- Ares Commercial Finance Launches a Healthcare Asset Based Lending Platform

- Interview with SFNet’s Emerging Leaders Summit Keynote Speaker Dave Spandorfer, CEO & Co-Founder of Janji

- Kansas City Fed President Addresses Secured Finance Network Amid Market Turmoil; Vows to Fight Inflation

- Mazzotta Rentals, Inc. Secures $160 Million Credit Facility to Accelerate Growth and Continue Fleet Expansion

- Empowering or Overshadowing? Balancing Technology and Expertise in ABL

Convention Panel on Cannabis Points to Growing Market with Many Red Flags

December 14, 2022

By Susan Carol

Cannabis remains a controlled substance at the federal level, but a number of states have legalized it under state law. As a result, marijuana-related business (MRB) lending is ripe for growth. However, banks and non-bank lenders are entering this sector with caution. The presenters at SFNet’s 78th Annual Convention in November provided Canadian and U.S. perspectives on this dynamic market.

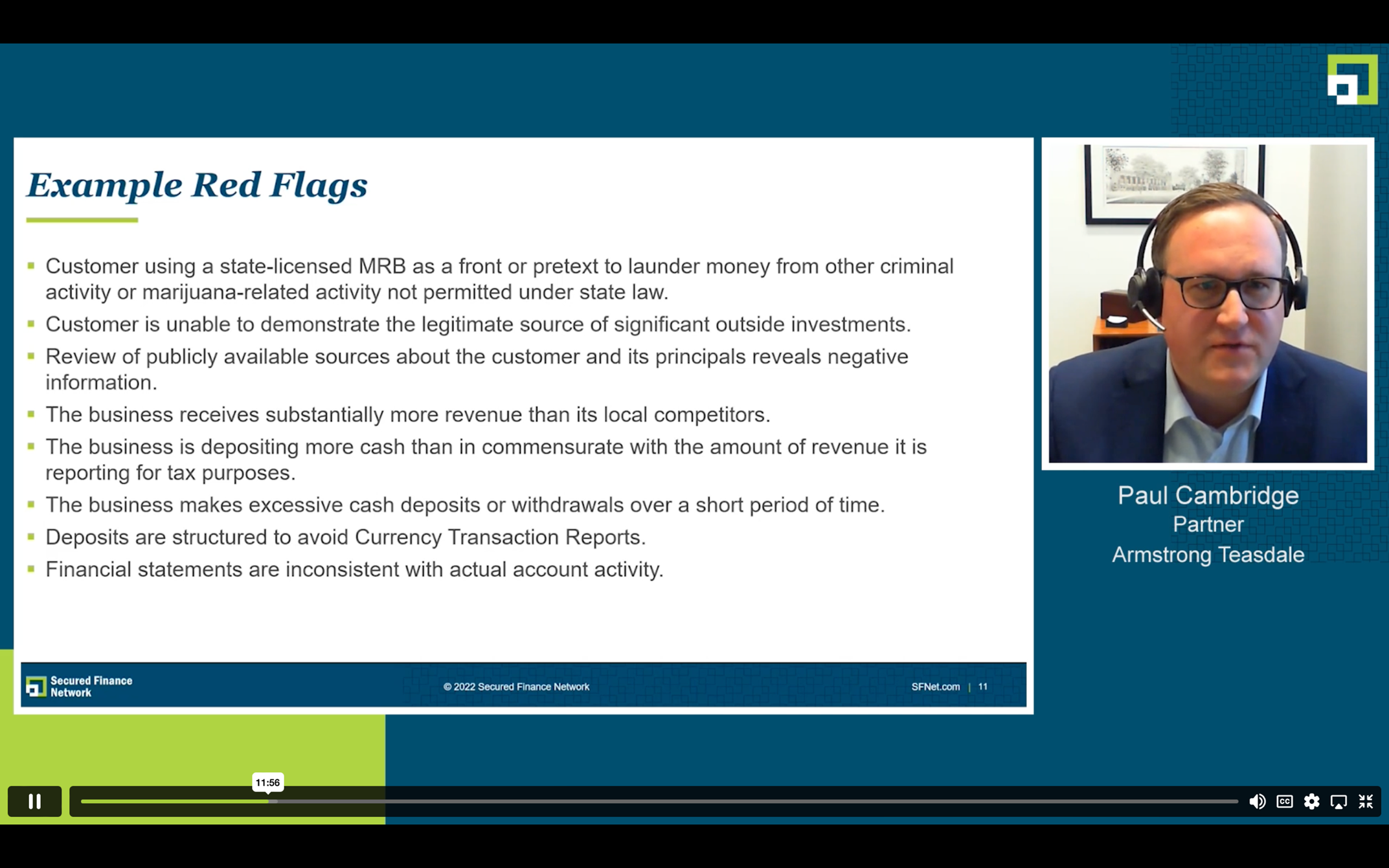

In the U.S., FinCEN (Financial Crimes Enforcement Network) guidance is carefully reviewed to avoid violations. The convention panel provided informative slides outlining hurdles—useful for review when considering entering this market. They said MRB lending can be complicated. The FinCEN outlines 23 red flags as guidance on customer due diligence. See the slide below listing some of them.

There are many practical risks, according to Paul Cambridge, partner at Armstrong Teasdale. But there are usually some workarounds that enable various parties to participate in this business. He pointed out that most of his clients are quite comfortable with indirectly entering this sector by lending to business affiliates such as landlords that don’t require them to file Suspicious Activity Reports (SARs). The filing of SARS is part of the reporting requirements of financial institutions.

Many U.S. banks are still on the sidelines of this market even after the SAFE Banking Act which was introduced in 2019 to open up some opportunity. However, the Act did not make the product legal, nor does it provide a safe harbor for bank, Cambridge said. According to 2021 data, some 755 financial institutions are lending to MRBs or processing their funds.

In Canada, the Treaty Land Entitlement (TLE) provides opportunities for direct lending to MRBs. However, Canadian banks often are linked with U.S. banks and there can be tremendous hurdles if the American side is not onboard to embrace this business.

One presenter, whose firm has been in the sector since 2013, cautioned others who are entering it not to rely too heavily on a borrower’s counsel. A security pledge is recommended, with licenses being the most valuable asset to consider for this. However, few of the states where cannabis has been legalized permit a pledge of licenses.

The Farm Bill of 2018 created a viable path for MRB operators. Hemp is a Cannabis byproduct and is not federally prohibited. So, Hemp can be used as an agent in CBD, but due diligence is still critical, the presenters noted. This would include such things as requesting information about crop inspections.

The Wall Street Journal reported in November that recreational marijuana is legal now in 21 states, as well as in Washington, D.C., citing the National Conference of State Legislatures as the source.