In This Section

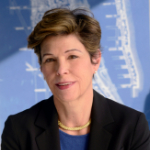

Donna Evans

Managing Director, CIT Asset Management

Biography:

Donna Evans is a managing director at CIT Asset Management, where she leads the underwriting team for CIT Northbridge Credit, LLC. Donna and team are responsible for screening, structuring and underwriting financing solutions for a broad range of asset-based borrowers. Facilities are typically revolving lines of credit and term loan commitments from $15-$150 million, tailored to middle-market companies in a turnaround environment.

Prior to Northbridge, she was a managing director in the ABL division at CIT. Her team provided and monitored senior secured revolvers and term loans, targeting asset-rich companies with greater than $50 million in annual revenues, managing $1.1 billion of portfolio accounts. Prior to joining CIT in 2005, she was an SVP/team leader at GE Capital in Chicago. She led the Midwest Restructuring and Retail teams from deal evaluation and structuring through final approval, as well as managed a $1.8B retail portfolio with commitment sizes ranging from $30 milion to $500 milion. She began her career at First Chicago, where she spent 15 years in the ABL department as a portfolio manager and senior underwriter.

Donna received a bachelor’s degree from the University of Illinois and an MBA from the Kellogg School of Management at Northwestern University.

How do you balance work/personal time?

We are a small team, so we have many periods where we are extremely busy. I use a number of strategies to make sure I meet all my deadlines and still have personal time.

For example, I get up early and work out before I come into the office, so I am wide awake and have a clear head to begin the day. I delegate as much as I can because I have a fabulous team that supports me. At day’s end, I prioritize my workload, so I will tackle the most important projects first. I also review every email received that day and either delete or catalog it by deal or project, so I don’t waste time when I need to access an email. When I work weekends, I work in 3-4 hour cycles so I don’t get burned out.

What do you know now that you wish you had known at the beginning of you career?

I wish I had known that being a working mom would have many positive impacts on my children, helping them become happy, productive adults. It would have saved me so much guilt, anxiety and questioning of my career choices during their formative years.

Obviously, it takes a lot of work, a supportive spouse and the willingness to overlook a frequently messy (but clean!) household. What I have found to be most important is quality time at home, not quantity. Our fondest family memories are of reading before bed, which was a sacred time for us. So many books captured what my kids were experiencing at each age range. We laughed, we cried, we discussed them endlessly.

So if you have kids or plan on having kids, don’t feel guilty. Kids are resilient; they just need to know that you love them unconditionally. No one is the perfect parent; we all make mistakes. But it is great for them to see both parents contributing, working through problems and sharing the workload.

What do you enjoy most about your role?

• Meeting new people, including management teams, sponsors, appraisers and turnaround consultants. I find that, if you ask questions and then listen carefully, you can learn a lot, particularly if you are looking at a new company, industry or asset class.

• Visiting our prospects to understand their businesses. I learn so much watching how owners interact with their employees, how efficiently products are produced and how the inventory cycles. The company visit either makes or breaks the deal, so always be well prepared.

• Structuring facilities to meet the needs of troubled companies. We have put together some very creative financing proposals that won the day but that were also structurally sound. Our small team has a long history together; we pride ourselves on being innovative, flexible and timely.

• Mentoring my team. They are smart, funny, dedicated and hard-working. Each deal has been a learning experience, whether structuring an Agreement Amongst Lenders, a Keep-Well with an owner, or a First-In Last-Out tranche that stretches on collateral. Troubled companies require a higher level of diligence and structuring that you learn as you go. I welcome all their questions and concerns.

What do you enjoy least about your role?

Anything that isn’t deal-related. I understand the importance of matters like politics, policy and governance, and back-office functions. But I prefer the income-generating responsibilities that come from working and closing deals.

Professional Development Courses

- Live online classes for ABL and Factoring professionals

- On Demand classes in Appraisals, Factoring, Legal, Workout & Bankruptcy