- The State of Retail: How Did We Get Here and What’s on the Horizon?

- Is a Corporate Default Wave Ahead In 2022?

- Interview with Gene Martin, CEO, and Mark Forti, Managing Director, Head of Origination at Callodine Commercial Finance

- Next Frontier in Lending: High Net-Worth Lending

- The Digital Transformation is Severely Disrupting Retail: The Time for Action is Now

Should You Rethink Your Lien Filing Strategy?

By Suzanne Konstance, Boaz Salik, and Archita Bhandari

The effects of the ongoing COVID-19 crisis are being felt in almost every financial sector. While current CARES Act stimulus programs offer strong government support for lending through these programs, these are a short-term opportunity. Overall, institutions that lend money are incurring increasingly higher levels of risk. The most obvious concern surrounds borrower default and lenders are facing the challenge of maximizing recovery on their existing portfolio as default rates are increasing and will continue to increase significantly in the near future. The spike in unemployment recalls how the Great Recession of 2008-09 caused a wave of bankruptcy cases, and it’s nearly certain that we will see an uptick in business and consumer bankruptcy filings. As a result, we see several large lenders continue to increase their credit loss reserves. There are ways to increase recoveries, however, and one is to systematically file UCCs on a portfolio as early as possible.

Introduction

A UCC filing or lien is a legal form that a creditor/lender files with the Secretary of State when they have a security interest against personal or business property of a debtor. Essentially, UCC filings allow the lender to seize or even sell the underlying collateral if the debtor fails to repay the loan. Accordingly, it is well established that recoveries for a secured loan would be higher than that for an unsecured loan. However, if the borrower has loans from more than one lender, the first lender to file the UCC lien is first in line to take ownership of the borrower’s assets. “Filing liens is not a magic bullet, but it does improve collectability, especially at the early stages of legal action” says Dan Massoni, principal at M-Analytic Services LLC and former chief credit officer of American Express Global Commercial and Merchant Services.

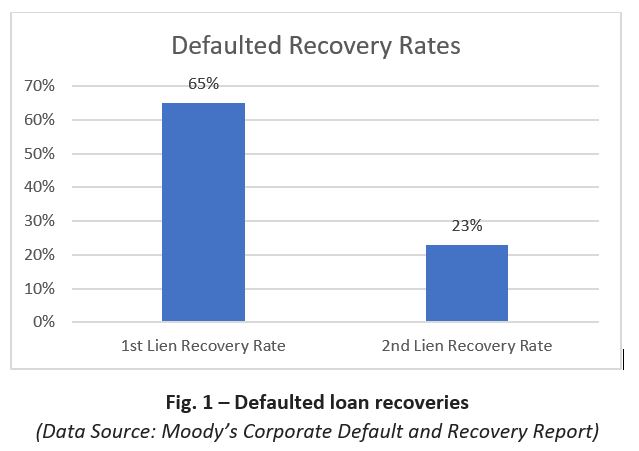

In order to answer the question: “how does the recovery rate, in case a loan defaults, change when one has the 1st position lien vs the 2nd position lien?”, we used Moody’s Corporate default and recovery rates1 (see Fig. 1)

Fig. 2 is generated based on defaulted debt recovery rates for 1st Liens and 2nd Liens over a period of approximately 10 years. The long-term average ratio of the recovery rate of 2nd Liens to the recovery rate of 1st Liens comes out to be 34%. One question that immediately springs to mind is in regard to the value of that 34%. If some, even one, of those loans are large, the risk to a lender could be in the tens of millions of dollars.

There are extra benefits of UCC filing in times of crisis. UCC filings can help in cases of legal actions, such as bankruptcy, to improve the lender’s recovery rate vs an unsecured loan, with no collateral pledged by the borrower.

Early Trends of the COVID-19 Crisis

There is a huge amount of uncertainty related to the extent of the negative economic effects from the pandemic as well as the duration.

