- Cahill Announces Julie L. Cohen as Firm’s First Chief Marketing Officer

- Jennifer Wallace, Chair of SFNet’s 40 Under 40 Awards, Encourages Members to Nominate Rising Stars

- Gordon Brothers Completes Big Lots Purchase & Facilitates Going Concern Sale

- eCapital Acquires LSQ to Expand Technology Solutions and Strengthen Market Leadership

- Interview with Kristin Maxwell, Member of SFNet’s Inclusiveness Committee

Bigger Is Better When It Comes To Banking – Part II

July 22, 2013

By Mark Sunshine

Last week SFNet's blog featured Chairman & CEO Mark Sunshine of Veritas Financial Partners. Here is Part I of Sunshine’s piece on why “Bigger Is Better When It Comes to Banking” and below is Part II of the series.

Imagine driving up a hill on an interstate in a very small old car with a tiny engine. No matter how hard you press on the gas, you are passed by faster, newer and slicker cars. Eventually, an 18 wheeler pulls up and runs you off the road as it passes your slow, old and small vehicle.

Well, that is how small bank CEOs feel. They are getting pushed off of the economic highway because their engines are too small and old, and they cannot run fast enough to keep them on the road.

In Part I of this series on too small to succeed banks, I explored the slow speed that small banks run at relative to larger banks as measured by return on equity. I also showed that the small bank industry sector has been consistently losing market share since 1997, and is literally being run off of the road by bigger and faster competitors.

In this article, which is Part II of the series, I will explore some of the reasons why small banks are being pushed out of the United States’ economy.

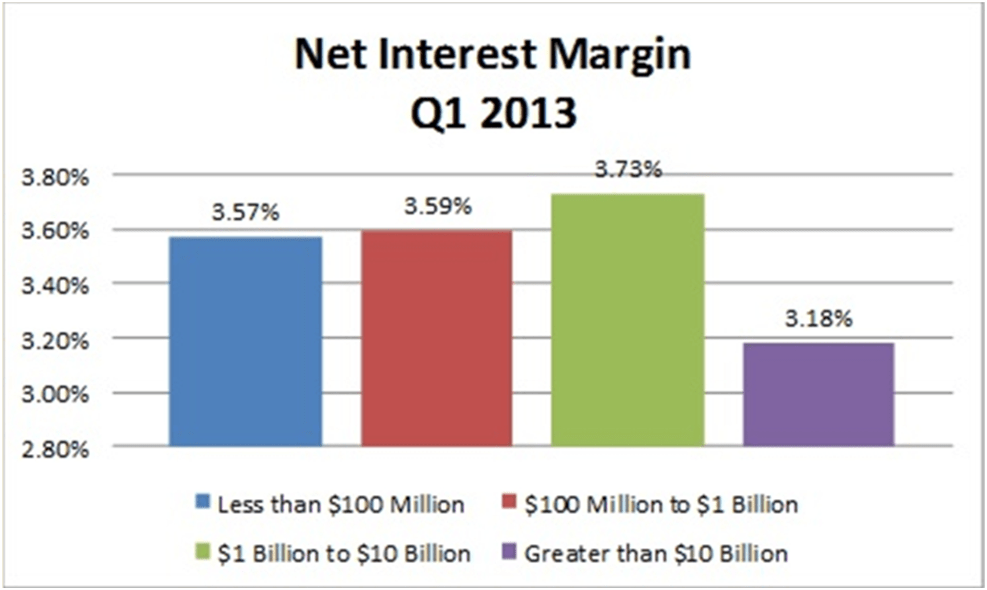

Net Interest Margin is not the problem that is killing small banks

Small bank CEOs who I talk to from Maine to San Diego all tell me that they are getting financially killed because of a weak net interest margin, i.e., the spread earned between their interest costs and their interest expenses. They swear that they cannot earn a competitive return on equity relative to the big guys because they cannot charge enough for loans in a community banking setting.

As it turns out, the complaints of small bank CEOs are not valid. The biggest banks have a lower net interest margin than their smaller competitors, and all banks under $10 billion have approximately the same net interest margin.

