Reaching the Top: C-Suite Women in Secured Finance Roundtable

By By Michele Ocejo and Eileen Wubbe

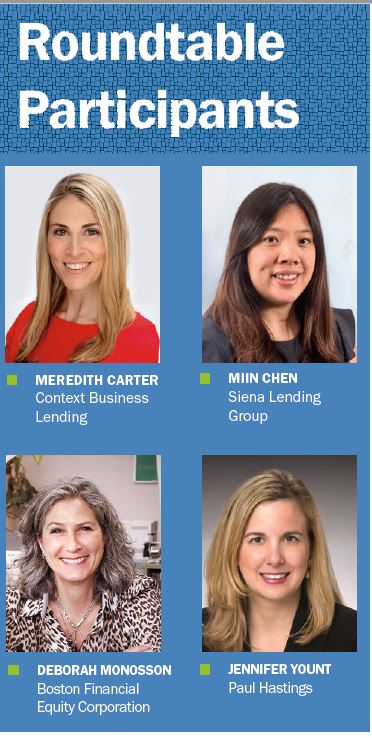

What does it take to break the proverbial glass ceiling in secured finance? What does the journey to the “top” look like for women in financial services? We interviewed four C-Suite women and here is what they had to say. The women we spoke with are Meredith Carter, president and CEO, Context Business Lending; Miin Chen, COO, Siena Lending Group; Deborah Monosson, president & CEO, Boston Financial & Equity Corporation; and Jennifer Yount, partner, Paul Hastings LLP.

Please tell us about your career trajectory and your journey to your current role.

Carter: I have had a different career path than most specialty finance company CEOs, having begun my career as a corporate attorney in Delaware. I grew up wanting to be a corporate litigator, likely before I knew exactly what that meant, and spent college and law school very focused on getting there. I graduated college early and interned at three corporate law firms in Delaware while in school, having chosen to attend UD for that purpose. After graduating Villanova University School of Law, I was fortunate enough to be hired by one of the “big” Delaware law firms and occupy an office next to a renowned lawyer who is now Delaware Supreme Court Justice. The attorneys with whom I worked were brilliant and loved their work but, unfortunately, I quickly realized that I did not love mine.

I was lucky to be at a firm that supported my desire to explore another area of business law, and a few years in transitioned to the corporate transactional group. I enjoyed that work more than litigation, having more client contact and helping prevent problems before they began. But when the firm explored the idea of creating a business development position for the first time, that position resonated with me. I expressed interest and ultimately became the firm’s first director of business development. It was people-facing, intuitive and I liked being able to translate law to non-lawyers. Soon thereafter I was promoted to run firmwide marketing and business development, leading a national team across three offices.

A few years later I learned that a well-regarded committed capital fund in our area was looking for a manager of business development and applied. I was hesitant to leave the practice of law, both out of pride and after having taken bar exams in three states. But, knowing the excellent reputation of this fund and its team, I ended up taking a leap of faith and parked my clients with a few colleagues, just in case.

The fund was originally focused on patent enforcement, but then launched a patent litigation funding arm. Over the next five years, I helped to grow that litigation funding business, and ultimately helped package it and sell it to a UK-based funder looking for a U.S. presence.

My experience in law and then in growing a business development-based business for a fund prepared me very well for my next endeavor as CEO of what is now one of the fastest-growing lending companies in the country.

Chen: I started out as an auditor at PwC in the Banking and Capital Markets industry group and then moved to J.H. Cohn a few years after. While at PwC, I was able to learn about asset-based lending (ABL) with the client that I was on; however, it just felt like too big a firm for me. I am grateful for everything that I was able to learn at PwC, but I knew that I wanted a different type of audit experience than PwC was able to offer me at the time. Moving to J.H. Cohn afforded me the opportunity to work with various companies in multiple industries and really get a chance to learn best practices and how different companies operated. After some time there, I transitioned to private accounting with the assistant controller role at Burdale Capital Finance and then treasurer at Patriot National Bank in Stamford, CT. After the relaunch at Siena, I was asked to rejoin the team and I did so in March of 2014 as their controller, moving to CFO in June of the same year and now currently as their COO.

