- Mazzotta Rentals, Inc. Secures $160 Million Credit Facility to Accelerate Growth and Continue Fleet Expansion

- Empowering or Overshadowing? Balancing Technology and Expertise in ABL

- Empathy from the C-Suite: Michael Haddad’s Lessons Learned From His Self-Run Job Process

- Quasar Capital Welcomes Rob Hydeman as President of Business Credit

- PKF O’Connor Davies Expands Advisory Service Offerings with PKF Clear Thinking Integration

YoPro Leadership Summit Recap

By Eileen Wubbe

This year’s YoPro Leadership Summit, held virtually August 26-27, brought together the young professionals of the secured finance industry for opportunities to hear from industry leaders, connect with peers, and to discover together how to succeed in the post-COVID environment. The theme this year was "Succeeding in the New Environment."

The Standing Out While Working panel was a “choose your own adventure” style format, where attendees were polled and selected which direction they wanted the panel discussion to go. An Economic Discussion dove into wealth management with an outlook on the current private banking landscape, navigating liquidity, major life milestones, and personalized capital solutions. Lending Through COVIDexploredthe changes in credit and legal due diligence during a pandemic, while the Titans Roundtable participants discussed career advice and experiences going through the ranks as well as advice for managing teams during COVID.

Standing Out While Working from Home kicked off the Summit as a “choose your own adventure” style format, where attendees were polled and selected which direction they wanted the panel discussion to go. This Q&A panel covered various aspects of working in the virtual world. Panelists discussed ways to grow a career path and build a personal brand. Rob Meyers, president, Republic Business Credit, served as moderator and Susanna Siskind, vice president, director of operations, PNC Business Credit and Alex Drost, founder, Connection Builders were panelists.

The first topic was Should I inform, annoy, or leave my manager alone? Panelists discussed how employees should share concerns with their manager during the remote environment or discuss their own career development or tout their accomplishments.

“It’s important to have an open and honest conversation about workloads, and express what your needs are, particularly for those who may be homeschooling,” Siskind said. “Come to the table with potential ways to help out, whether it means stepping away in the afternoon and then coming back online later.”

Siskind also recommended writing down your accomplishments that may have been outside of your usual realm.

Drost noted how barriers have broken down between working time and home time with remote work environments.

“People may expect you to be available the second they need you and there should be boundaries to give people that space,” he said. “People have to be cognizant of the new working environment. What happens all too often is, if you’re a junior employee and you’re responding to e-mails on a Saturday because you have to, and you’re trying to keep up with what your manager is demanding of you, that’s fine. If you’re doing it just to demonstrate you’re working on the weekend, that’s a whole other issue.”

Next up was Expectations for a raise during a pandemic. While Drost says the approach for many should be that they should be happy they have a job, he stressed if people believe they are adding more value, they should start having those conversations and raising that up the flagpole. If the organization isn’t producing the revenue and profitability to support that though, it won’t matter in some cases.

“That doesn’t mean you shouldn’t be going in and advocating for yourself and helping make sure you’re growing so that when that time comes and the organization is better able to offer that, you have more ammunition for that conversation,” he explained. “Work hard, add value, and the money will come. We’re in unchartered times now where we don’t know about raises. It will eventually come; it just may not be right now.”

Super Cool Remote Team Projects was the next turn the panelists took.

Siskind, who has 60 team members across the country, said raising your hand and making yourself accountable for your own career growth is ideal when it comes to leading a project, with soft and hard skills both of equal importance during this time.

“You want to work with people you like, and you have to know some of their skillsets,” added Drost. “Forming that bond and that trust does take time. On the soft skills side, you may have to work with someone to see their skillset. It’s hard to pick someone from a team that you may really only work with once a quarter. It really comes down to knowing your team well enough and spending enough time with them so you can pick them.”

For those not chosen for a project, Siskind said, “If it’s a minor project, like a new tool to help with efficiency, give feedback. Volunteer new ways to help improve things. We’re working in a time where every thought is ‘What can I do to automate?’ It’s a recurring theme. Keep the line of communication open.”

Drost added it pays to be genuine in relationships with co-workers. Instead of asking how someone’s weekend was, dig deeper and ask what they did. “Don’t be looking at your phone or at the corner of your screen on Outlook while asking.”

The panel agreed that hard workers are always going to be valued.

“We’re at a time in secured finance where retirements are coming,” Siskind said. “Ask yourself what you did to differentiate yourself this year, whether it’s this year or any year. We are all being compared to our peers.”

