The Story of LaSalle Business Credit

November 13, 2023

By Charlie Perer

In this feature series, Charlie Perer sits with the key entrepreneurs and executives who have built leading commercial finance companies. The purpose of this series is to

tell the story behind many of the most famous and dynamic firms of past, present and future. These stories will and should be told by the people who were there in order to ensure accuracy.

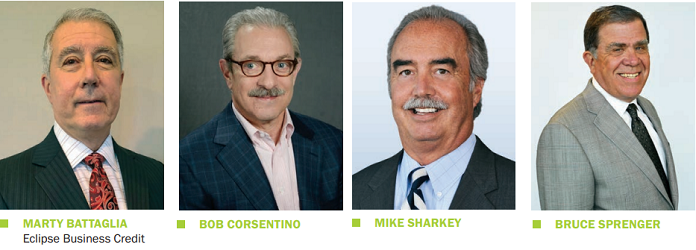

This feature is about LaSalle Business Credit, told by some of the key executives who played seminal roles in the 1990s. The core team at LaSalle went on to be leaders throughout the entire commercial finance industry. Here to tell the story are Mike Sharkey, Marty Battaglia, Bob Corsentino and Bruce Sprenger.

Charlie Perer: Gentlemen, please briefly introduce yourselves.

Mike Sharkey: I have been involved in numerous ABL groups over the years. In 1980

I went to Manufacturers Hanover Commercial Corp. (MHCC) with some senior folks from

GE Capital to help them start up an office in Chicago. With Manny Hanny’s reputation and resources, we quickly established a strong presence in the market. From where I went to Standard Chartered where Martin Battaglia helped me to start up Stanchart Business Credit, which we ended up running for 10 years before we sold it to LaSalle. At

LaSalle we grew the company into a national powerhouse until it was sold to Bank of America. Cole Taylor was the easiest startup of them all. We already knew the national market inside and out and we knew who to hire. We had built a national reputation for fairness and reliability, and we had an approval process with former LaSalle bankers that gave us a strong story to tell. We started up in 2009 when there was no liquidity in the market and we had fresh capital. It was a great time to start up an ABL. Virtually the entire market looked like one big ABL opportunity.

Marty Battaglia: Currently, I am CEO of Eclipse Business Capital. My ABL career spans over 40 years. I have successfully started, nurtured and grown several ABL platforms in the past, both bank, non-bank and foreign. The opportunity presented itself again several years ago to create a non-bank national asset-based lending platform. This very successful business, Encina Business Credit, was recapitalized in 2021 by Barings, Mass Mutual and participation by all senior management. Now known, as Eclipse Business Capital or EBC, the team continues to grow and expand capitalizing on the non-bank ABL market which continues to realize double-digit annual growth.

Bob Corsentino: I am co-head of CIBC’s U.S. Asset Based Lending Team and have 40 years of industry experience. In this role, I’m responsible for developing and co-managing the national business efforts for the team. In 2009, I initiated the startup of the team with Bruce Denby.

Previously, I served as the chief credit officer for the president and CEO of LaSalle Business Credit. I was also group senior vice president at LaSalle Bank managing a team with offices in Chicago, Texas and the Pacific Northwest. Prior to that, I created a new restructuring Lending Group at LaSalle Bank which focused on new lending opportunities, including DIPs, exits and B/S restructurings.

Bruce Sprenger: My experience in ABL spans 40 years. I joined LaSalle after departing as president of First Wisconsin Financial (FWF). I met Mike Sharkey via the CFA, now SFNet, FWF was an ABL startup following the sale of a small ABL in Milwaukee, called Civic Finance. Civic sold to Aetna Insurance, which was not in ABL, but was interested in the business. ( Note: Aetna Business Credit was formed.) Staff departed shortly after the Civic sale/Aetna purchase and FWF was founded. Another staff of Civic, John Nickoll of Foothill fame started Foothill, also from the roots of Civic Finance West.) After 20 years at FWF, my joining role at LaSalle was to open a new region office in Milwaukee. That office rapidly grew, adding additional locations and evolved to a full service (sales, audit, account management) covering 19 states. My responsibilities also included the start-up of LaSalle Cross Border lending team in cities of Western Europe and Canada.

How would you tell the story of LaSalle Business Credit?

Sharkey: LaSalle was a dominant ABL lender in the U.S. managed by individuals with deep roots and experience in the fundamentals of ABL. Virtually every officer and manager had an impeccable background in ABL, including field exam which allowed us to aggressively serve the market while walking a fine line between service to our borrowers and the safety of our portfolio. Our backgrounds allowed us to work with our borrowers through both good times and bad without overreacting or taking unnecessary aggressive action. This led to a reputation of fairness and cooperation. That reputation led to a loyal referral and customer base throughout the U.S and Canada.

By the way, we embedded our key objectives into an acronym, which we referred to in all of internal communications: GOALS.

- Grow profit per customer

- Operational efficiency

- Asset Quality

- Loan Growth

- Syndicated transactions

Corsentino: LaSalle Bank was led by Norm Bobins from 1990 to 2007. As a great president and CEO, he truly understood the ABL business, and supported its growth patiently while working with borrowers in troubled times. We had a great reputation for not overreacting. It allowed us to tell a good story and grow tremendously from the early 90s until we were purchased in 2007.

Battaglia: LaSalle was the culmination of several different groups with different cultures. The two main groups were the original LaSalle Bank asset-based lending unit formed by Walter Macur and StanChart Business Credit, which became part of LaSalle in 1993. Mike and I were part of the StanChart organization.

These units operated separately under the LaSalle banner for several years and were ultimately merged by around 2000. A couple other add-on entities became part of this franchise along the way although were not as significant as the original LaSalle ABL unit or StanChart.

Sprenger: LaSalle consisted of great dedicated professionals who grew the scope and size of our business of 18 domestic offices through outstanding focused staff and several tuck-in acquisitions of other ABLs. We segregated the business around teams of traditional ABL, Cross-Border finance, Corporate Restructuring and Retail Finance.

Click here to continue reading the interview.