- Lender Liability Management: DIP Financings and the Non-Ratable Roll-Up

- Flexible Workplace Arrangements – Attracting and Retaining Talent in the Current Environment

- Is a Corporate Default Wave Ahead In 2022?

- Where are they now?

- Cybersecurity: Evaluating and Mitigating Borrowers' Risk to Cyber Breaches

How Today's Economic Pressures Will Affect Tomorrow's Consumer

January 16, 2024

By Robert Gorin

The consumer product industry is facing rapid, unprecedented change, and today’s economic challenges are creating ripple effects that will shape American shoppers for years to come. With data mining, there’s a path forward.

If you don’t know what to make of the current U.S. economy, you’re not alone. The unprecedented pressures facing American consumers are ever-changing, increasingly volatile, and impossible to predict with authority.

Between high inflation rates, a looming recession, and persistent supply chain issues, if businesses haven’t already felt the reverberations to their bottom line, they soon will. These market stressors are poised to have both an immediate and long-term impact on today’s shoppers.

Consumer product companies need to prepare for this squeeze, which will undoubtedly cause a reduction in overall spending, lower margins, less brand loyalty, and shifts in purchasing patterns that may last for decades to come. If business leaders can identify the key forces impacting consumer behavior and shape innovative, data-driven strategies to respond to them, they will be able to lead the charge—and follow their consumers well into the future.

The Ripple Effect: Consumer Behavior in an Uncertain Market

The consumer industry is facing unparalleled economic challenges, and although higher

costs of living spurred by persistent inflation—the current rate increased to 3.7 percent—is certainly a seismic ripple, today’s pressures are more dynamic than ever.

They can create a disruptive paradigm shift that will shape the lives of consumers for years to come. Experts are already seeing the first wave of these behavioral changes:

They’ll buy less.

Until recently, consumers have been resilient to inflation. July surveys show that 65 percent of Americans have managed expenses by increasing credit card usage or diving into savings.

However, as pandemic-era savings programs are depleted and student loan payments restart, consumer purchasing power will wane. Shoppers will have less disposable income and will likely cut back on nonessential spending.

They’ll show reduced brand loyalty.

Consumers will opt for cheaper alternatives to their go-to brands, with 74 percent of shoppers already trading down to a less expensive option at least once.

Still, even as consumers prioritize bargains and defer to store brands versus premiums, they will expect the same, if not higher, value for every depreciated dollar spent. To that end, negative experiences—from poor customer service to shipping delays—will more readily be factored into future buying decisions.

They’ll shift spending from goods to services.

Consumers are increasingly willing to own less as more companies, like Spotify, prioritize subscription-based or pay-to-use access to items.

As consumer products become commoditized with advancements in online shopping and AI-enabled automation, buyers will make selections based on intangible benefits, namely convenience. For instance, online grocery delivery has seen immense growth, with 72 percent of shoppers reporting that they buy at least some groceries online.

They’ll resist big-ticket purchases.

Thanks to interest rates, their highest since June 2013, 60 percent of consumers believe it’s harder now than a year ago to get mortgages and other loans. As a result, major purchases—homes, cars, and appliances—have plummeted.

Those determined to push forward amid rising production costs may avoid borrowing by opting for simple solutions. Instead of remodeling their kitchen, they’ll replace the refrigerator. Or instead of replacing the fridge, they’ll attempt to fix it.

They’ll be much harder to predict.

The current market has exacerbated the misalignment of consumer feedback and consumer behavior.

A recent study determined that 78 percent of U.S. consumers say they want to purchase sustainable goods, but companies often report poor sales of their “green” product lines. Customers claim to support brands that align with their values, but the majority of them still choose products with affordability as a top priority.

The Future Imperative: Finding Data-Driven Solutions

Industry leaders have immense ground to cover to meet these ever-changing customers where they are—and where they will be.

Certainly, they’ll need to use a less formulaic approach to forecast market demand, rethink global supply chains, and identify sustainability practices that have long-term solvency.

But the most important strategy—the one that addresses all the consumer ripple effects—happens to be one that most companies don’t yet prioritize: Data mining.

Roughly 70 percent of consumer products executives say that mining data is critical, but most companies aren’t prioritizing it. They often don’t even analyze the sales data they already own, nor are they willing to pay for demographic data. Without this vital investment in consumer research, in-house or otherwise, organizations have no reliable way of gauging or attaining product profitability.

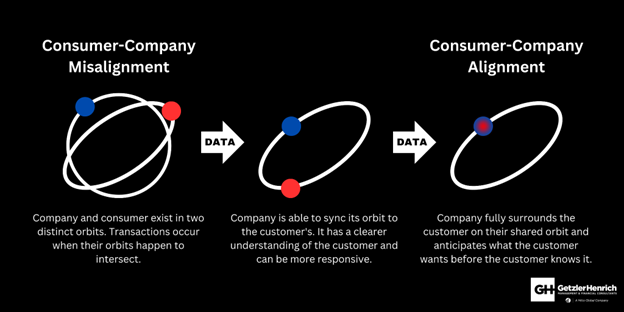

These companies, in essence, exist on a different orbit entirely from their consumers, and business is only conducted whenever those orbits happen to intersect.

This creates missed opportunities that can have devastating consequences.

Charting a Path That Follows the Customer

Companies need to learn more about their consumer base, which is only attainable by gathering all the data and analyzing it for additional deep insights.

Currently, most production teams use different data from sales and marketing departments when they should be eliminating these data silos, where profits go to die. Not only is this vital from an operational perspective, but when you break down data barriers, your financial data, customer data, and product data can be interwoven to produce a single source of truth.

For instance, you know your consumers’ buying habits—how much they spend, their product preferences, and frequency of purchases because you sourced the sales data. You know where they live by pulling the shipping records. You know what they look like, how old they are, what they do for a living, and how much they earn because you bought the demographic data.

By viewing the data holistically, you’ve created a 360-degree view and formulated a few key customer personas with purchasing profiles to help make data-based decisions when determining, for instance, what they’ll buy next—which will impact future business outcomes.

Now, as a company, you can sync and align your orbit to the customer’s.

Creating Bonds That Embrace the Customer

Still, knowing your customers is not enough. In today’s climate, you must fully understand them as individuals.

Think about the last time you’ve had a strong link to a brand, where you’ve thought, “They get me.” This bond is achieved through data. The company knows you tend to repurchase their product every five weeks, so they send you a reminder email after 4.5 weeks. They know you prefer a specific product, so they share tips on how to maximize its use and make suggestions for what to try next. They see you doing most of your shopping online, but they alert you to in-store sales in your area—with a coupon attached.

This is how brand loyalty is born, built, and sustained.

By optimizing data, companies that sell consumer goods end up selling services as well: They save time and mental energy while adding intrinsic value.

It’s also how, as every other company is forced to either raise prices and lose customers or lower prices and lose profits, data-mining businesses can maintain their margins. And if there is some price elasticity, this well-served consumer base is willing to pay extra—they won’t be as quick to cut the expense or substitute it for a cheaper brand.

The benefits of this approach stand to impact companies selling small-scale grocery staples and big-ticket items alike. Companies selling refrigerators, for instance, tend to make higher margins on filter sales. Employing these strategies—serving up filter replacement reminders and YouTube video tutorials—will encourage shoppers to continue engaging regularly with that brand.

When fully embracing the customer in their orbit, you can anticipate what they want before they do and provide it before they’ve sought it elsewhere. These are the bonds that even today’s economic pressures can’t break.