- Gordon Brothers Appoints Liz Blue Head of North American Business Development, Retail & Real Estate Services

- Ares Commercial Finance Launches a Healthcare Asset Based Lending Platform

- Interview with SFNet’s Emerging Leaders Summit Keynote Speaker Dave Spandorfer, CEO & Co-Founder of Janji

- Kansas City Fed President Addresses Secured Finance Network Amid Market Turmoil; Vows to Fight Inflation

- Mazzotta Rentals, Inc. Secures $160 Million Credit Facility to Accelerate Growth and Continue Fleet Expansion

SFNet Q3 Asset-Based Lending Index Analysis

By By SFNet Data Committee

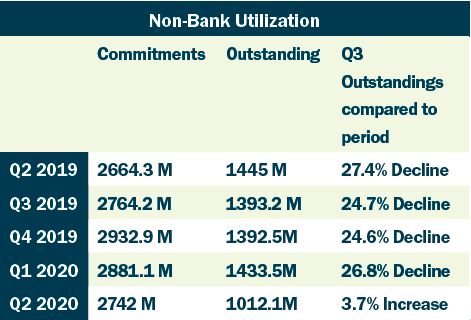

While sentiment from both bank and non-bank lenders was more positive from Q2, the overarching theme of Q3 can be told by the continued decline in utilization for both bank and non-bank lenders alike. Bank groups set their lowest level in the five years since these figures were collected by SFNet, with 75% of banks reporting decreases. Non-bank usage reduced slightly over the previous quarter but are back to levels not seen since the first and second quarter of 2017.

Comparing previous periods against Q3 results of $243.3B in commitments and $80.7B in outstandings shows that an issue with portfolio returns could be taking root within the banks, which have been impacted by the defensive draws of Q1 being repaid by PPP funds, robust capital markets issuances, and low utilization by the SNC credits. These circumstances coupled with a low net-interest margin for commercial U.S. banks, (2.81% in 2020 Q2, the lowest margin since the 1980s) imply supply is generally outpacing loan demand.

Non-Banks have seen a similar trend but, without the worries of committed capital, the larger trend of increase commitments will ultimately have a positive impact through larger unused spreads and prepayment penalties.

With industrial production and capacity utilization still running below historical levels, there is hope that loan utilization will improve as customers ramp up production in the coming quarters and return to historical levels of production.

Q3 Bank Data Highlights Confidence Index

Confidence indicators improved or remained steady as the economy rebounded during the third quarter. Lenders were expecting the economy to improve in Q2 and this sentiment has continued in Q3 as outlook for portfolio performance and general business conditions increased. Both write-off and non-accrual saw a significant improvement, mainly due to economic improvement and immediate and careful action at the beginning of the pandemic. Credit standards continue to tighten within both small and large banks alike.

As highlighted above, utilization continues its decline and, while respondents in Q2 did not expect this to occur in Q3, they have tempered their expectations slightly and expect Q4 to remain the same. New business demand expectations were slightly lower, but zero Bank respondents expect demand to decline. Expectations for hiring declined with all reporting fi rms indicating that they do not intend to reduce or increase hiring levels.

Commitments and Outstandings

Continuing a negative trend of the 2nd quarter, outstandings reduced further during the period to $80.7B. Clients used PPP funds and took advantage of robust capital market issuances leading to further paydown in revolvers. This decline is well beyond the recent periods and recent defensive draws and places the industry back into the first quarter of 2017 and similar to quarters prior to 2016.

New credit commitments fell significantly to $5.3B, a reduction of 22.1% from Q2 and 44% from the same quarter in 2019. New outstandings decreased by 4.8% from Q2 and were significantly so when compared to 2019, a 45% reduction. A silver lining can be gleaned from the net change in commitments rebounding in both Q2 and Q3.

Amongst those reporting an increase in new commitments and runoff was consistent with Q2 but this data does not match the values presented on the whole. This leads the data committee to believe that runoff was not equal across the peer group.

Credit Quality

Q3 witnessed reducing non-accruing loans and criticized/special mention classifications with non-accruals reduced $116 million, an 18.7% decrease from Q2 2020. Net write-offs reduced 74.6% from the prior quarter, but the reduction was mainly due to a large Q2 one-off event, bringing 2020 write-offs to a manageable percentage of outstandings.

Concerns of a larger event similar to that of the great recession have now passed, but with an eye towards continued COVID spikes or broad shutdowns.

Due to the broad decrease in both non-accruals and write offs, credit quality remains a strong point for the banks. The second-quarter rush to move credits into special mention would have led the industry to believe that Q3 would bring additional write-offs, but it now looks like it was part of a larger process for the banks to carefully track customers impacted by COVID. For comparison, C&I delinquencies and write-offs ticked up to 1.3% and 0.6% in Q2, respectively, while ABL non-accruals rose to 0.8%. Losses are well below Great Recession highs, 4.4% and 2.6% for C&I delinquencies & write-offs and 2.3% for ABL non-accruals. It will take some time to determine if the recent decline in write-offs is a trend or if there is a longer lag as historically seen during periods of economic stress.

Q3 Non-Bank Data Highlights Confidence Index

Stable for business conditions, portfolio performance, new business, and expected hiring from Q2, the non-banks continue to hope that economic dislocation to have a positive impact on portfolio growth and utilization. While easy monetary policy and new lending facilities have had a limited impact on banks’ willingness to lend, Non-Banks are likely to continue to be a major source of credit as long as central bank policy keeps yields low and pushes investors to seek higher returns.

Loan outstandings were slightly up and utilization was flat, which reflects clients in this market using up April PPP loan funds and slight borrowings to replenish stock, but not breaking past fi gures that were last reported in Q3 of 2017. Unlike the Bank market where significant run-off was seen because Issuers had access to the equity and debt capital markets, it is expected that utilization and outstandings will grow in the immediate future. It is important to note that this metric compares outstandings to commitment size. It does not capture the effect of shrinking borrowing bases. When outstandings are compared to availability, the utilization picture may be a bit different. New commitment growth in Q3 increased sharply to a level above the historical average.

The backlog of workflow and pauses taken by non-bank credit teams and investors in Q2 has subsided and it is clear that non-banks are taking advantage of market disruption. Multiple lenders announced acquisition financing for sponsor groups that were historically completed by banks.

Following a significant spike in non-accrual loans during Q2, values as a percentage dropped 330 basis points returning to levels similar to those seen in prior periods.

Conclusion

Q3 2020 resulted in a surprisingly quick rebound for lenders in both credit quality and confi dence following what was the most volatile quarter since the great recession. Demand for the ABL facilities increased during the quarter but, with low utilization, the market has become very aggressive for any new opportunity that can increase portfolio yields. The true test for lenders in Q4 will be whether ABL lenders will continue to compete aggressively for new transactions, as previously noted, in order to hunt for meaningful outstandings, or if the M&A market and fallen angels can bring an increase in the supply of transactions.