- Mazzotta Rentals, Inc. Secures $160 Million Credit Facility to Accelerate Growth and Continue Fleet Expansion

- Empowering or Overshadowing? Balancing Technology and Expertise in ABL

- Empathy from the C-Suite: Michael Haddad’s Lessons Learned From His Self-Run Job Process

- Quasar Capital Welcomes Rob Hydeman as President of Business Credit

- PKF O’Connor Davies Expands Advisory Service Offerings with PKF Clear Thinking Integration

SFNet’s International Lending Conference Reveals Reasons for Optimism

By Susan Carol

The industry worldwide was profoundly shaken by the events of 2020, and the two-day SFNet International Lending Conference provided attendees with a broad global view of economic recovery and a deep dive into the new normal of covenants, risk management and other areas of the secured finance business.

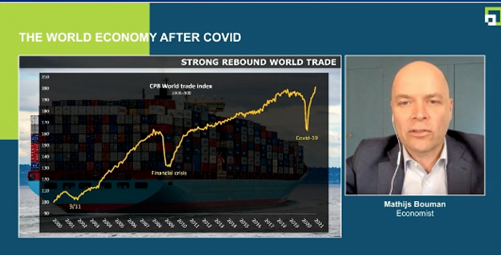

On the opening day, May 12, keynoter Mathijs Bouman, a Dutch economist and journalist, presented the “World Economy after COVID,” but he lightheartedly called it the “Monetary Fairytale at the Moment,” perhaps a more apropos title given the level of worldwide optimism and the sharp and unexpected rebound from the COVID-induced downturn last year.

Bouman only briefly noted the lockdowns, focusing more on the rebound, the effect of COVID on world trade, and the European economy. He pointed to International Monetary Fund (IMF) GDP data revealing the 2020 downturn was worse than the 2009 “Great Recession.” However, valuable lessons were learned, one of which was the downside of certain areas of global interdependence.

Bouman said the IMF expects a great rebound in 2021 and 2022, and a return to

“normal structural growth” beyond ’22--however, with inflation concerns.

Despite the second and third wave of COVID, the world is recovering, though India may not begin to see the same rebound as others until ‘22.

In terms of effects on GDP, he said there was considerable divergence in Europe, with Finland least affected by COVID and Spain most so. He noted China only had one wave and returned to production.

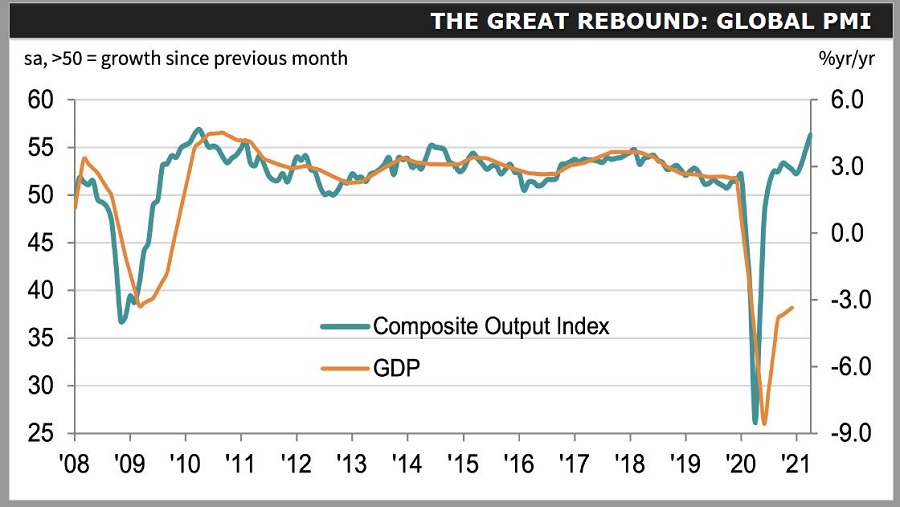

Bouman said indicators overall are “really, really” optimistic. The Global PMI (purchasing managers index) clearly shows purchasing managers’ optimism and an exceptional rebound rising sharply from -9 to +6 percent year-over-year growth from 2020 to 2021.

He also pointed to the German IFO (business climate index) showing a strong rebound in a country that influences the European nations; he also noted a new CO2 emissions rights indicator as being positive.

While he said he favors free trade, the pandemic may have contributed to more economic protectionism on both sides of “the pond” because countries have now realized their dependence on others for everything from computer chips to personal protective equipment, among other urgent necessities. “Now they are thinking, maybe we have to make our own,” he said.

Business sentiment may be moving from “just-in-time” manufacturing to “just-in-case”—given the pandemic’s drastic disruption to supply chains. But, he said, relying only on local production is not the answer. “It is not robust enough. Perhaps diversification is the answer,” he suggested.

On a positive note, Europe developed a new economic resilience facility and issued bonds with low interest rates, but on the downside, there is rising inflation, he said. Europeans are also watching the Biden administration programs for their potential effect on the U.S. economy.

