Transformational Change and Crisis Costs Weigh Heavily on Both Sides in Stressed and Distressed Retail/Supplier Relationships

By Ben Nortman and Ian Fredericks

As we look toward the horizon and the point at which the COVID-19 curve will flatten here in the U.S., it is difficult to digest that more than 40% of retail square footage in the country is currently closed for business. According to research firm Global Data Retail, retail sales are expected to be down 12.4% for March, 11.6% in April and 6.1% in May; and that may be somewhat optimistic based on information now coming from the CDC. All told, by some current estimates, close to 15,000 retail stores may ultimately close their doors for good this year.

By comparison, retail store closings announced in 2019 totaled near the 9,000 mark, an increase of nearly 60% from the previous year and, notably, the largest number recorded since such data has been tracked in the U.S., according to CNN Business. Among other contributing factors, mounting debt brought on as part of necessary transformation initiatives and the associated strategies pursued by both private equity investors and longtime management, have had a crushing impact on retailers across the country in recent years.

Case in point, in the early stages of developing this article, prior to any pandemic-driven stay at home or business closure actions being taken in the U.S., a 60-year-old furniture retailer, one of the Midwest’s largest with almost 180 stores, announced that it was shuttering all of its locations.

A private equity firm based on the east coast had acquired a majority stake in the company in 2017, after which the retailer engaged in a significant expansion strategy that included buying competitor chains and opening new stores in the very locations vacated by other retailers who had experienced a similar ultimate fate.

To be certain, these are tricky times for senior leaders at the helm of retail and consumer goods behemoths as well as for those that invest in these businesses and drive strategy. Accurately forecasting the scope of the liquidity crisis requires answers to questions that remain unknown at this point in time. How long will this overall “hibernation” period — as many are now calling it — last? When will retail stores open nationally? How quickly will consumers reengage with those retailers? And, how long will it take until retail returns to some level of “normalcy”?

At present, we expect to see comp sales during the first 30-days following a national retail re-start down by approximately 80%; at 60-days out, down by 50-60%; at 90-days out, down by between 25-40%. The hope is that comp sales will slowly build to flat by some time in Q4 2020, but at this point that may be optimistic because the future is so uncertain. Of course, we could return to a level of normalcy sooner, in which case these numbers may be too conservative.

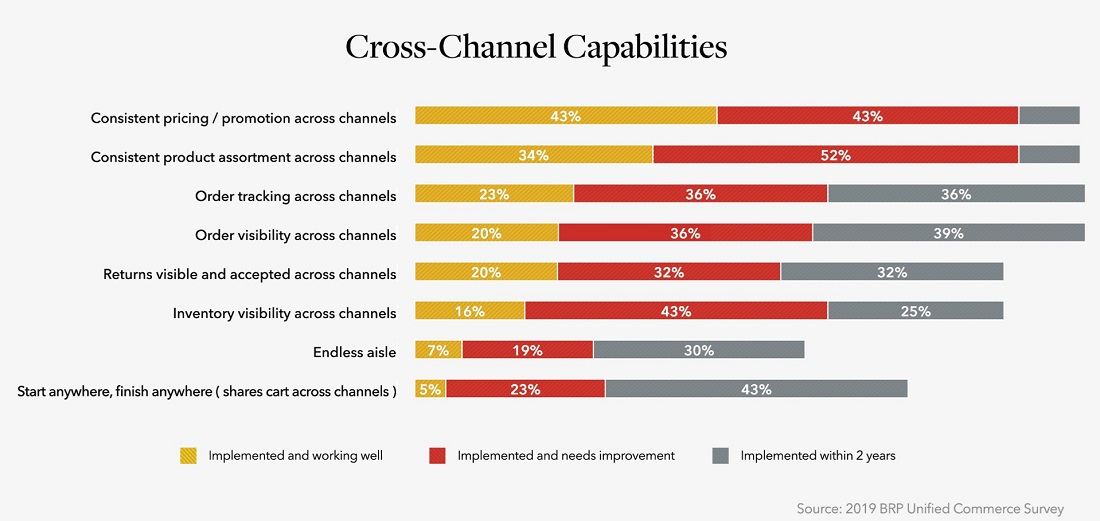

When things do return back to “normal”, retail customers who wanted the ability to conduct their shopping in a seamless fashion across every channel before the crisis will in fact begin to demand it. In 2019, 86% of consumer respondents in a BRP Unified Commerce Survey expressed interest in a personalized and consistent experience across all shopping channels. Indeed, the ability to easily cross channels as consumers research, shop and purchase was important with (i) 82% of consumers who shopped online or via mobile and then purchased in store (webrooming), and (ii) 56% who shopped a store and then purchased online or via mobile (showrooming).