Many lenders have already started seeing an increase in loss rates due to the COVID-19 pandemic and loss rates are expected to increase further.

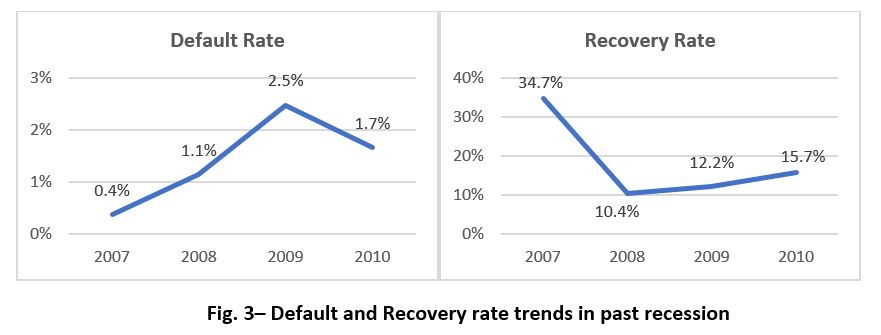

Early studies show that the economic impact of the COVID-19 pandemic could be worse than the 2008 global financial crisis. We checked FDIC (Federal Deposit Insurance Corporation)2 data for default and recovery rate trends during the 2008 recession (see Fig. 3). For top financial institutions, the default rate increased more than 2.5x times and the recovery rate decreased by 3x times.

Moreover, due to the volatility of the current environment, new originations have hit a roadblock. While originating new loans, lenders are becoming extra cautious and looking for ways to minimize the losses on the portfolio.

(Data Source: Federal Deposit Insurance Corporation)

Impact of UCC liens on maximizing recoveries during and after the COVID-19 crisisWe believe if financial institutions file liens early and on the right loan sizes, they can minimize the impact of COVID-19. Let’s review how lien filing cut offs can be impacted by the COVID-19 crisis.

We identified the below primary factors in setting lien filing threshold loan amounts:

- Loss rate: percentage of all outstanding loans that a lender has charged off after a prolonged period of missed payments.

- Recovery rate: the extent to which the principal and accrued interest on defaulted debt can be recovered.

- Risk profile of the portfolio: How creditworthy are the borrowers in the current portfolio.

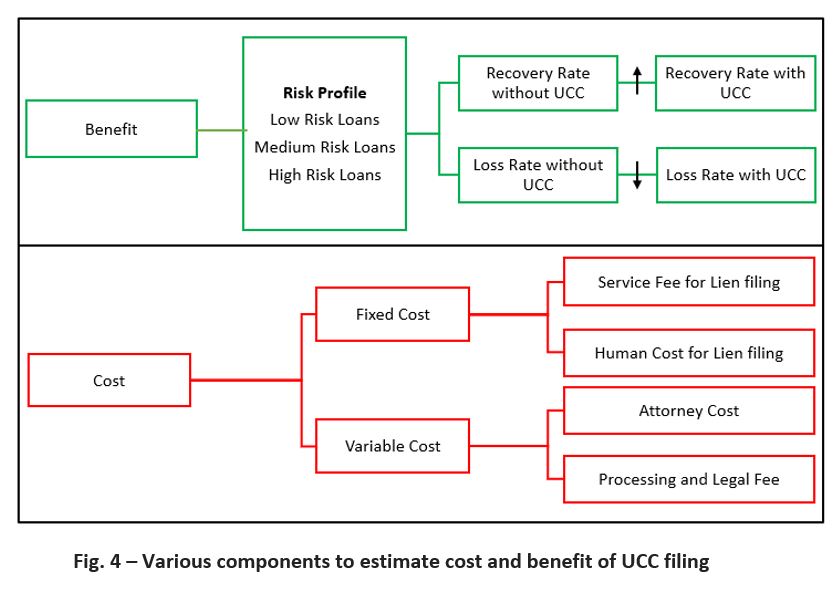

Based on the above criteria, we developed a model (Fig. 4) to determine how the loan cut off will change in these unprecedented times.