“No one expected that indicators would rise so fast and be so far above where they were in 2019,” Bouman said, noting that smaller past worries disappeared during such a swift recovery. This is also a bright time for entrepreneurs, he observed.

A New Normal in Covenants and Trickle-Down ESG

With more money chasing investment than there are deals, there is a new normal in covenants, a panel on May 19 reported. Overall, there is greater leakage, weaker covenants and “COVID tailwinds.”

However, according to Xtract Research, at the end of last year there was one positive move toward making covenants more investor friendly in institutional loan and bond markets, both in the U.S. and Europe, regarding EBITDA synergy add-backs. James Slessenger, the European managing director of Xtract, said they are seeing more caps on synergies that inflate EBITDA, so the questions being addressed are: “What size should it be, and is there a look forward, and, if so, how far?”

What has to be added to the equation are the real costs of the pandemic.

Matthew Sparkes, Executive Director at J.P. Morgan’s Asset Based Lending business, said. During Q1 2021, there was $27BN of syndicated ABL volume in the U.S., $5BN higher than the quarterly five-year average. “At current run-rate that will equate to in excess of $100BN of syndicated ABL volume during 2021, and we haven’t seen thats volume since 2011. ” The demand and supply dynamics of available capital wanting to be deployed results in a borrowing friendly environment, he said.

Sabrina Fox, CEO of the European Leveraged Finance Association, said she agrees with Sparkes and the others on this panel, and said her trade group is taking action to educate members, urging them to strengthen protections, focus on transparency and provide more disclosure to meet today’s level of covenant complexity.

She said they have created guidance for term-sheet completeness (available on the ELFA website here) and environmental, social and governance (ESG) information to educate their members (in collaboration with the Loan Market Association).

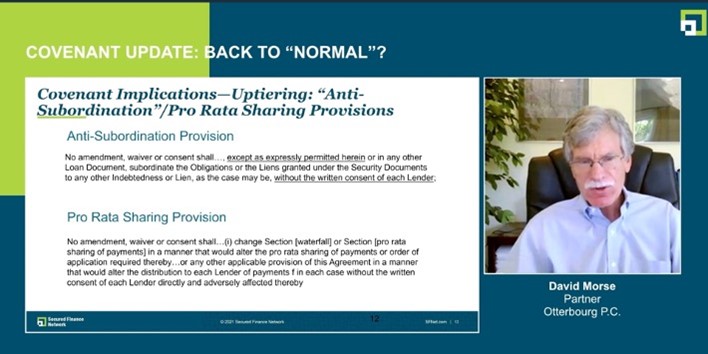

The expansion of covenant baskets, described in this session as “baskets here, there and everywhere,” and which are being used in unanticipated ways, was a dominant theme of the panel. Confronted with the economic challenges brought on by the pandemic, what are companies doing? David Morse, partner at Otterbourg P.C., said companies in distress are conducting “liability management exercises” where debt is restructured by reference to the baskets in the covenants, but which restructuring often has an adverse impact on the potential recovery of lenders or at least a subset of lenders.

He also said that we now have new terms to describe these practices, such as “drop-down financings,” in which intellectual property or other assets are transferred from the original loan party to another party—such as an unrestricted subsidiary, so as to no longer be available to lenders that may have provided the financing to acquire such assets. The panelists are keeping an eye on this, focusing on preserving liquidity, having exit strategies and generally maintaining a better borrowing base. They are addressing documentation fixes, such as “JCrew blockers,” based on what was learned from the debt restructuring by J. Crew.

Discussion led to reference to another term that Morse noted is being used to describe a different type of liability management exercise that has become a hot point for lenders: “uptiering.” In these transactions, the priority of lenders as to either collateral or repayment is shifted without their consent, increasing the risk that their debt will be repaid. Morse explained that the structure of voting rights on amendments to the loan documents so as to require the approval of all lenders for the subordination of liens and the payment priority of lenders as among each other, and to change pro rata sharing provisions were ways to address this issue. See slide below.

On the broader topic of ESG, the panel moderator, Jason Bennett, a partner at Winston & Strawn LLP, said it was a topic big enough for its own session.

While ESG was first raised by Fox, others from Europe chimed in to concur that it is having a growing impact in financial services, driven mostly by regulators but also by companies finding ways to monetize ESG and use it in negotiations. This is leading to new provisions in many leveraged transactions.

Ivestors are feeling pressure to invest in ESG , boards have ESG champions, and basis points on interest are being adjusted for companies that can measure and meet prescribed targets. Slessenger said he saw three and four basis points in leveraged loans attributed to this and anticipates seeing that rise to 10 to 15 points.

The panel said ESG interests will grow and trickle down throughout financial services.

Other topics addressed during this conference were country specific, and the conference included sessions on insolvency, building reserves to borrowing base and cross-border transactions.

SFNet’s 77th Annual Convention will be held in Phoenix, AZ, Nov. 3-5, giving members a welcome opportunity to meet in person once again.