some companies are looking to diversify supply chains and bring them closer to their markets to reduce risk factors like tariffs, demographic shifts, future product shortages and transportation delays, even if it might increase costs. Some may consider using smaller factories around the world rather than having manufacturing in one place. Going forward, others may increase inventory and add additional domestic sources of supply for critical items.

So far there’s little evidence of more diversified supply chains given the costs, uncertainty and time needed to implement changes. This could ripple through the global economy fueling growth in some area and curbing it in others. Prices for consumer goods could rise, depending on where goods are sourced, and higher inflation and interest rates could follow.

In our next article, we’ll provide a more in-depth look at how trade with China and demand for Chinese goods, which have soared amid pandemic lockdowns and holiday shopping, may affect supply and demand across industries and asset types.

For more on the supply chain headwinds discussed in the article, trade with China and forward-looking trends, mark your calendars for the Secured Finance Network’s Supply Chain Disruption: Implications and Workarounds event on February 19.

Related Articles

Turnaround Time Podcast from TMA NYC: Supply and Demand in a COVID Economy

Supply Chain Disruptions & Other Financial Effects of the Coronavirus

What’s in Store for Post-COVID-19 Retail?

Berta Escudero: “After the crisis there will be fewer players competing for a smaller market”

[1] Institute for Supply Management, December 2020 Manufacturing ISM Report on Business https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/december/

[2] Institute for Supply Management, December 2020 Manufacturing ISM Report on Business https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/december/

[3] Port of Long Beach Statistics https://www.polb.com/business/port-statistics/#latest-statistics

[4] Port of Los Angeles Statistics https://www.portoflosangeles.org/business/statistics/container-statistics/historical-teu-statistics-2020

[5] American Shipper, “Q&A: Inside the early warning system of global trade,” June 4, 2020, https://www.freightwaves.com/news/qa-inside-the-early-warning-system-of-global-trade

[6] DAT Trendlines™, https://www.dat.com/industry-trends/trendlines

[7] Accenture Supply Chain Disruption https://www.accenture.com/us-en/insights/consulting/coronavirus-supply-chain-disruption

[8] US Federal Reserve, Beige Book December 2, 2020, https://www.federalreserve.gov/monetarypolicy/files/BeigeBook_20201202.pdf