The Economic Discussion featuredmoderator Miin Chen, CFO, Siena Lending Group, and panelists Ted Leh, managing director, Goldman Sachs and Shannon Saltos, private banking regional managing director, Wilmington Trust.

Panelists dove into wealth management and their outlook on the current private banking landscape, explaining how they help navigate their clients' liquidity, major life milestones, personalized capital solutions and how they integrate that with estate and business planning.

Leh kicked off the panel discussing the historical ups and downs of the stock market and how to stay calm through a turbulent economy.

“Even though we had one of the worst pandemics in 1918, the stock market actually went up during that period,” said Leh. “When we had the terrible news in February and March of this year about the virus, and it was truly terrible, we didn't lose our cool at Goldman Sachs. In fact, we went overweight on equities in March and in April, because we knew we would get through this. We knew the healthcare system in the United States is better than it was 100 years ago. On top of that, the Federal Reserve, president, and Congress put an unprecedented amount of liquidity and stimulus into the economy. The market had an extraordinary drawdown in March. In about 20 trading days the market lost about a third of its value. But, because of the tremendous amount of liquidity that was put in, the market has snapped back rapidly.”

At a time when many young professionals may be looking to buy their first home, the panelists discussed the current state of the housing market. The yield curve stayed relatively flat, resulting in long-term interest rates staying low, which encourages people to spend and put money back into the economy.

“We're seeing mortgage rates in the 2 to 3% range, which makes it really affordable for people to evaluate their current debt structures and residential mortgage structures,” Saltos said. “You can work with your banks to look at creative repayment options if you want an interest-only repayment or principal repayments. Taking the time to do that and evaluate where you're at today, and what your goals are, could not only get you lower costs for the long term, but also generate some liquidity that you could invest in the market. Pick up the phone and call your advisers, your CPAs, and your bankers and say, ‘Can I save money here? Does it make sense for me to purchase now versus rent, because I think that it's a good time’.”

Saltos added that single-family homes are at a premium right now with a shortage of supply in the market and home appraisal values are strengthening. Particularly in the Northeast, as home prices rise, buyers could find themselves in a competitive bidding situation.

“If you're going to purchase, talk to your bank about a pre-qualification or a pre-approval letter so that you’re a competitive bidder when you come to the table and they know that you're qualified,” Saltos added. “One of the things we caution against, as you're building your balance sheet and your assets, is don't over-leverage your home, keep it 70 or 80%. That gives you a little bit of cushion in case the market softens again.”

Leh added that fixed-rate mortgages have an advantage over variable rate.

“The Fed can change its mind. It can change very quickly. Fixing in your rate for 5,7, 10, 15 years makes a lot of sense,” he said.

For those who are already homeowners and are looking to refinance during this time, Saltos explained banks can do a portfolio remodification. For those with an existing loan, she encourages them to discuss what they’d qualify for and what their interest rate would look like.

“That usually is a very quick and easy way to adjust your rate without having to submit a full financial package and go through a full underwriting,” Saltos said. “There would be a fee to do that at the bank, but that's a really easy call that can help you evaluate what your decisions are. There may be a little cushion for refinances because it is such an active market right now. If you are lowly levered on your property, 70% or less, and are looking for some liquidity reserves, you could look into putting a home equity line of credit behind your mortgage, and typically your existing bank will do that. That would give you access to a resource for liquidity or cash, should you need it for whatever reason. Calling your bankers and accountants to have those discussions I think is well worth your time because it could be significant savings.”

“At the end of the day, your goal is to get to the get to the end zone,” Leh added. “You want to make sure you have enough money so you can retire comfortably. Equities over the last 10, 20, 30, 50 years have done much better than bonds. It's our view that will continue so people should be willing to take more risk. But again, you get something that happened in March, and it scares you. Not only do you get scared because your portfolio value is down, but you're listening to pundits who are scaring you even more. So, it is critical to come up with an asset allocation that you are comfortable with for the next three to five years at a minimum. I think the most important thing, if you get anything out of this conference, is set your asset allocation to your risk tolerance so that you will not panic and get emotional and then you dollar cost average into the market.”

Following the economic panel was the virtual networking cocktail party. Attendees got to select from four themed rooms, including Verve Wine, OurVodka, El Guapo Bitters, and tequila with Jena Ellenwood from Raines Law Room based in New York City. At the halfway mark, attendees had the option to jump into a new room or continue hanging out in their first.