To estimate the benefit of filing a UCC, we explored how recovery and loss rates change when a UCC Filing is made versus when one is not, taking into account the risk profile of the portfolio.

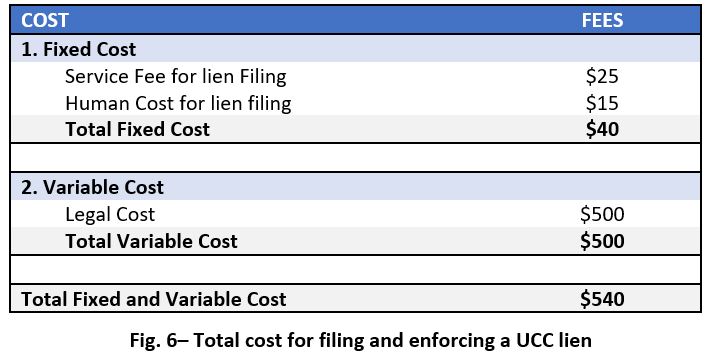

To calculate the cost of filing a UCC, we considered two components: one is a fixed cost which is independent of the loan amount, lender, etc and another is a variable legal cost which will come into the picture when one wants to recover the remaining loan amount from the defaulter.

Fixed cost is further divided it into two sub-components:

- Service fee: state jurisdiction fees or fees charged by service provider

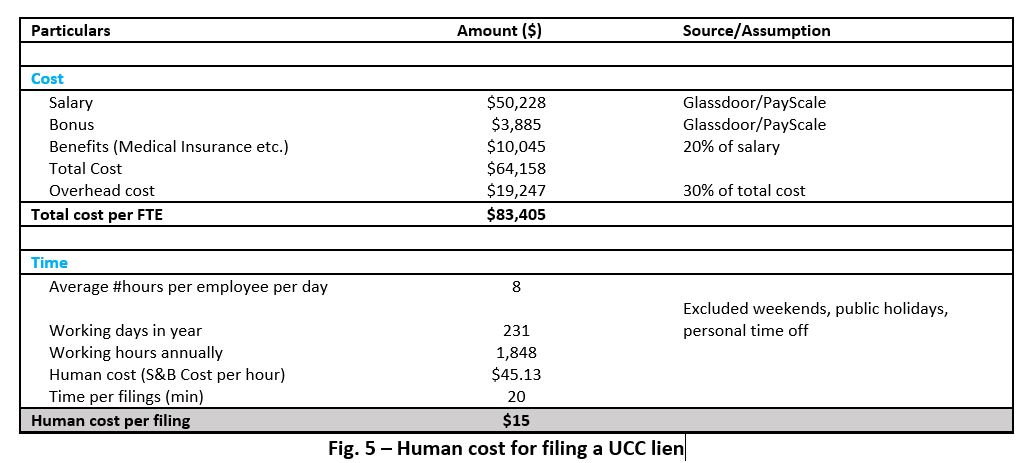

- Human Cost: the cost incurred by a company for an employee who would be filing a UCC (see Fig. 5)

For variable cost we have assumed a flat $500 fee as legal cost. This fee will only come into the picture when there is a default on the loan, and the lender decides to take legal action against the borrower. Fig. 6 represent the total cost involved in filing and enforcing a UCC lien.

To estimate the change in the loan threshold value due to the pandemic following assumptions were made

Pre COVID-19:

- Based on recovery rate data (Fig. 2) we assumed 66% reduction in recovery in cases where a UCC lien is not filed.

- We assumed 10% reduction in the loss rate when a UCC lien is filed because of the following factors:

- In case of a loan default, the lender can sell the pledged collateral to recover the debt.

- UCC liens also enable creditors to seize the borrower’s money from account receivables and subsequently use that money to pay off the debt.

- All UCC liens appear on credit report(s) and lenders consider previous liens in their underwriting process before giving a new loan.

