- ABL Navigates New Economic Crosswinds

- Gordon Brothers Appoints Liz Blue Head of North American Business Development, Retail & Real Estate Services

- Ares Commercial Finance Launches a Healthcare Asset Based Lending Platform

- Interview with SFNet’s Emerging Leaders Summit Keynote Speaker Dave Spandorfer, CEO & Co-Founder of Janji

- Kansas City Fed President Addresses Secured Finance Network Amid Market Turmoil; Vows to Fight Inflation

The Voids Created in Asset-Based and Asset- Backed Lending

By Charlie Perer

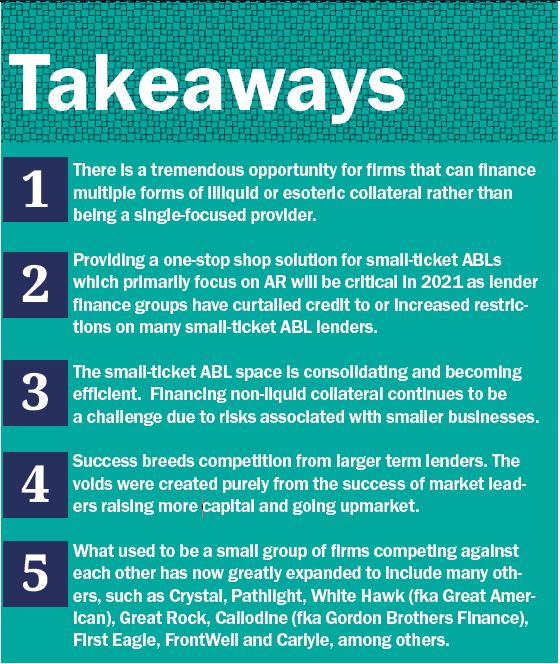

Credit cycles typically bring about two correlated occurrences – consolidation and credit voids. This last cycle has been no different as several market segments experienced consolidation, which has created unique and unrelated voids in both small-ticket ABL and the asset-backed term space. New firms are emerging to fill the voids as we are about to enter a new cycle of competition and innovation.

Traditional ABL has, by any measure (growth, market share, adoption), become a mainstream product over the past decade. Market share gains have come from all over including at the expense of both banks and factors, among other participants. As with all markets, growth in one area has created voids in others. Not one, but two huge market opportunities exist in the asset-based and asset-backed lending world that no one is talking about. The first market opportunity is to provide small-ticket ABL to companies where AR is not the dominant form of collateral, thus creating a collateral imbalance. Small businesses are tougher credits to begin with, but especially hard to obtain lender fi nancing for when receivables are the smallest part of the collateral base. The second opportunity is to partner with the traditional ABL community to provide sub-$10 million split-lien asset-backed term facilities in conjunction with a working capital facility. These asset-backed term facilities would be used to fi nance any and all fixed assets including M&E, RE & IP, among others. The uniqueness of the asset-backed split-lien category is being able to write smaller checks that the big asset-backed funds can’t, as many of them have moved upmarket. What’s clear is that both of these market voids were born out of the last cycle as the bigger the traditional bank and non-bank ABL world became the bigger the voids created for the non-traditional.

These two voids arose and grew across separate and distinct parts of the market for both shared and disparate reasons. The small-ticket ABL void is for businesses who are more often than not inventory-heavy and AR-light. These are smaller businesses that are traditionally abandoned by most of the ABL universe, which primarily focuses on receivables as a dominant form of collateral. The reason they are abandoned is that most conventional ABLs can’t get leverage to finance these businesses when there is a large imbalance. For an industry that typically works on a 4:1 leverage ratio, it’s not worth it to tie up equity on tougher-to-finance and tougher-to-liquidate businesses. The second void is to finance assets including M&E, RE and IP or a combination of them to provide a onestop solution to partner with ABLs across the market-ranging from small-ticket to large bank-ABLs. Again, these are harder forms of collateral to get leverage on and the reason most term providers are fund structures. This is also why the larger term players need scale to make the economics work and are too big to serve sub-$10 million capital needs. These voids in both asset-based and asset-backed are real and exist for several reasons including lack of lender financing, scale and difficulty of liquidation, among other reasons.

Both the traditional ABL and lender finance market grew and matured together so the appetite to finance non-liquid collateral changed. With so much industry focus on the world of traditional ABL, very little attention has been given to the non-traditional world. The gulf between the two worlds is large for many reasons. First, let’s be clear to define traditional ABL as any ABL deal where accounts receivable is the dominant form of collateral and non-traditional where the inventory, M&E, IP or other form is dominant. Essentially, any ABL deal with AR being less than 50% of the collateral becomes tougher to finance because the loss in a liquidation increases as the imbalance increases. Inventory-and M&E-dominant companies are hard to finance and harder to liquidate. This is why there is a dearth of lenders chasing these companies. Most non-bank ABLs are thinly capitalized to begin with and any risk of tying up capital for a pro-longed liquidation makes the bar to lend that much higher.

