- Deal Activity Slows for Asset-Based Lending, but Portfolio Performance Stays Strong

- Exploring the Future of Supply Chain Finance: Insights from SFNet's Inaugural Conference

- Navigating 2025: SFNet’s Asset-Based Capital Conference Returns to Las Vegas with Premier Insights and Networking

- Siena Lending Group Announces Leadership Transition Plan

- Celebrating the Achievements of SFNet Chapters

How are inventory levels impacting cash flow and performance?

August 15, 2022

By Juanita Schwartzkopf

Since the COVID-19 shutdowns, discussions about supply chain and inventory levels have focused on the need to build inventories to offset supply chain risk. Companies have replaced just in time inventory approaches with higher inventory levels to offset the supply chain problems. In addition to building inventory quantity levels, the per unit value of the inventory has been increasing as evidenced by inflation at 40-year highs. The June CPI was 9.1% and the June PPI was 11.3%.

Let’s consider a company that had a 2019 inventory level of $10 million with two months of inventory on hand. An 11.3% increase in the unit value would increase the investment in inventory by $1.1 million. An additional 30 days of inventory on hand would increase the investment in inventory by $5.0 million, a 50% increase. A combination of increased inventory on hand to 90 days coupled with an 11.3% increased unit value would result in an increased investment in inventory of $6.7 million, a 67% increase in dollars invested in a key working capital component.

If this company has a 60% advance rate on inventory, the company would need to find access to nearly $2.7 million in cash or it would need to be able to increase its accounts payable to support the 40% of inventory that the company needs to self fund.

The company’s performance would now be impacted by a larger investment in inventory, increased leverage to support that inventory, and increased operating expenses caused by labor issues and overall inflation.

Layer on changes in consumer purchasing decisions

On July 26, 2022 Walmart reported its Q2 earnings and updated its 2022 full-year performance guidance. Analysts believe this signals middle-income consumers may be reducing their spending, or changing spending habits. The increased fuel and energy costs and increased food costs mean consumers are focused on ensuring they are able to meet the increased cash needs for fuel, energy and food costs. Consumers are responding to the increased costs of basic necessities by lowering spending in discretionary categories such as electronics, and as workers are returning to the office or returning to work, the stay-at-home products are losing their appeal. This means the inventory a business has on hand may not turn over as quickly as before or may require price reductions to sell. Consumers may also be holding back their spending levels due to fear of recession or a need to preserve cash for the upcoming winter energy-use season.

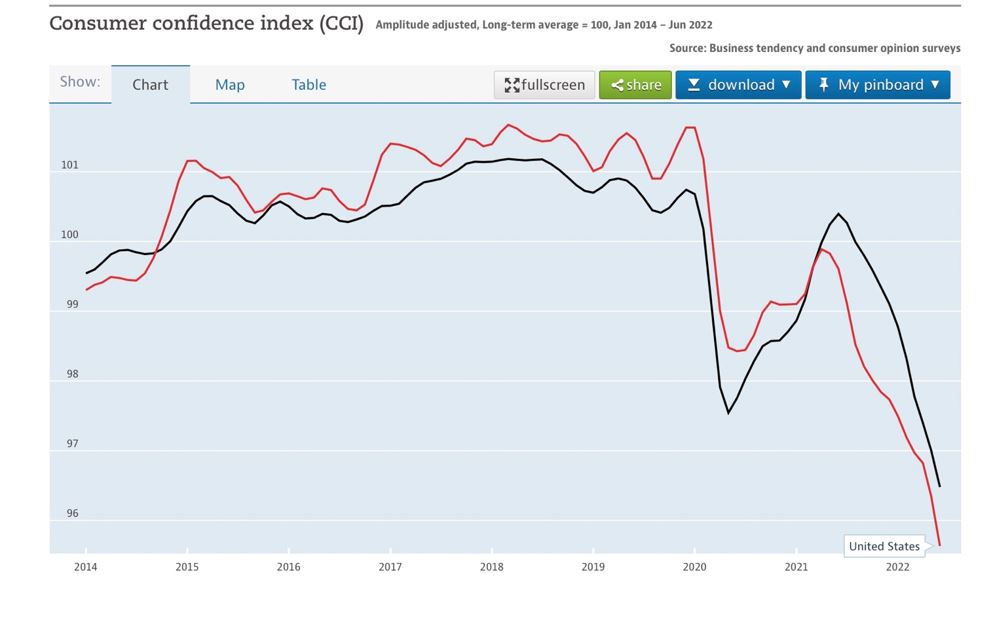

U.S. Consumer Confidence (“CCI”) for June was reported on July 26, 2022 and the CCI in the U.S. is now at 95.63, a steep decline from 99.83 in May of 2021.