Source: FDIC’s 2013 Quarterly Report

Source: FDIC’s 2013 Quarterly Report

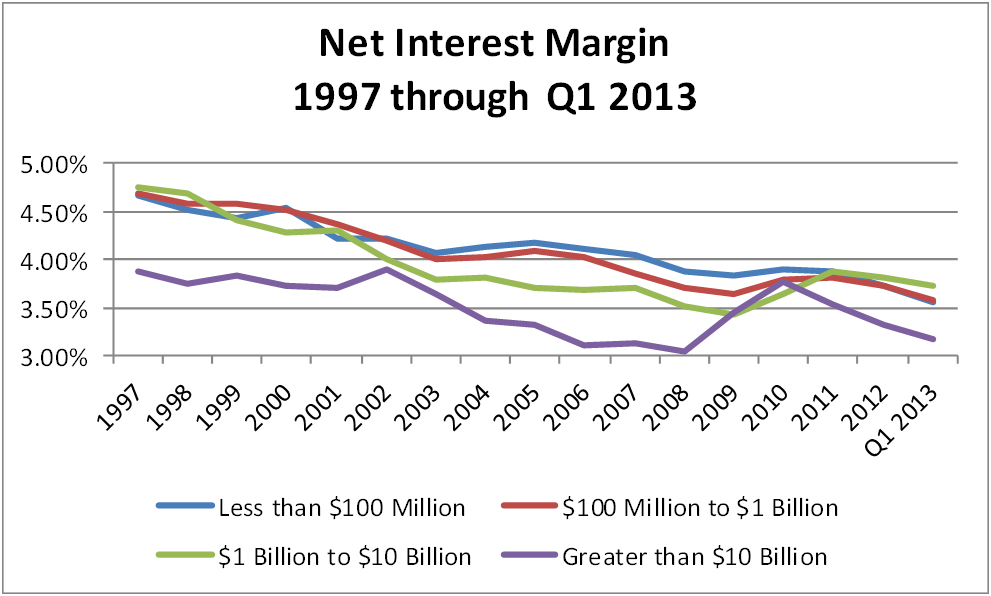

Also, while the net interest margin has declined over the last 15 years for small banks, it has declined for all banks.

Source: FDIC’s 2013 Quarterly Report

Source: FDIC’s 2013 Quarterly Report

Simply put, while small banks are experiencing net interest margin pressures, banks of all sizes are facing the same challenge, and the biggest banks who have the worst net interest margins are earning the highest return on equity.

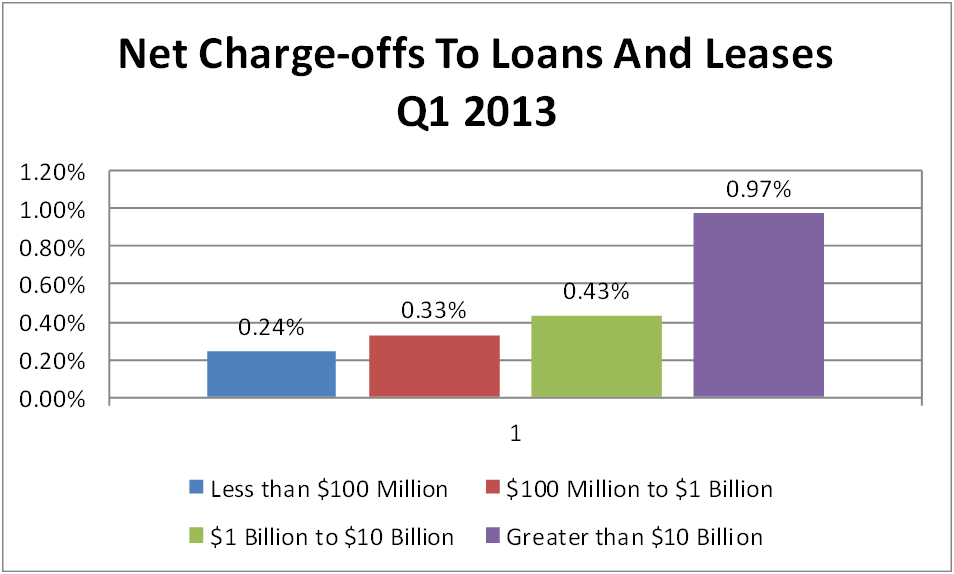

Credit quality and net loan losses are not holding back the performance of small banks

As the below chart illustrates, in the first quarter of 2013, when it comes to loan losses, small banks did better than big banks. Even so, during the quarter, big banks had a return on equity that was more than 5% higher than the return on equity that small banks had.