Monosson: My career path was not linear. I worked in the stock brokerage industry for five years, went to graduate school, worked in PR for a software company and then joined my father’s company as a salesperson. I spent 10 years in business development, and eventually handled all the advertising and marketing. In 2001, my father approached me out of the blue and offered me the role of CEO. I was a bit surprised, as I didn’t expect him to ever retire. I took a month or so to think about it. It was not obvious to me to take the position. I had to think about the responsibilities involved and how it would change my life.

Yount: My career started well before I went to law school. As a child growing up in Los Angeles, I was obsessed with books. I would spend hours at the library. I recall setting a challenge of reading every non-fiction book at my public library – starting with A and going all the way to Z. I never finished. I also loved watching courtroom dramas – The People’s Court, Law & Order and To Kill a Mockingbird.

Years later in law school, two events happened that set the journey for my current role. I did an externship with a bankruptcy judge, and I took a class on Article 9 of the Uniform Commercial Code. The process of reorganizing a business was fascinating. I enjoyed the intersection between legal issues and business issues. I started my career as a law clerk to a bankruptcy judge, and then practiced for a few years as a restructuring lawyer representing secured creditors in Chapter 11 bankruptcy cases.

When the economy started to improve during the U.S. housing boom of the early 2000s, I gradually started working on more front-end finance transactions. Acquisition financings, asset-based lending, multi-lien and multitranche deals. When the housing bubble crashed during the late 2000s, I was back to restructurings again – DIPs and exits in bankruptcy. Then, as the economy improved and the non-bank lending market started to grow, I was back to front-end financings again. I was spending a lot of time commuting back and forth from Los Angeles to New York, and in 2015 I decided to move to New York permanently. Being in New York has helped me focus intently on growing into a global full-service finance and restructuring practice.

Were there any detours or setbacks along the way to getting to this role? If so, explain what and the negative or positive effect it may have had on getting you to where you are now?

Chen: I don’t necessarily think that were any detours or setbacks for me on my journey to this current role. I really believe that all the positions that I’ve held have helped me get here. In the current role, I think that being able to think a few steps ahead and make contingency plans if things were to go awry is absolutely key to success. At PwC and J.H. Cohn, I learned that with our audit plans and how to pivot if what was originally planned could not materialize. During my time at Burdale and Patriot, especially in the accounting function, you really get to see how everything comes together and therefore how intricate every part of the organization is to the overall business. These two definitely helped me in being able to see how things work from both a high level as well as how the nitty gritty really works.

Monosson: I probably had a different type of setback. My father was the business. Everyone knew him. I was a daughter. One time when I was negotiating on a deal, the gentleman on the phone actually said to me, “Let me talk to your father” … well that did it. That was not going to happen. I actually think it gave me more strength. But it took a while before people in the industry trusted that I knew what I was doing. The other hurdle was being an employee one day and the boss the next day. There were employees that had the same, if not more, experience than me. There were employees who were my friends, whom I socialized with and I was suddenly their superior. It was not an easy transition.

Yount: I remember when Lehman Brothers’ shares plunged by nearly 50% and it filed bankruptcy on Monday, September 15, 2008. I remember the stock market crashing, at the time, the largest drop by points in a single day since 9/11. I remember this drop was exceeded by an even larger drop in late September.

I remember this distinctly because I had just been promoted to the partnership at Paul Hastings. This rite of passage requires that a lawyer transition from being an employee to an owner of the business. As an owner, a partner is required to focus on new business and growth. I recall sitting in a conference room in New York with all the other new partners and thinking, “Now what?”

It was at that moment I realized I needed a strategy. I sketched one out and spent a lot of time speaking with bankers, listening to them talk about the market, the companies they helped finance, their experiences, and the business realities they were facing. It was eye-opening.

There was a lot of change in the market at this time, as many of these bankers moved to new opportunities. When you are in the trenches with other people during challenging times, you learn a lot.

How did your current role come about? Were you promoted or did you change companies/firms?

Chen: In my current role, I was promoted from controller to CFO to COO.

Yount: I was promoted to the partnership and then to chair of the Global Finance and Restructuring Practice at Paul Hastings.

