Encina Private Credit Delivers Strong Growth With Year To Date Volume Up 52% Through Third Quarter 2024 Versus Same Period 2023

November 14, 2024

Source: Encina Private Credit

November 14, 2024 – During the first nine months of 2024, Encina Private Credit (“Encina”) provided over $355 million of first out enterprise value loans to a wide range of middle-market companies. Encina continued to partner with direct lenders and private equity sponsors to support portfolio companies with growth capital and finance add-on acquisitions.

Encina helps direct lenders offer competitive solutions with enhanced yields by providing:

- Competitively priced first out tranches up to $100 million

- One stop solution including first out revolvers (& LC’s), term loans, DDTL’s

- Speed and certainty via an efficient and reliable approach

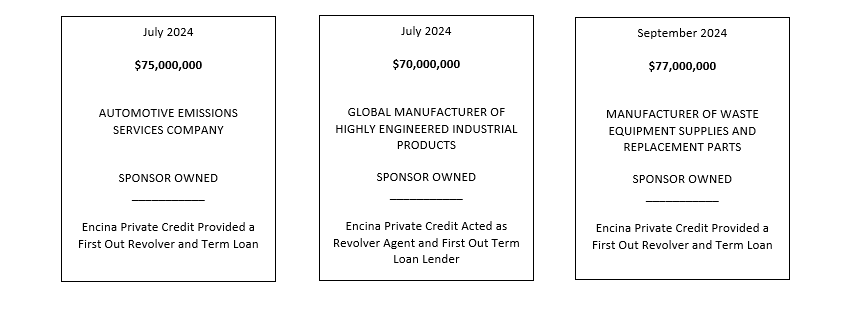

Notable transactions include:

About Encina Private Credit

Encina Private Credit (“EPC”) is a specialty finance company that partners with direct lenders to provide first out enterprise value loans to private equity-sponsored and non-sponsored borrowers. EPC provides credit solutions in the form of first out priority revolvers, term loans, and DDTLs and typically invests between $15 million up to $100 million per transaction. For additional information, please visit EPC's website at https://privatecredit.encinacapital.com/