How will business inventories and consumer-purchasing decisions impact financial performance?

A major problem businesses are now experiencing is the product mix in their existing inventory. Consider the example of Company ABC, with a $6.7 million increased investment in inventory. If those inventory purchase decisions were made based on consumer sentiment a year ago, the products in inventory may no longer be desirable or may only be desirable at a reduced price.

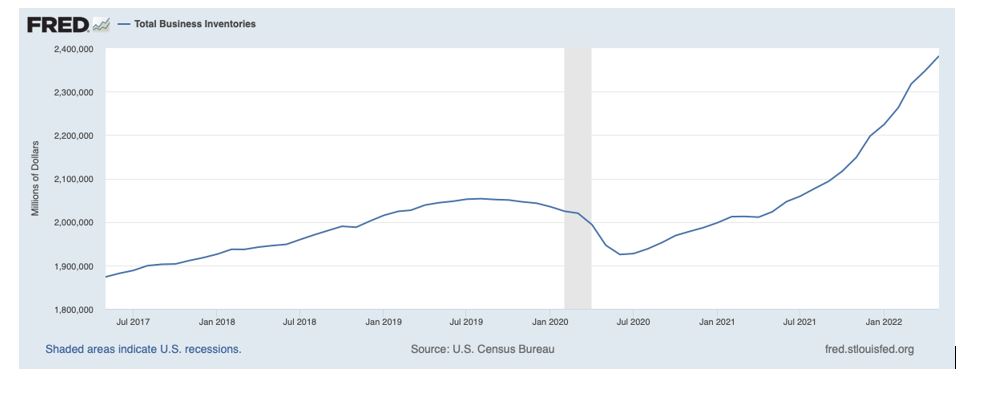

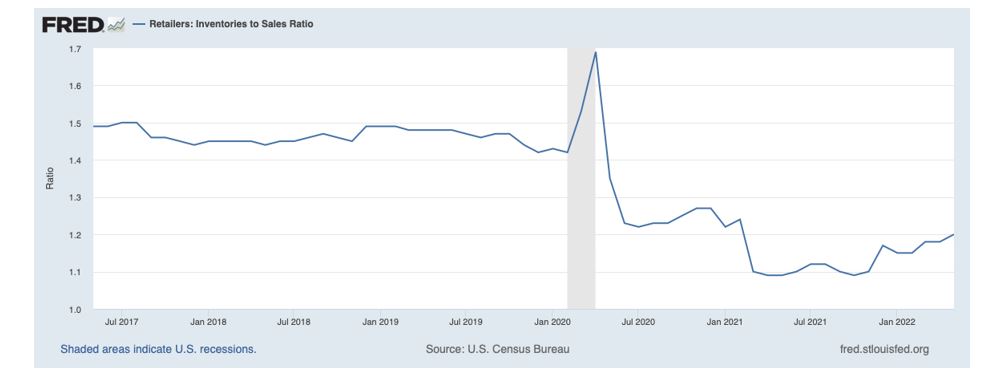

Business inventory levels have been rising. The St Louis Fed tracks total business inventories and retail inventory to sales levels on a monthly basis. Both tracking measures are concerning for businesses and their lenders.

The first graph from the St Louis Fed shows the inventory levels over the past five years, and clearly identifies a sharp increase in the investment in inventory.

The next graph shows the inventory to sales ratio for retailers. This indicator tells us that retailers have approximately 1.2 months of sales on hand in inventory. Over the last five years, this indicator bottomed out at 1.09 in October of 2021 and peaked at 1.69 in April of 2020. The March 2019 indicator showed a pre-pandemic level of 1.48.

What does this mean for borrowers and lenders?

Additional financial analysis will need to focus on specific inventory valuation and inventory levels.

- Overall inventory levels in dollars compared to sales levels.

- Turnover by SKU.

- Gross margin to sales analysis by SKU, with trends over time.

- Gross margin to sales analysis by customer.

- Accounts payable levels, with aging analysis.

Businesses will also need to evaluate their borrowing-base formulas for any unexpected impacts. For example, if inventory is being held longer than expected, will inventory age past stale requirements, or will inventory levels exceed turnover limitations? Is the mix within inventory changing (raw materials, work in progress, finished goods, in-transit inventory) or the mix of accounts receivable compared to inventory changing?

Inventory appraisals should be expected to emphasize turnover and margin performance, and there may be more recovery value pressures as new appraisals are being finalized.

Businesses need to evaluate their investment in inventory.

- Do they have the right product?

- Do they have the right amount of the products?

- Are the product values holding?

This type of analysis is going to be a key contributor to operating performance and working capital management performance moving through the remainder of 2022 and in to 2023. It will be important for businesses to forecast working capital needs, and a weekly cash flow and working capital forecast is a tool every business needs today.