- Loan Broker Compensation – Ethical And Legal Considerations

- The Five Most Common Misconceptions About Credit Insurance

- Cybersecurity: Critical For Businesses Large And Small

- Fintech and Due Diligence – Disruptors and Established Firms Evolve

- Hogan Lovells Cross-Trains Attys To Boost Bankruptcy Ranks

Audit Prep: Why a Paperless Approach Makes Sense

February 15, 2017

By Alan Wooldridge

How much time does your financial institution spend preparing for audits?

We recently surveyed 187 community banks, and the results were astounding. According to our research, 91% of banks surveyed require more than five hours of prep time per audit. Even more surprising, the vast majority (58% of those surveyed) use more than twenty man-hours for each audit.

Gathering the requested loan files and resolving last minute exceptions can feel like an overwhelming task. This is especially true for banks relying on paper loan files.

In this article, I’ll discuss why a paperless approach to audit preparation solves many headaches – and saves you money in the long run.

Centralized & Accessible

If you rely on paper loan documents, pause for a moment to think about your current audit prep workflow. Upon receiving the list of loans that are up for review, your team springs into action. Your momentum takes you to the records room, where you hope to find every file on the list. Unfortunately, several are usually checked out by lenders or other staff. You make a few calls, send several emails, and eventually collect the missing records.

As you dig into the files, your heart sinks again. Several important financials and tax returns are missing, and you can’t figure out why. No one in the office seems to know either. Your only option is to start calling customers, hoping you can track down the missing information.

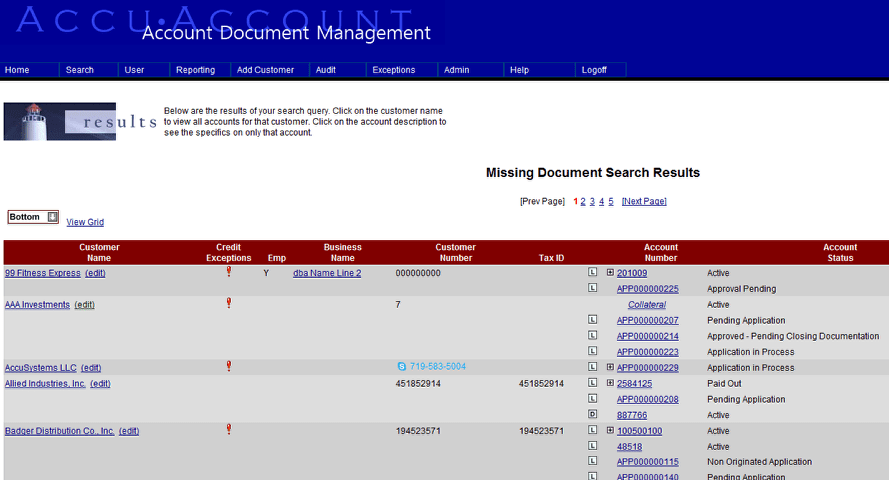

Compare this approach to that of a paperless system (such as our AccuAccount platform). In an electronic ecosystem, there’s no rushing around between the records room and your colleagues’ offices. Instead, everything is stored conveniently on your servers, instantly accessible by you (or your approved users) with just a few clicks. Search by typing in a customer’s name, customer number, tax ID, or account number. Presto, everything you need is right in front of you.

Once you’ve identified each loan, the process of resolving exceptions is also greatly simplified. For starters, exceptions can be cleared as new documents are scanned in. This means that fewer documents go missing in the first place. But, if you still need to identify a few documents that somehow slipped through the cracks, simply pull a missing document report. Drill down into the specific loan to view a digital paper trail of notes, comments, and notice letters sent by your team. On the off chance that you’re unsuccessful recovering customer documents in time, at least you can show due diligence of past attempts to collect.

Better Transparency for Auditors

Auditors also appreciate the additional transparency offered by an electronic loan document management system. Instead of carting in mountains of paper loan files, hand your auditors a disk or flash drive with everything they’ve requested. (You might even send it to them in advance of their visit, allowing them to spend less time onsite with you.)

Upon opening the file, auditors will see a pre-filtered list of the exact accounts they’ve requested. Upon clicking on a customer’s name, the auditor can then view basic information, linked documents, loan details, additional guarantors, and collaterals.

Best of all, auditors can only view the information they’ve requested. No more, no less.

Is Five-Minute Audit Prep Possible?

If you find your bank spending too much time preparing for audits or exams, perhaps it’s time you considered a paperless system. Man-hours represent a real, tangible expense for your financial institution. Spend time studying the true cost of your audit preparation process and compare that to the upfront expense of electronic imaging software.

Also, before you make the switch to paperless audits, be sure to do plenty of vendor research. Look for a software application that not only offers convenient audit preparation but also streamlines your day-to-day loan operations. Picking the right solution should be a multi-faceted decision, involving lenders, senior management, loan operations, IT, and even your internal auditors. Form a team, talk to multiple imaging providers, and make an informed decision.

.jpg?sfvrsn=f1093d2a_0)