Carter: When one of the principals of a family office with whom I was acquainted learned that our litigation funding business was selling, he asked me if I would consider joining an asset-based lending business that they acquired. I knew some of the people in the parent company of that ABL business and thought the world of their ethics and intellect. I then had a choice of either joining people I knew in a new area of specialty finance or continuing in a familiar area of specialty finance but with new people. I chose the people I knew and trusted, taking another leap of faith to join a new niche of private capital. I reasoned that I could always go back to litigation funding but may never get a chance to work in such a unique culture again. I began my time at Context Business Lending (“CBL”) in a combined in-house counsel and BD role. At the time the company had two loans.

About a year into my work, the two leaders of CBL, who were also running another family office investment, transitioned to running the other business full time. The family office took a chance on me as interim CEO, with no promise of permanence unless I proved myself. Being fairly new to ABL, I approached the role like I had approached litigation in the past: I learned everything I could about the industry very quickly and hired experts to fill in the knowledge gaps. Ultimately, the family office made my role permanent and now, two-and-a-half years later, our team and portfolio have tripled in size.

Has mentorship or sponsorship played a vital role in your success?

Chen: Mentors have definitely helped me along my career and even before I knew it started. From career advisors in college to today, they have helped me find my voice and given me their experiences to learn from and lessons to take away. I was lucky to have mentors along the way that knew what I wanted even before I came to the realization. They guided me in many career decisions as well as how to approach each position to take away the most I can to get to where I am today.

Carter: I am extremely grateful to my Board for giving me the opportunity to lead the CBL team, and for all of the support they have given me since. I know that I am very lucky to work in a rare environment where our parent company and family office are patient and incredibly supportive. The Board’s guidance and thoughtful insights have created a safe environment for CBL to establish a culture focused on creativity and good decision-making.

Also, when I began each of my distinct career chapters, I immediately sought out someone whose success I admired and tried to pick their brain as much as possible for best practices. Most recently in ABL, I was fortunate enough to be introduced to Rob Frohwein, founder and CEO of Kabbage, one of the world’s largest fintech lenders. Rob is also a graduate of Villanova Law and also had little credit experience when he started Kabbage. Rob has been very generous with his time and serves as an inspiration to me on many levels. Shortly after I started as CEO of CBL, Rob and his co-founder, Kathryn Petralia, were kind enough to spend a few hours with me brainstorming novel approaches to sourcing and structuring asset-based loans. Their creativity and advice sparked a number of initiatives we have since implemented and I am extremely grateful to them.

Monosson: My father was my mentor, as he was to many people inside and outside our company. He was a very patient teacher, even more so with me. He had started several companies over the course of his career and BFEC was his favorite. Outside of my father, the people I met through SFNet played a large role. Many of them I relied on for help, or guidance. I am still a big proponent of getting involved with associations. You don’t gain trust and friendship by just attending conferences once or twice a year. Many are developed by being on committees and getting involved in small groups and getting to know those people.

Yount: Mentorship and sponsorship are indeed vital to success. The most valuable contribution to my career has been an informal board of advisors that has grown over time. Diversity of perspective is key. I seek ideas and thoughts from a diverse group of successful professionals – leaders at Paul Hastings, leaders in the finance and banking industry, and leaders at other law firms. The generosity of shared knowledge and experiences in this industry is extraordinary.

According to a 2019 report from Deloitte, the proportion of women in leadership roles within financial services firms is 21.9 percent, with a projection of 31 percent in 2030— an improvement, but still well below parity. We might not see an equal number of women in overall U.S. leadership roles until at least 2085. What do you think financial services firms need to do to speed us this progress?

Chen: Finance is still a field dominated by men and that just escalates when you get into the leadership roles – it is just how the numbers will play out with the current makeup. I think first, as an industry, we need to learn how to attract more women to the field. Either it is through more outreach efforts early on or through programs in the workplace. There is definitely more that can be done.

We can start in the recruitment at the collegiate level to educate women on what life as a woman may look like in the finance industry through panels or discussions. We can also help women navigate through some insecurities (for me, it was speaking out) to help them become more confident in the workplace. Not only can we help women, we can also help men understand what it is to be a woman in the finance industry and build awareness through that channel. As a woman who joined the finance industry (although via an audit position) right out of school, I was extremely intimidated by those around me who had louder voices and more experience. Speaking to women was always easier, as I felt that they could at least relate to me on the basic level that we were both women. Classes or mentorship program that aims at the aspect to be able to relate beyond gender would have been beneficial.

