- Austin Financial Services and Stearns Bank Enter New Strategic Joint Venture

- Economic Outlook

- ABL Navigates New Economic Crosswinds

- Gordon Brothers Appoints Liz Blue Head of North American Business Development, Retail & Real Estate Services

- Ares Commercial Finance Launches a Healthcare Asset Based Lending Platform

Despite Continued Difficulties, Small Business Owner Optimism Continues to Grow in Latest Wells Fargo Survey

By Businesswire

Q3 study highlights improved future outlook tempered by significant near term headwinds

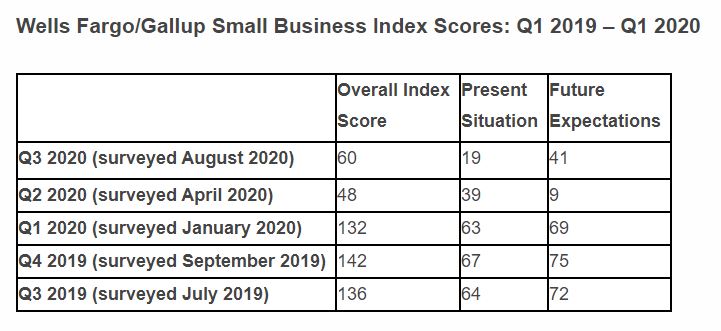

Small business owners have faced unprecedented challenges due to the pandemic and are in the midst of great uncertainty with the upcoming presidential election. However, the Q3 Wells Fargo/Gallup Small Business Index indicates there is a continued spirit of forward-facing optimism among small business owners despite the persistent trials. The overall score rose 12 points from last quarter’s historic low-water mark, driven by a sharp rise in sentiment about future expectations. The overall positive movement in sentiment was contrasted by the third successive quarterly decline in optimism about current business conditions.

A brighter future seen amid challenging current environment

The Q3 pulse check of business owners, fielded in early August, shows a clear dichotomy between the immediate challenges small businesses face and their views on the future. While only 19% of business owners feel optimistic about their present situation (a 20% decline from Q2), 41% feel optimism about what the future may hold, marking a 32% quarter-over-quarter rise.

Further illustrating this split in sentiment between current and future state, when asked about revenues, 48% of small business owners expected increases in the coming 12 months versus just 29% who reported actual increases in revenues over the last year. Furthermore, seven percent fewer owners (55%) say they felt somewhat or very good about their cash flow in the last 12 months, while 16% more owners said the same about their cash flow in the coming 12 months.

“Small businesses have been navigating through incredibly stressful circumstances for the last several months,” said Steve Troutner, head of Small Business at Wells Fargo. “This latest survey data indicates that many have worked hard to make adjustments and are feeling better about their future prospects, yet they still face tough near-term struggles as the economy recovers at an uneven pace. During these tough times, we remain committed to doing everything we can to help small business owners adapt and succeed.”

2020 election and economic recovery are top-of-mind for business owners

The Q3 survey also delved into how business owners perceive the upcoming presidential election and found a high level of interest and engagement, with 97% saying they were planning to vote in November, and nearly 60% saying the outcome would have a major impact on their business. When asked what issues they would like to see the candidates focus on, three ranked highest: relief for small businesses, taxes and getting the economy back on track. The handling of the economic fallout from COVID-19 was also noted as a critical expectation for the eventual winner, with 88% of small business owners calling the next president’s approach to this extremely or very important.

“It goes without saying that there are multiple major factors impacting how businesses owners feel right now, from navigating a pandemic to a hotly contested presidential election to an economy that remains significantly hampered, and it’s all happening in the same year,” said Mark Vitner, Senior Economist with Wells Fargo. “With the impacts still being felt in a wide swath of industries and sectors, the continued climb in owner optimism is an indication of continued hope that time will move them toward a better landscape for their businesses.”

Other top challenges

While the loss of business or closings due to impact of COVID-19 maintained its place as the top challenge for owners, this indicator dropped by 17 points to 27% quarter over quarter. Simultaneously, challenges in attracting new business rose five points to 15%, while concerns around financial stability and cash flow rose by four points to 11%. Meanwhile, though owners had called out taxes as a key issue in the upcoming election, only two percent said it was the top challenge in Q3.

Wells Fargo/Gallup Small Business Index Scores: Q1 2019 – Q1 2020

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.97 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, investment and mortgage products and services, as well as consumer and commercial finance, through 7,300 locations, more than 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 31 countries and territories to support customers who conduct business in the global economy. With approximately 266,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 30 on Fortune’s 2020 rankings of America’s largest corporations. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo

Methodology

Results for Wells Fargo/Gallup Small Business survey are based on web interviews with 600 small business owners, conducted during the period August 7-14, 2020. Beginning in Q2, 2019, interviewing formally transitioned from outbound phone data collection to a national small business web opt-in panel provider.

Contacts

Media

Manuel Venegas, 213.269.2723

Manuel.venegas2@wellsfargo.com