Source: FDIC’s 2013 Quarterly Report

Source: FDIC’s 2013 Quarterly Report

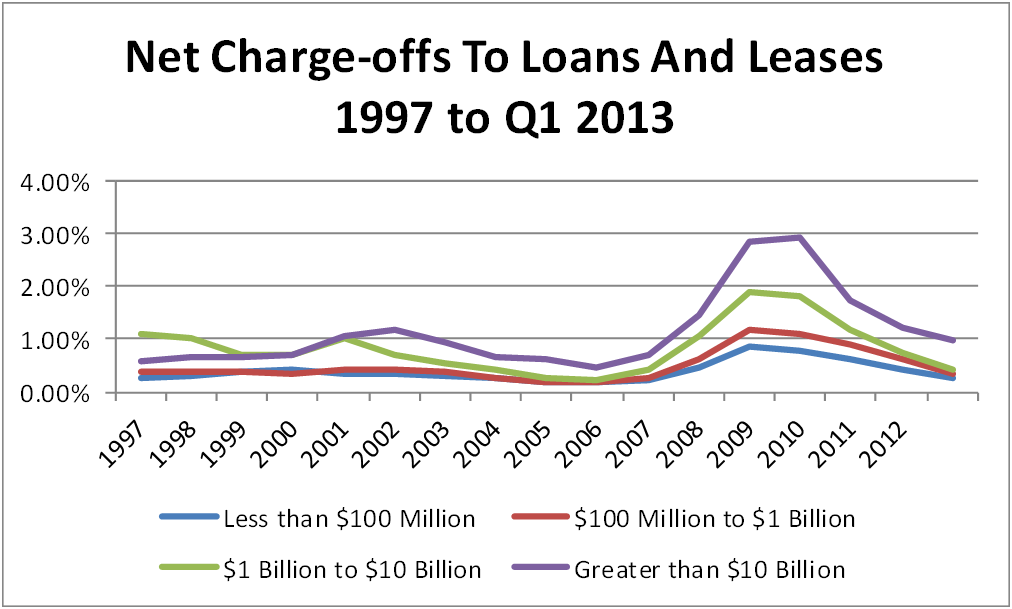

From 1997 through 2013, small banks consistently had better credit performance than big banks.

Source: FDIC’s 2013 Quarterly Report

Source: FDIC’s 2013 Quarterly Report

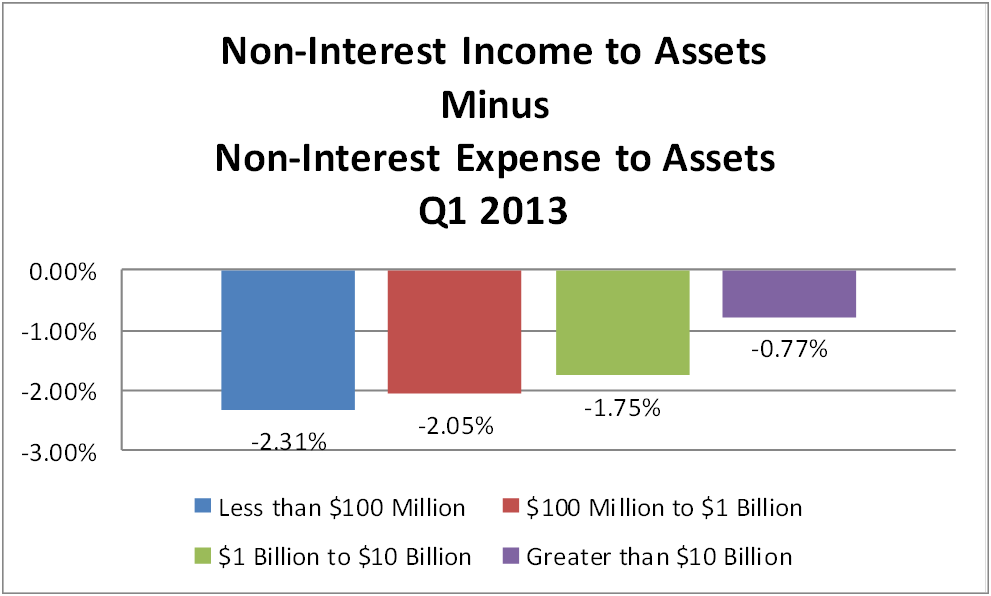

The biggest problem for small banks is that their overhead is too high, and they don’t earn enough fee income

At small banks, non-interest revenue is too small, and non-interest expenses are too high relative to their bigger competitors. Examples of non-interest expenses are the costs of staff and overhead, while examples of non-interest revenue are credit card processing fees and checking account fees.