- UCC filing cost (fixed and variable) is assumed as $60 per filing for all the lenders.

- Across charged-off deals, in the cases where a UCC is filed, legal action will be taken against 50% of the dealsand in the cases where a UCC is not filed, legal action will be taken against only 25% of the deals.

Post COVID-19:

- Based on FDIC data (Fig. 3) we assumed default rates and recovery rates will be similar to the 2008 recession period.

- Other assumptions specified in the Pre COVID-19 section are assumed to remain valid even for Post COVID-19.

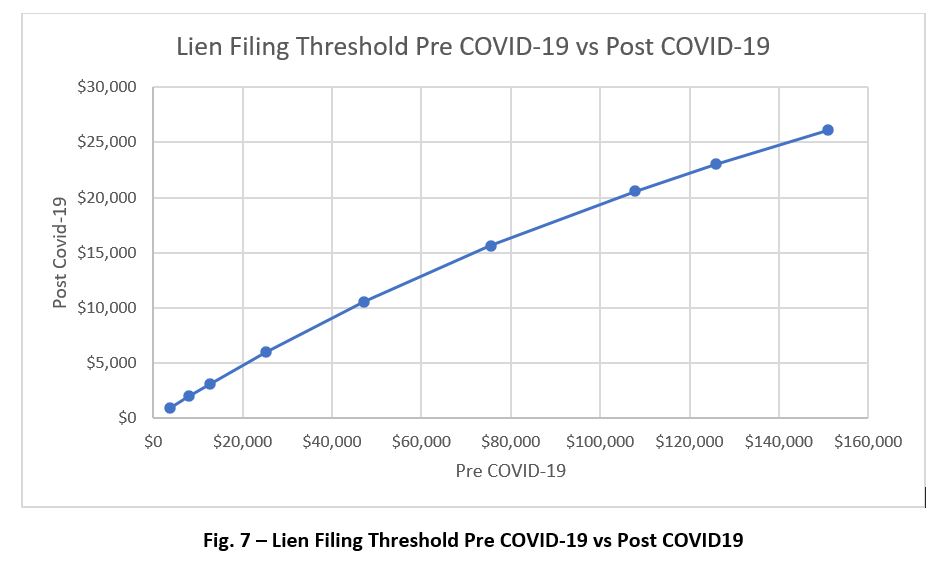

Fig. 7 shows relationship between the new post COVID-19 loan threshold amount versus the previous cut off above which lenders were filing a lien. For example, before COVID-19, if the lender was filing liens on all the loans where the loan amount was greater than $75K, the data indicates they should reduce that cut off to $15K.

Conclusion

UCC filings are sometimes overlooked for certain loans, whether because traditionally liens weren’t applied at that loan value, or due to a lack of understanding of the benefits. In times of crisis, the benefits of UCC filing become more pronounced and help minimize risk and improve recoveries. “Lenders should all be having the debate of whether to use liens more often, especially in this new macro-economic environment,” says Massoni. Overall, it is advisable that one determine the appropriate cut off and file a UCC lien as early as possible so that they can take advantage, in good as well as bad times, by being ahead of other lenders in the debt payoff queue.

Reference

About the Authors:

Suzanne Konstance is vice president of Product Management and Marketing for Wolters Kluwer’s Lien Solutions. She leads a team focused on understanding and solving client problems and needs to create and go to market with innovative products and solutions that help clients mitigate risk and improve efficiencies. She earned her B.A. from Cornell University and an M.B.A. from the Kellogg School of Management, Northwestern University.

Boaz Salik is managing partner of FischerJordan. With over two decades of consulting experience in the financial services industry, his primary focus areas are risk analytics, investment optimization and product strategy. Salik holds a Ph.D. and M.S. in electrical engineering from Caltech, and a B.S. in electrical engineering from the University of Arizona.

Archita Bhandari is a consultant at FischerJordan, and received her B.Tech in chemical engineering from IIT Bombay.