Yet, heading into the crisis, only a small percentage of retailers, by most counts less than 10%, provided such an experience, and for good reason. For starters, beginning a sale in one channel and completing it in another was barely on the radar screen as a consideration when many retailers made their first move into e-commerce. Adding to the problem, many companies’ follow-on mobile apps and other implementations were created in a bit of a vacuum when viewed through the lens of current interoperability expectations. As a result, seamlessly synching today’s customer experience across channels such as these and others is no small task from either a financial, systems, or scope standpoint.

Source: Forrester Research-The State of Retailing Online 2019: Omnichannel, Marketing and Personalization.

And for those who may think that this is an issue only in terms of serving today’s younger consumers, it should be noted that omnichannel engagement has become a cross-generational expectation. In fact, according to a 2019 study by the CMO Council in partnership with Pitney Bowes, some 91% of consumers overall indicate that omnichannel experiences are either important or critical to them, while 29% suggest that companies should be where they want, when they want, and ready to share and communicate in the manner they, the consumer, expects.

Translation for retailers? As we move past a (hopefully) flat Q4 and into some level of growth again in 2021, retailers need to be prepared to engage and meet consumer research, shopping and purchase expectations via touch-points ranging from traditional mail, in-store, web, phone, email, social media and increasingly popular and intricate video-centric experiences.

While the omnichannel experience itself is crafted for the end user, optimizing it is a complex, costly and painstaking endeavor that requires far more than a focus on the consumer. Among other things, managing inventory effectively across all channels is of paramount importance to delivering an optimal omnichannel experience for buyers. Doing so means ensuring that vendors, those working in the store, in call centers, the warehouse and points in between, have access to stock levels, inventory, logistics and related data to enable them to obtain information about where products are and will be at any point in time.

On a widespread basis, mounting capital expenditures associated with building or enhancing the e-commerce channel and improving stores to meet customer expectations will continue to drive the need for additional liquidity that retailers may believe they do not have. Yet, the reality is that even in extraordinary times like these, most companies possess certain assets with as-of-yet unrealized economic potential that can be tapped to fund the capital and other expenditures they need to make in order to drive customer engagement and sales. Even many of the largest and most sophisticated companies, however, fail to recognize this potential or struggle identifying a viable approach to access the funds required for these needed endeavors. This may be exacerbated by little to no cash coming in the front door during the COVID-19 pandemic. To offset this, many businesses are drawing down their lines of credit, but these companies could quickly burn through these funds. Some analysts have suggested that most department stores, for example, have only 6-8 months of cash reserves on hand (including cash from borrowings), depending upon their burn rate.

Strategic Debt Placement & Inventory Procurement

In instances such as these, we have seen that retailers can greatly benefit by augmenting an existing ABL facility with FILO (First-in-Last-Out) loans or term loans designed to unlock the maximum asset value of their holdings. Since this expertise rarely exists within a retail organization itself, from a best practices perspective, doing so effectively often requires engagement of a third party resource that possesses the requisite knowledge and experience. At ReStore Capital, we serve Retail and Consumer Products industry leaders in this capacity to develop and leverage innovative, yet highly practical, strategies that unlock the additional untapped value within their companies’ existing assets. Working in close partnership with prospective borrowers throughout this process, we utilize a variety of approaches that range from mezzanine loans with option or warrant based equity-upside and asset-secured term loans designed to assist with longer term initiatives or restructurings, to bridge loans designed to meet short-term capital needs. While mezz and term loans are often used for CapEx or other investment that will enable the business to grow and ultimately create more profit, reduce costs and enhance enterprise value… in the current environment, an approach such as a bridge loan may be better suited for short-term liquidity needed to “keep the lights on” if stores remain closed on a widespread basis beyond April 30th, with no date certain as to when they will be able to reopen.

On the other side of this equation, we have observed all-too-often in recent years, situations where the stress or distress - or even the perceived stress or distress - of a retailer has a cascading effect on the vendors and manufacturers with which it does business. Given existing retail climate challenges and the additional uncertainty now presented by the current COVID-19 outbreak, there exists today among suppliers a heightened sensitivity in this regard that can prove highly detrimental to both suppliers themselves as well as to the retailers upon whom they rely to move their products.

