Will the Coronavirus impact your borrowers?

By Juanita Schwartzkopf

Do not underestimate the impact of the Coronavirus on a company’s Q1 and Q2 2020 financial results. The supply chain issues are unknown, the potential economic slowdown is unknown, and the length of time the impact will be felt is unknown.

This will certainly be a standard excuse for performance weakness that will be heard over the next year. Be prepared!

As a lender, which borrowers do you consider for impact, and what do you do to stay ahead of the problem?

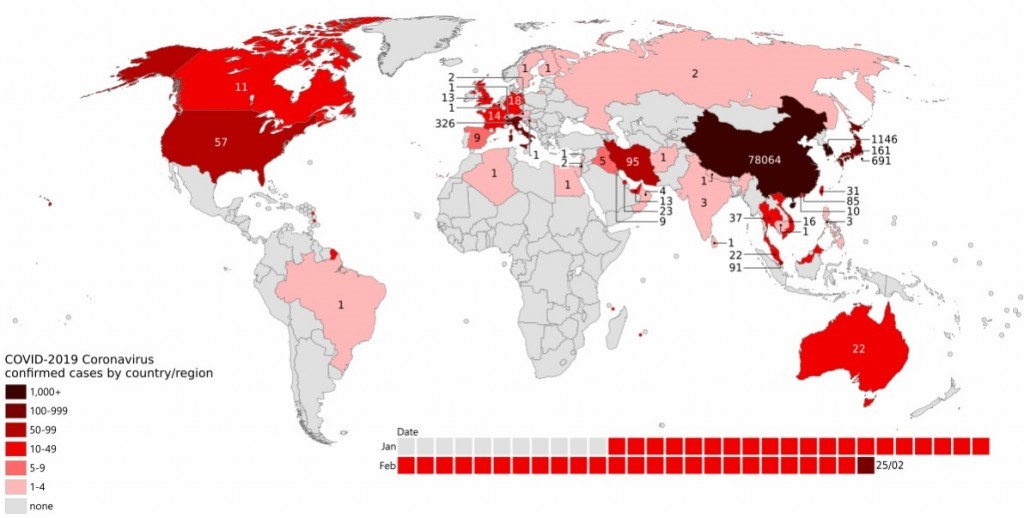

Confirmed Coronavirus cases by country as of Feb 25

The question of which borrowers is best answered by saying all borrowers need to be evaluated for the potential impact.

Initially any company that receives product into their supply chain from China has the highest risk. Followed by any company that relies on those companies. For example, an importer / supplier of lights or furniture may directly experience interruptions in deliveries from China. That is an obvious impact. The company that uses those lights in manufacturing or the furniture rental company that uses imported furniture in its rooms would also be impacted. There might be a delay at different points along the supply chain but there will be an impact.

In addition to those obvious impacts, consider the companies that rely on travel to affected areas. Clearly cruise lines, airlines, and hotels are impacted in proportion to the amount of business generated in affected areas. Consider the companies that supply to cruise lines, airlines and hotels – liquor, food products, laundry services, paper supplies, cleaning supplies, etc.

Also consider the impact of fear and uncertainty. Trends show people are limiting their travel, and that now seems to be evolving into limiting activities outside the home or work. More employees asking to work from home, which impacts food services in work related settings, fuel, and other similar items.

The question of how to stay ahead of the problem is more complicated. Borrowers typically do not welcome additional questions, reporting requirements, and other scrutiny. The best approach is to be firm on information requests and tie the scrutiny to your perception of the risk.

For example, an importer of goods from China needs to prepare a weekly cash flow and borrowing base addressing when product will be received, when it needs to be paid for, and when it can be delivered to customers who will pay the borrower. Often borrowers use averages or past performance or outstanding orders to develop a cash flow. That is only part of what is needed in this situation.

Be sure to consider future impacts as well as current impacts. For example, if one supplier sources from China and another sources from India, given the current environment, your borrower’s customers may evaluate switching short term and long-term business relationships to spread the risk – especially looking to the future.

During the quarterly review process, consider adding a section to the credit risk assessment specifically related to the impact of Coronavirus.

In Summary

Be careful not to accept the Coronavirus as an excuse for weak performance. Management needs to adapt to changing environments and needs the liquidity to manage through any setbacks. Accepting Coronavirus as an excuse could allow the borrower to mask other issues and put the lender is a difficult situation. For example, accepting reduced sales as the impact of the Coronavirus could hide the loss of a major account, or the change from a single source supply relationship, or the loss of a key salesperson, or overall shifting consumer demand.

The key for all of us is to break through the excuses and use facts and numbers to evaluate the performance of a borrower and the length of time their liquidity will allow them to survive.

.jpg?sfvrsn=f1093d2a_0)