Lending Through COVID began the second day of the Summit with an exploration ofthe changes in credit and legal due diligence during a pandemic. Ikhwan Rafeek, member, Otterbourg P.C. served as moderator. Panelists included Rebecca Bruch, director-ABL underwriter, CIT Northbridge; Steven Torrez, associate, Goldberg Kohn; Minna Lee, director-ABL Underwriter, Wells Fargo Capital Finance; and Thomas Pabst, president, HYPERAMS, LLC.

The common theme panelists agreed on was that lending through COVID involved planning and shifting your mindset and adjusting accordingly.

Rafeek began by asking from what sectors the panelists are seeing deals originate.

“It seems very end-user driven. Aside from hospitality, we’re seeing a lot of deals across a variety of industries, including home, consumer products, snack foods, lumber construction, material distributors for the custom home build and DIY projects, since more people are home,” Lee said, adding that she expects this trend to continue for the next several quarters as the pandemic continues.

Working for a non-bank lender, Bruch is seeing deals originate from more distressed companies. “A very hot space where we’re seeing a lot of deal flow is the retail brick-and-mortar stores,” she said. “The home décor market has been very strong. We’ve seen some strength in the aftermarkets auto. With the uncertainty in the market, instead of buying a new car, people are fixing up their old ones.”

Pabst said that surprisingly 10% of HYPERAMS’ appraisal business has come from strategic acquisitions by healthy businesses, mainly in the oil and gas industry.

“In general, we have had a very sizable cross section of deals from e-commerce to fabricators to the oil- and gas-based industries. Aside from the acquisition related work, our distribution of business during COVID has been about 65% new deals and about 25% collateral monitoring. Collateral monitoring has certainly increased in importance to our clients.”

Torrez said more recently he has seen acquisitions come across his desk, more on the ABL side over the cash flow side as well as more tech deals.

Regarding pricing, Bruch reported seeing pricing come back to pre-COVID levels with increased competition. “We’re seeing more pressure to get higher and higher LIBOR floors,” she added.

“I’m seeing it come down now that there is more competition out there, but not necessarily to pre-COVID,” Lee said. “We are pushing hard on the LIBOR floors. It really depends on the deal itself and the challenges they are facing.”

On the legal documentation side, Torrez said, “I’ve seen more anti-cash hoarding provisions being added into documents, both as a mandatory pre-payment if unrestricted cash goes over a certain amount and as a condition to borrowing under a borrower. EBITDA addbacks are more specific. There are some terms that I thought were only in forbearance agreements, like a 13-week cash flow for example, that are now making their way as amendments in documents.”

Rafeek asked if panelists had been seeing any collateral types that previously weren’t considered but are now more focused on moving forward during COVID.

“The tax code has been redone. The CFC definition has changed. Instead of taking a 65% pledge of foreign subsidiaries, you can now take 100% pledge without facing certain tax consequences,” Torrez explained. “So, when companies are in default, our clients may look to bring that in under their fold because there aren’t the same tax consequences. I think those are the big areas where people think of taking on additional collateral when a company is struggling.”

“One thing I see more emphasis on now is IP,” Bruch added. “Especially with the retail environment and selling online, e-commerce platforms are making the money for the company. With the move to internet sales and online shopping, IP is playing a bigger component in the collateral pool.”

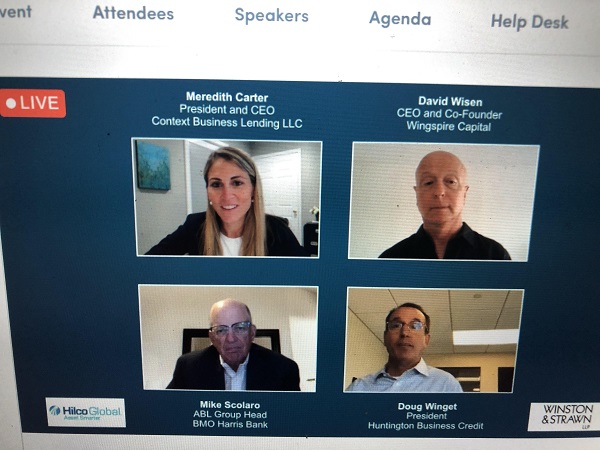

The Titans Roundtable, consisting of Meredith Carter, CEO, Context Business Lending, as moderator, and panelists Mike Scolaro, ABL group head, BMO Harris Bank; Doug Winget, president, Huntington Business Credit; and David Wisen, CEO and co-founder, Wingspire Capital, discussed career advice and shared their own experiences going through the ranks. They also discussed ways they’ve been managing their teams during COVID.

