- ABL Navigates New Economic Crosswinds

- Gordon Brothers Appoints Liz Blue Head of North American Business Development, Retail & Real Estate Services

- Ares Commercial Finance Launches a Healthcare Asset Based Lending Platform

- Interview with SFNet’s Emerging Leaders Summit Keynote Speaker Dave Spandorfer, CEO & Co-Founder of Janji

- Kansas City Fed President Addresses Secured Finance Network Amid Market Turmoil; Vows to Fight Inflation

Financial Analysis - Getting Behind The Numbers

By Walter Schuppe

Financial analysis is a cornerstone for any credit administration function. Each loan officer must know his or her borrowers and thorough financial analysis is the best way to start.

The goal of financial analysis is to link business events to changes in the balance sheet, income statement and cash flow to explain the company’s performance during the period under analysis. Without this linkage you end up with “elevator analysis” (sales are up, AR is up, EBITDA is down, etc.) and no meaningful understanding of the company’s performance.

Where do you start? EBITDA is often a starting point for many people. Why? It is a standard measure of performance in the banking and finance industry. EBITDA is a measure of the profitability generated by a business before interest expense, tax expense and depreciation and amortization expense. While this gives the analyst a place to start and some ability to compare to comparable companies, EBITDA should not be viewed as a proxy for cash generation ability.

Cash is the life blood of any organization so the temptation might be to jump right to an analysis of cashflow. Since cashflow is the result of operations and balance sheet management you would be better served to begin with an analysis of the P&L and then move on to the balance sheet. Armed with a full understanding of the P&L and balance sheet, your analysis of the cash flow will be easier and more informed.

Summary financial statements can be helpful in getting a quick snapshot of performance, but you really need the detailed financials to truly understand the results of operations. There are various degrees of “detailed” financials and it is up to the analyst to determine how much information he or she needs to understand and explain the company’s performance.

This article is not meant to be a comprehensive guide to credit analysis, but rather, it is meant to discuss approaches to financial analysis that prompt the reader to think about how he or she can expand their analysis to get a much deeper understanding of the strengths or weaknesses of their borrower.

You should begin your analysis with some general expectations of what you expect to see based upon what you know has been happening in the business. Some basic expectations are:

- As sales increase, current assets and current liabilities should increase but remain the same as a percentage of sales.

- As sales decrease, current assets and current liabilities should decrease but remain the same as a percentage of sales.

- Growing companies will likely be net users of cash and companies that are stable or experiencing slow growth should be net providers of cash.

INCOME STATEMENT:

When analyzing revenue, be sure that you understand how many revenue streams the company has and what the gross margins are for each stream of revenue. You will have to decide how material each revenue stream is and how deep you want to dive. Is this transactional revenue, repeat business or recurring revenue? Is the GAAP revenue influenced by the recognition of deferred revenue? What is the quality of the revenue? Are the products or services provided considered mission critical to your borrower’s customers? Are there any meaningful switching costs? An analysis of revenue by customer can help you understand this. You will want to look at sales by customer on a Year Over Year basis (YOY) and a Year to Date basis (YTD). Are the sales highly concentrated and how would the loss of the largest customer impact performance?

Cost of Goods Sold (CGS) can be influenced by a number of factors and some will need special attention. Is there depreciation or amortization of intangibles in the CGS? Is there an overhead allocation and is it consistently applied? Are there raw materials that are considered commodities and how did the movement of the commodities market affect the cost of production? Is the supply chain U.S. based or heavily dependent on foreign vendors? If there are foreign suppliers, how is the trade relationship with that country and what could cause that to change? Have there been changes in tariffs? Are the production costs consistent from year to year in terms of raw materials (RM), Work-in-Process (WIP) and Finished Goods (FG) as a percentage of revenues?

Operating expenses should first be reviewed in terms of broad categories (selling and marketing, administrative, R&D, to name a few) and then by line item within each broader category. You should discuss the significant expenses as well as those expense which may have had significant changes YOY and YTD. Depreciation and amortization may also be classified in Operating expense or they may have their own line.

Nonrecurring expense is a frequently seen classification. In some cases, there may be special circumstances which have led to these costs and they should be explained. If your analysis shows that each year the company has the same non-recurring expenses, it’s a good bet those are truly re-occurring costs of operations.

Interest expense may contain both cash interest expense and PIK interest. It is important to understand the breakout and look for that to be separately classified on the cashflow.

Tax expense can be influenced by deferred taxes or NOLs and you should understand how the taxes were calculated.

When you have analyzed the full P&L, you can build EBITDA. Based on the specific circumstances you may choose to create an adjusted EBITDA calculation. You may elect to add back rent or any other expenses which will make the analysis more meaningful or comply with industry standard analysis. You may choose to review the balance sheet before you analyze EBITDA. Changes in deferred revenue or other unusual changes in other balance sheet accounts may influence your presentation of EBITDA.