This is also why the traditional ABL market predictably consolidated during the last cycle, which leads us to where we are today. The traditional ABL market has never been more competitive or efficient from small-non-bank to large-bank ABL. What is not efficient is the non-traditional world for the majority of companies that either collect their AR rapidly so they have minimal AR or have a balancing issue. These are typically companies heavy in inventory or other forms of collateral that are not as liquid. All forms of capital entered the traditional ABL market from investors, lender finance and new and old management teams who saw the non-bank opportunity. The efficiency at all levels created an effi cient market for both clients and finco acquirers wanting to enter this asset class. It also created massive inefficiencies that exist today.

It’s really not an overstatement to say that any firm can get into traditional ABL, but very few can get into non-traditional. The product has become no different than any consumer product that is driven by cheap costs of goods and great marketing or distribution. The same cannot be said for the non-traditional side of lending. The leverage ratios are lower, the need for financial and human capital is much higher. The author also denotes the difference between true asset-based and asset-backed to illustrate voids in different market segments. The asset-based void is relegated to small-ticket ABL and the asset-backed void spans across all lending markets from small to large. It is really meant to fill the void left by the myriad large term funds that raised too much capital and simply can’t finance smaller deals.

New firms need to be over-equitized, have an originations engine and really understand esoteric assets and liquidations. It’s no surprise that many firms have shied away from this space. Why bother when there is so much opportunity in the middle of the proverbial football field and chasing these deals just ties up equity? The beauty and simplicity of the non-bank model is that it offers a surprisingly high ROI, but relies on 4x leverage --meaning for every $1.00 of AR financed, the ABL is borrowing 80 cents and putting up 20 cents. Not a bad model and easy to understand why it is very attractive for both lender finance groups and equity investors in the asset class. This leverage, at least in the small-ticket space, typically only works with AR-heavy deals as a means for lender finance groups to control risk. The same cannot be said when there is an imbalance of collateral with inventory or other collateral being the dominant form. This is why most small-ticket ABLs focus on transactions where AR is the dominant form as they get the most leverage on these deals.

The ABL playbook including the lender finance model became not only clear, but widely adopted in the past 10 years. This drove industry growth and consolidation for traditional ABLs. Ironically, non-traditional ABL did not really change, consolidate or experience margin compression for many reasons, including that not a lot of equity or firms entered the space. The barriers to entry are higher at each and every level. There is no 4x leverage so, unless a team can raise significant capital, then the story stops right there. Assuming a team can raise capital, then the next hurdle becomes one of product marketing and national reach. The more one goes through the hurdles to enter, the more one realizes why the voids exist in disparate parts of the market. A firm also has to be indifferent as to being the sole lender or partnering to outsource the non-traditional part.

This conversation about voids can’t be had without mentioning the changes in the lender finance market. The diaspora of executives from some of the market-leading lender finance banks left larger groups to join competing banks or start new groups so more entrants entered the bank lender finance space. At the same, new non-bank lender finance groups started gaining traction to finance many of the firms targeting nonconforming niches, whether it be M&E, RE or others. Most of the actual lenders formed for non-traditional asset-backed were formed for single-use products only. This would be a firm formed solely to finance equipment or solely to finance RE. Many of the single-use, non-traditional firms have higher rates and better margins than typical traditional ABL, but usually have a higher cost of capital, given the illiquid collateral and potential for losses in liquidation.

Few firms have over-equitized and provided traditional ABLs with a one-stop shop partner to finance everything non-traditional, including stretch risk. By focusing on all nontraditional niches and not being limited by single-use product, a firm can ensure providing a complete solution for the majority of working capital lenders. Plenty of deals require a working capital lender to partner with one or two single-use non-bank firms and the deal still might need stretch. By being well capitalized, a firm could provide all non-traditional products and provide a stretch to truly craft a bespoke solution to help the working capital lender and simplify life for the client. Dealing with just one other lender can be time-consuming, but multi-lender deals for small businesses created meaningful challenges.

We are entering a new dawn for lenders entering the non-traditional asset-based and asset-backed spaces for several reasons. Firstly, the non-bank lender finance firms are growing, so the financing appetite is there. There would be no opportunity were this not the case. Secondly, and just as importantly, the voids are there, which means the market is there. Entrepreneurs and firms like SG Credit are going to grow in size and we can expect to be joined by others. While the past decade was about traditional ABL consolidation and market efficiency, the next decade should bring rise to many lenders focused on the voids created.