After giving their background and how they got their start in ABL, the panelists discussed some of the challenges they are facing during COVID.

“I think the number-one challenge has been training,” Winget said. “And, for our less- experienced individuals, starting in a functional position as a field examiner or collateral analyst or even moving into underwriting; those typically require training that is needed within a team. So, we've made a conscious effort to focus on training as best we can in this environment. But I would say that has been the most challenging.”

“I think the biggest thing we have missed in the COVID world has been the interaction between different sets of people,” Scolaro said. “We've hired people that are energetic and excited about going into the workplace. The esprit de corps that developed, as well as learning by osmosis and having people sitting next to each other, in the pre-COVID environment, that understood what was going on in their partners’ deals, what headaches they were facing, what opportunities they were facing and what competition they were facing. We've tried to continue to develop that. But it's awfully difficult to force communication when it was free before.”

In Wisen’s case, Wingspire started up in November 2019 so they have had to build their own culture during COVID.

“We’ve lived in COVID longer now than we lived pre-COVID,” Wisen explained. “So, we’re building that culture, especially onboarding people. We've overemphasized communication. You really can't emphasize it enough. Don't take any of those things for granted. Recognize that you're missing a lot of the subtle points that people might offer if they were in an office together. So, we're overcommunicating with our customers and our other stakeholders. We try really hard to focus on the hiring process, and we put lot of time into it. Anytime you're joining a startup, you already need a certain personality type, somebody that is okay with ambiguity and is ready for a fastball or curveball.”

Young professionals can use this time to learn and volunteer for projects as they navigate their careers in this difficult environment.

“If you're lucky enough to be in an organization that's thriving through this, I really think you're situated to have this be a tremendous benefit to your careers for two primary reasons,” Wisen said. “It’s a fantastic opportunity to learn, as difficult as the world is right now. We're all experiencing things that we haven’t before. So, number one is learn, learn more, keep learning as much as you can. Not just about what you do, but about what all your colleagues are doing —and raise your hand. We're succeeding through this by writing a new playbook for how you do things. So, that means that every person's job is a little different and includes some things that they didn't know they needed to do before.”

Scolaro added he’s had several employees at BMO who have raised their hand and quickly stepped up to become part of the solution.

“That changes the whole arc of your career,” Scolaro said. “It changed because you said, ‘I want to figure this out. I want to become the subject matter expert.’ You put yourself in the field of fire and contributed above and beyond. The most important thing to me is the people who are critically thinking and want to be part of a solution. That's priceless.”

Beyond the usual Zoom or Teams meetings, panelists’ have come up with additional ways to keep their team members engaged. Wingspire has done trivia Zoom meetings and BMO Harris has had interviews of senior management during the last ten minutes of their Zoom meetings.

“We've learned how people like their eggs and if they’re side sleepers or back sleepers. It’s actually pretty fun,” Scolaro said.

For Winget, he encourages members of his team to take their laptop or iPad to a different area of their house while on a video chat to see a glimpse into someone’s life and see part of the house they haven’t yet.

“There are some places you can get outside and social distance,” Winget added. “I think golf is very acceptable within our team.”

Carter’s team has done a scavenger hunt, with extra points awarded to those that not just found a costume in their home but also wore it.

Going forward, panelists agreed working remotely will allow the talent pool to open up more.

“I think that's something that is going to be really appreciated by the workforce,” Scolaro said. “It might make banking and asset-based lending a really cool place to work and an environment to work in and we'll have to figure it out and go forward.”

“The health crisis will pass, but the changes to business and society will linger,” Wisen said. “Some of those changes will merely be the acceleration of what was already in place. Retail will not be the same, but it was going there anyway. Mostly what we're planning for is when we're underwriting, we're acknowledging that we're not smart enough to know, so we try not to have a binary situation where we're either going to be right on our guess about the future or wrong. We try to make sure that through the structure, we're going to be okay regardless. That's one of the reasons why I really am very bullish about asset-based lending. If it's done correctly, the reason why asset-based lending will be a good solution for retail is that it can be structured so that the lender can make a smart deal.”

The YoPro Committee expects to offer additional opportunities virtually and possibly in person in 2021 including the YoPro Leadership Summit, coffee or cocktail happy hour virtual events and a half-day educational/networking event. Stay tuned!