BALANCE SHEET:

A proper analysis of AR and AP will include both a calculation of turnover/days on hand and an analysis of the aging, AR dilution, and AR write-off history. Reviewing the aging will provide insight into the customer and vendor concentrations which can lead to further analysis of sales by customer and purchases by vendor to understand any significant reliance that could lead to a dependency on a customer or supply chain disruptions later. Do the various “buckets” on the aging support the AR or AP turnover calculation? If not, why not? Does seasonality require your analysis to be done on a T3M as well as TTM basis?

Does the AR aging have any significant concentrations? What is the financial wherewithal of those account debtors? Check the AP aging. Are there any contra accounts (same company that owes AR also owes AP) that could result in a setoff and impact cash flow?

You should consider an analysis of purchases by vendor to better understand the AP aging. Do the vendors provide early payment terms? Is your borrower taking them? If not, why not?

Analysis of inventory can require significant analysis depending upon the complexity of the company’s operations. The cost accounting aspect of the inventory can add a degree of complexity in analyzing the operations but can also impact the inventory on the balance sheet. Shifts in the composition of inventory between raw materials, WIP and finished goods can impact gross margin analysis and inventory book values. To fully understand your borrower, you may need additional ad-hoc analysis of the inventory to dig deeper and fully explain their results of operations. Work with your borrower to develop that analysis and require it to be delivered monthly with the financial statements. It is very likely that the CFO has the same questions you have and is performing his or her own analysis for management purposes.

Is the inventory a commodity or are the finished products seasonal? Since inventory is valued for GAAP purposes at the lower of cost or market, swings in the marketplace pricing can impact your inventory values if market conditions seriously deteriorate. If the company is seasonal, your calculation of inventory days on hand may need to be analyzed on a T3M basis as well as TTM basis to get a full understanding of performance.

Capital expenditures need to be analyzed. It is not enough to say “the company had a use of funds of $1MM related to capital expenditures.” What were the CAPEX? What is the payback period? Is there a minimum level of annual CAPEX required for the company to remain competitive? How much of the total cost was for the actual asset vs. installation and assembly costs?

Capitalized software development costs are becoming a more frequent balance-sheet item for certain companies. Companies that create software or SaaS or that have a heavy investment in computer systems my need to update these systems regularly. Based on the type and character of the expenditures, they may qualify to be capitalized. That means the cash outlay will not flow through the P&L and you must adjust operating cash flow accordingly.

Deferred revenue is becoming more common, particularly for companies that have SaaS offerings. Deferred revenue needs to be analyzed because as it builds the company receives cash but does not recognize revenue, which is a temporary benefit to cash flow. However, if contracts are not renewed, or new contracts are not signed, deferred revenue will be reduced and the company will be recognizing revenue, but not receiving cash, which may create significant non-cash EBITDA. An adjustment will need to be made for this.

Accruals and reserves are places where savvy CEOs and CFO2s salt away revenue and income for a rainy day. Consider the company that suffered significant inventory damage due to a flood. The CEO wrote off the book value of the damaged inventory. Several months later the company received payment from their insurance carrier for the full book value of the inventory. The CEO debited cash and credited other reserves. This allowed him the flexibility to smooth dips in future income.

Other assets and other liabilities are another place where creative accounting can find a home. Companies may defer certain customer acquisition costs to better match them with the life of the customer’s contract. In certain instance this maybe appropriate, but in others it may not. In either case, you need to adjust EBITDA to properly reflect the cash impact of these accounting entries.

The equity section in the balance sheet is also a place to find pieces to the cash-flow puzzle. Make sure to understand the gross changes in the various ownership accounts and the paid in capital accounts. Identify any investment or repayment made in the period under analysis and question that activity. To get a good understanding of how the equity is impacting the cash of the business be sure to look back several years to see if there is a history of dividends or a history of investing additional capital to support the business.

You may also want to understand the cash conversion cycle. This is the net time period encompassing the purchase of goods and or labor, the conversion to and sale of inventory and the collection of the billings. This is calculated by AR Days on hand + inventory days on hand less AP Days on hand. This is helpful in understanding the cash flow, borrowing needs and the efficiency of managing the working capital.

+ AR Days

+ Inventory Days

- AP Days

Cash Conversion Cycle

CASH FLOW:

Your cash flow analysis will start with the net income, then add back non-cash expenses and deduct non-cash income (such as the gain or loss on the sale of assets), add back depreciation and amortization and reflect any changes in deferred taxes to arrive at the Funds From Operations (FFO). This measures the net cash that will be collected as a result of operations for a specified period. From there you will look at the changes in the current assets and current liabilities to get a net change in working capital. When the net change in working capital is added to FFO you will arrive at the Cash From Operations (CFO). CFO represents the cash available after establishing necessary reserves, moving certain production costs to the balance sheet and working capital management. CFO is used to make non-operating expenditures such as CAPEX, debt repayment, dividends, acquisitions, etc.

