- Navigating 2025: SFNet’s Asset-Based Capital Conference Returns to Las Vegas with Premier Insights and Networking

- Siena Lending Group Announces Leadership Transition Plan

- Celebrating the Achievements of SFNet Chapters

- Checking in With Steven Meirink, CEO, Wolters Kluwer Financial & Corporate Compliance

- 2025 Policy Outlook: Navigating Economic and Regulatory Shifts Under New Leadership

Dealing with the Volatility of Commodities

December 11, 2023

By Myra Thomas

Commodity producers face volatile market swings due to factors such as macroeconomics and supply chain stability, creating risks for secured lenders. Understanding each commodity’s nuances, risk-management strategies, and regulatory considerations is crucial. To navigate these challenges, secured lenders must maintain strong industry knowledge, adapt lending structures, collaborate with third parties, and balance risk and return for their clients.

Steel, copper, aluminum, gold, and silver producers are subject to wide swings in value. Oil, lumber, paper pulp, or even fertilizer face the same sort of pricing pressures. There are implications not only for the producer of the commodity, but also the businesses servicing them, as well as the processors and the related traders. But secured lenders handling commodities are keenly aware of the volatility in this sector, creating bespoke structures and pricing to deal with the associated risks. And those risks can be many and sometimes out of the control of the client.

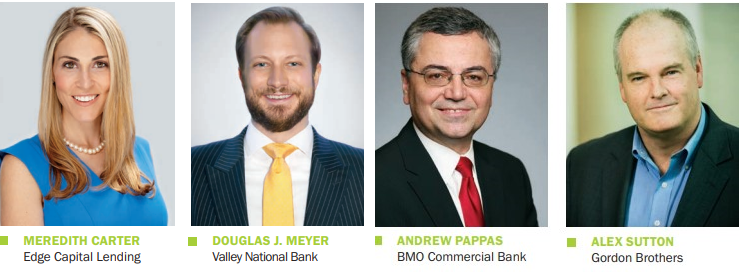

Macroeconomic forces and supply and demand can have an outsized impact on commodities. The stability of the supply chain and how the product is secured are major considerations for lenders too, notes Andrew Pappas, managing director, head of ABL Special Industries Group at BMO Commercial Bank. That’s why it’s essential for secured lenders to keep a watchful eye on the market and why many have former traders and other commodities experts on staff to help understand the risk. Pappas notes that underwriting commodities requires a more controlled approach, since the market can easily and quickly shift. “You always manage the risk by making sure you’re lending to the point where you’re comfortable,” he says. The right appraisers, appropriate counsel, and even trusted advisors and partners abroad can help prevent and mitigate the risks inherent in commodities.

Plus, it’s a constant process to learn and evolve to handle an assortment of commodities clients, including everything from metals to frozen orange juice concentrate, says Pappas. Protein commodities, such as meat and dairy, may be subject to spoilage and the related costs. “We continually educate our team, letting them know what the trends are so we can manage our risk and add value to our customers,” he notes. But no matter the commodity, the volatility is something that the ABL structure has to take into account.

Understanding the Nuances

Of course, the ABL structure is designed around predictability, so that there’s a predictable recovery on the value of the collateral. “With commodities, it becomes more difficult to create an ABL structure that will work when there’s market volatility,” says Alex Sutton, managing director, head of research for Gordon Brothers’ valuation practice. The volatility of commodities’ pricing is something that the ABL structure has to take into account. “That’s where there is a challenge,” he adds. For commodities, the ABL structure also needs to be adjusted to be a percentage of market value for the commodity as opposed to the cost of the inventory.

It’s also essential to understand the strategies that commodities clients employ to reduce the pricing risk of their business. Sutton notes, “It could be something as simple as locking in a price for the product that they sell to that order, so no matter what happens with the market price of the commodity, from that day forward, they lock in their margin.” Others will hedge that risk, and secured lenders need to be aware of the client’s own risk-management strategies.

Each commodity has different underwriting standards too. That’s why it’s essential to take a deep dive into how invoicing works for clients, says Douglas J. Meyer, first senior vice president, national head of specialty finance, and head of NYC Corporate Banking at Valley National Bank. “For instance, with a commodity like coffee, where there is an exchange price, there are still differentials because the quality can actually be a little bit better on a particular type of coffee bean than what the market trading it typically says,” he notes. That’s when field examiners and the internal underwriting team need to understand those nuances.

Please click here to continue reading.