For the working moms who are aiming for leadership roles, work-life balance is extremely sensitive. I read somewhere recently that working moms are expected to work as if they don’t have kids and be a mother as if they don’t have a career. It’s hard to juggle those expectations! Programs or support surrounding that may help attract women to the field, who are thinking of what a future or a career path would look like with a family, could also help speed those statistics along. I have to say, though, in terms of work life balance, especially with kids involved, this goes for working dads too, who are also caught up in the middle of it all. In that respect, I think programs related to work life balance and a home life needs to be extended to all.

Monosson: I am definitely not qualified to answer this question. We have probably been asking the same question year after year after year…it needs to start with getting more females interested in finance and banking in the first place. There is a lot of competition out there in other industry sectors, How to make this industry more appealing is a subject that needs to be thought out and then implemented at the college level.

Carter: I think the narrative around why women should be in in financial services leadership positions needs a new frame. Right now, many companies are creating artificial ways to slot women into leadership positions purely for the perceived perception benefits companies may enjoy as a result. I would argue that this approach is doing everyone a disservice. It perpetuates the notion that women have a handicap that needs to be accommodated and, in some cases, requires companies to accept a less-qualified candidate because they “need a woman” in that slot. Instead, the narrative should be focused on the skills that women bring to leadership roles. As noted in a recent article in Inc. magazine, “from increasing productivity and enhancing collaboration, to inspiring organizational dedication and decreasing employee burnout, the benefits of having women in the workplace are well documented.” In addition, as Philip Tetlock describes throughout his book Superforecasting, when a leadership team is making critical decisions, conclusions reached after consulting people with diverse perspectives are likely to be more well-reasoned and representative of a company’s customer base than those of often self-validating homogenous leadership teams which exist in a bubble.

What do you think are the most important qualities in a leader and why?

Chen: The ability to stop and listen/think before jumping into a solution is an important quality. On a whole, we just want to get things done, but there is a right way to do it and an easy way to do it. I think a leader needs to put aside the need to just check the box and mark it done versus thinking ahead and proceeding slowly. A leader should have the ability to calm a situation, think through the issues and be able to clearly address the plan of action. A leader should always be able to have back-up plans to be able to pivot and be flexible as needed.

Monosson: Disclosure: I still aspire to be a leader. I am not there yet. The qualities that I admire in a good leader are a quiet patience, listening more than speaking, being comfortable allowing employees to make decisions and also mistakes and learn from them (but not too many times!). I also think leaders. in tough times, can help steer the boat out from the eddies…and keep going on an even keel. My father was a good leader. Maybe someday I’ll get there!

Yount: Vision, strategy, and inspiration. A leader needs to unite people around an aspirational vision. Build a strategy for achieving that vision. Attract and develop talented professionals. And then inspire that team of professionals to implement the strategy in order to achieve the vision.

Carter: Above all else, I think the most important qualities in a leader are integrity, authenticity and open-mindedness. Leaders should set an example of always doing the right thing and rolling up their sleeves as team players themselves. I think good leaders should also be transparent, genuinely care about their employees and not pretend that they are infallible. They should openly talk about their mistakes and encourage others to do so as well so that the team can learn from each other. I think that good leaders should also be honest with themselves and others about their strengths and when they need assistance to fill their blind spots.

Also, I think that good leaders will routinely actively solicit the opinions of a variety of members of their team. Sometimes the least-informed people on an issue can produce the most objective solutions. Good leaders should understand that everyone enjoys the validation that their work and opinions are appreciated and incorporated. Good leaders should also empower people to challenge the status quo and create better solutions to established problems. I think that doing these things will lead to higher levels of motivation, empowerment, job satisfaction and retention of employees as well as increase the bottom line.

Finally, I think that good leaders should spend time personally interviewing potential new team members to help preserve company culture and bring on complimentary, additive new talents. As the famous Peter Drucker quote that we have framed in our conference room says, “Culture Eats Strategy for Breakfast.”