This leaves an analysis of the long-term assets (fixed assets, etc.), long-term liabilities (debt, etc.) and equity (dividends, capital infusions, prior period adjustment, etc). The result should be the change between opening cash balances at the beginning of the period under analysis and the ending cash balances.

Look deeply into the movements in the various line items and try to validate those movements with the business events you identified in your analysis of the P&L and balance sheet. Develop the most meaningful analysis possible by interpreting the data and creating ad hoc analysis when appropriate.

Detailed analysis applies to companies that are unprofitable as well as profitable. The analyst needs to peel the onion to fully understand what is leading to the net loss and negative cashflow.

BRIDGE ANALYSIS:

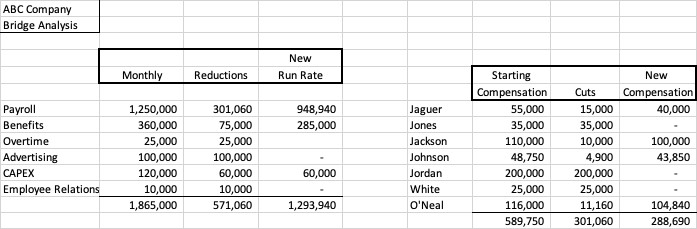

If a company is claiming they have made operational changes that will narrow losses or return the business to profitability and positive cash flow, be sure to have a detailed analysis to support those claims. This is often accomplished with a “bridge analysis” that will look at the financial impact of these changes in detail adequate to validate the improvements. The company can show price increases and the expected impact on volume and revenue. You can compare expense levels prior to cuts and after cuts. You can also analyze headcount reductions by reviewing a detailed list of employees impacted by the RIF, the related salaries and related benefits. The following is an example of a bridge analysis with supporting analysis to show where the payroll cuts were made:

13-WEEK CASH FLOW:

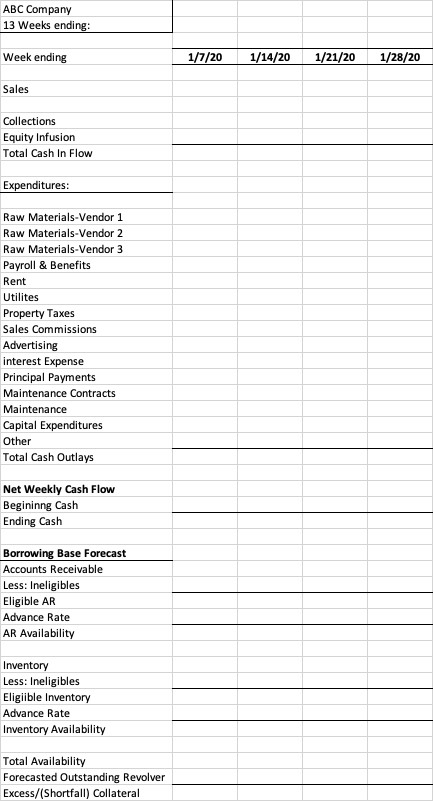

When a company develops a liquidity crisis cash is king. The company should have a laser focus on all of the movements in cash on a weekly basis. The generally accepted forecasting period is 13 weeks. For most companies it is very difficult to forecast beyond one fiscal quarter (13 weeks). The more detailed the forecast, the more accurate it is likely to be. Each week the banker and the company should review the previous weeks results and compare them to the original forecast and determine if the balance of the period should be reforested. If the company has an ABL facility with a borrowing base, there should be a forecast of availability over the 13-week period. The following is an example of a 13-week cash flow.

MODELING:

Software that aids in the spreading of financial statements helps improve efficiency by performing basic calculations (AR turnover, financial ratios, EBITDA Calc., etc.). This shortens the time to perform the various calculations, but the analyst needs to understand the formulas behind the calculations and how movements in the financial statements can impact those calculations. Understanding the formula will allow you to better interpret results and recognize anomalies.

Be sure that your financial model integrates the balance sheet, income statement and cash flow to ensure that you catch any out of balance condition in the financial statements submitted by the borrower.

COVENANTS:

Covenants, when violated, serve as an early warning sign to bankers that something that was forecasted to happen has not happened. Borrowers would like to limit the number of covenants, make the definitions of the calculations to be most favorable to the business and they would like the covenant levels compared to the forecasted performance to be as loose as possible.

It is usually best to structure covenants to measure what is most important to the successful operation of the business. It is also typically better to limit the number of covenants. You don’t want management to run the business so they can be in compliance with the covenants, unless it is a troubled business. Then there may be reasons to keep the company on a short leash in some regards.

Be sure the covenants are well thought through and the definitions do not include or exclude certain items because the company fears they won’t be in compliance or create “baskets” that exclude certain costs. Include the impact of those events in your calculations and set the covenant levels around the expected performance.

CONCLUSION:

Financial analysis is part science and part art. It is the cornerstone of strong credit administration and the analyst has to put in the time and ask the questions to fully peel the onion and understand why a company has performed as it has.