Most banks spend more on overhead than they earn in fees, and on average, all banks have a negative non-interest income margin. But, little banks have a much bigger gap than big banks. The combination of being less efficient than big banks, and not earning enough in fee income is the primary reason big banks are pushing little banks off of the road.

Source: FDIC’s 2013 Quarterly Report

Source: FDIC’s 2013 Quarterly Report

Little banks are not as efficient as big banks because of their smaller size. Small banks cannot spread their overhead out over a large revenue base, and they cannot afford to deploy efficiency enhancing software and technology solutions.

Little banks have a tough time figuring out revenue generating things to do for their customers, other than lending money and performing simple transaction processing.

As a practical matter, sophisticated banking services that generate high levels of fee income are reserved for large banks with a national customer base. For example, international transaction clearing, (i.e., import and export payment processing), is a very high margin banking product that has virtually no application to small banks. They cannot attract enough customers to make it worthwhile to offer these products given the upfront costs involved in setting up needed back office systems. As a result, the highest margin businesses are off limits to small community based banks.

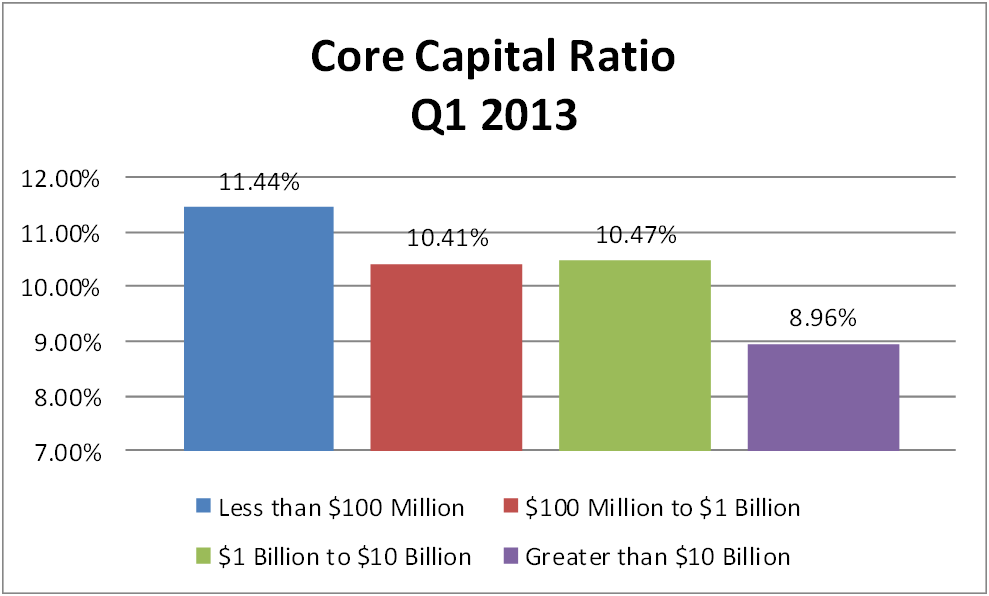

Big banks operate with lower levels of capital than small banks

Small banks are at a disadvantage when it comes to generating high returns on equity because they are forced to operate with higher amounts of capital, and therefore, lower leverage ratios than big banks. In general, a higher the leverage ratio leads to a higher possible return on equity. On the other hand, higher leverage rates are associated with a greater chance of bank failure because leverage equates to risk. Until big banks are forced to operate with the same core capital ratio as small banks, it will be difficult for small banks to earn a competitive return on equity.

Source: FDIC’s 2013 Quarterly Report

Source: FDIC’s 2013 Quarterly Report

In Part III of this series, I will suggest policy options for regulators to help small banks avoid getting run off the road by their larger and faster competitors.

Note: Data on the blight of the community and small banks is published by the FDIC in its Quarterly Banking Profile which contains key industry performance data and analysis. One of the tables buried deep in the Quarterly Banking Profile segments industry performance data by the asset size of the reporting institutions. Included in this article is selected data from the FDIC report.