Under normal or moderate circumstances, for example, a supplier might choose to sell receivables associated with an individual customer, or a group of customers, to a “factor” in order to optimize its own cash flow or insulate itself against the potential of those retailers defaulting. In taking this step, suppliers weigh the downside of accepting only a percentage of the full receivable value against the upside of the cash flow or protection they receive. Alternatively, they may choose to secure trade/credit insurance for a fixed premium, specifically to protect against concerns of a retailer’s pending default.

As a premiere partner to both leading retailers and those along the supply chain, at ReStore Capital we are often among the first to identify evolving trends that hold significance for the industry and those on both sides of the retail equation. In the current climate, ReStore is now noting the following: 1) We are approaching a timepoint where some retailers will be at risk of missing an entire selling season. With stores already stocked with spring merchandise that they are unable to sell, retailers may not have the funds to bring in summer or fall inventory; and 2) Even leading into the current crisis, an increased incidence of situations where broad-based knowledge of a retailers’ stressed or distressed position was making it expensive or undesirable for factors and insurers to engage. We can expect this condition to have worsened by the time we emerge from the current environment.

As a premiere partner to both leading retailers and those along the supply chain, at ReStore Capital we are often among the first to identify evolving trends that hold significance for the industry and those on both sides of the retail equation. In the current climate, ReStore is now noting the following: 1) We are approaching a timepoint where some retailers will be at risk of missing an entire selling season. With stores already stocked with spring merchandise that they are unable to sell, retailers may not have the funds to bring in summer or fall inventory; and 2) Even leading into the current crisis, an increased incidence of situations where broadbased knowledge of a retailers’ stressed or distressed position was making it expensive or undesirable for factors and insurers to engage. We can expect this condition to have worsened by the time we emerge from the current environment.

Unlike factors and insurers, the breadth of ReStore’s experience enables us to approach challenges such as these from an informed recovery value perspective rather than from the traditional risk of nonpayment standpoint. This frequently makes it possible for us to step into the middle of a vendor/retailer relationship where others cannot, to provide a unique, inventory procurement-based solution to our clients. Leveraging our affiliates’ expertise in asset valuation and disposition, to put it in other terms, we will underwrite the value of specific assets based on a thorough assessment of what those assets would recover in a liquidation scenario, should it become necessary.

By selling their goods directly to ReStore Capital at an agreed-upon discount to value, suppliers concerned about credit risks can receive either the shortened risk-free terms they require or even COD. This enables them to remain insulated from any downside risk associated with a given retailer and maintain historical cash flows. Moreover, the retailer is able to procure goods that might otherwise be unavailable due to liquidity constraints and/or credit concerns.

Under this approach, ReStore Capital will hold title to the goods and make them available for purchase in the retailers’ stores/online, but the retailer pays nothing until the goods sell. In exchange, once the goods sell, ReStore Capital receives the cost of the goods, plus a small share of the retailers’ gross margin. This creates a winning combination of positive cash flow, product on hand to display in-store and drive traffic and improves retailers' GMROI (Gross-Margin-Return-on-Investment).

We encourage you to become familiar with all of the options available to fund and protect your business in these tumultuous times. In doing so, it’s important to remember that many industry best practices considered “tried and true” today, were “nuanced and new” only yesterday. At ReStore Capital, we strive to bring fresh, strategically-creative thinking to the industry and our clients every day; and we follow that up with a dedication to precise execution to drive value in everything we do.

If you feel that a stressed or distressed situation is, or may soon be, inhibiting your business potential, give us a call. Chances are we can assist your need directly or even help you to assist your counterparts on the other side of supplier/retailer equation to your mutual benefit.

ReStore Capital is a commercial finance and alternative investment firm providing capital solutions to leading retailers and consumer products companies. Directly, and through its affiliates, the company leverages decades of retail and wholesale consumer goods and brand expertise to provide and unlock additional capital for inventory procurement, capex improvements, expansion and turnaround initiatives and debt refinancing.

About the authors:

Ben Nortman is respected as an expert in structuring complex lending, asset acquisition and disposition transactions. He co-founded Restore Capital in 2019 with Ian Fredericks, and in his numerous roles within Hilco Global, has helped companies, their lenders and professional advisors structure transactions to maximize returns on inventory, machinery and equipment, real estate and accounts receivable for nearly 25 years. Since bringing his expertise as a Chicago bankruptcy and creditors’ rights attorney to Hilco in 1996, Ben has structured and managed some of the largest and most complex asset based transactions in North America and has worked to acquire and reinvent numerous iconic brand names, including Sharper Image, Tommy Armour Golf, Bombay Company, Linens ‘N Things, Polaroid and Aéropostale. He can be contacted at bn@restore-cap.com and 847-849-2950.