- KeyBank Expands Commercial Banking Teams in Chicago and Southern California to Serve the Middle Market

- Provident Expands Commercial Lending Team as Part of Regional Growth Strategy for Eastern Pennsylvania

- Appraisers See a Mixed Picture for Valuations

- SLR Business Credit Adds Mark J. Simshauser as Senior Vice President Supporting Growth in Northeast US

- Bob Seidenberger Joins Franklin Capital as VP of Sales

The Story of Foothill Capital

By Charlie Perer

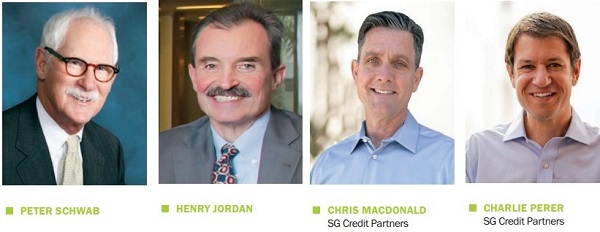

In this new feature series, “The Story of,” Charlie Perer sits with the key entrepreneurs and executives who have built leading commercial finance companies to talk about the origins of their respective firms. The purpose of this series is to tell the story behind many of the most famous and dynamic firms of past, present and future.

These stories will and should be told by the people who were there in order to get the information as accurate as possible.

The first feature is about Foothill Capital, which, of course was acquired by Norwest in 1998 and later by Wells Fargo. The core team at Foothill went on to be leaders at Wells Fargo Capital Finance and throughout the entire commercial finance industry.

Here to tell the story are Peter Schwab, Henry Jordan and Chris MacDonald.

Charlie Perer: Gentlemen, please briefly introduce yourselves.

Peter Schwab: I was in the asset-based lending business for nearly 40 years and finished my career in 2010 as chairman of Wells Fargo Capital Finance. I began my career with National Acceptance Company of California and then joined Aetna Business Credit (two names that most readers probably don’t know). I then joined Foothill Capital Corporation, which we sold to Norwest in 1998 and later became part of Wells Fargo when Norwest merged with Wells Fargo.

Henry Jordan: Retired CEO (2011-2017) Wells Fargo Capital Finance. I spent 32 years with Foothill Group and its successors beginning in 1984.

Chris MacDonald: I am currently a senior advisor at SG Credit Partners. I began my career at CIT Business Credit in 1990. In 1996, I started the New York offi ce for Foothill Capital and then went on to run originations in the Midwest and Northeast. In 2004, I joined Silver Point Capital in its Principal Finance Group. I co-headed Principal Finance until 2009. In 2010, I joined Virgo Investment Group, and was a co-founder of Fund 3, a leader in portfolio management. I joined SG Credit Partners in January 2021.

How would you tell the story of Foothill Capital to younger executives entering the field today?

Jordan: The Foothill Group began as a small finance company in the 1970s (with a few hundred thousand dollars in total assets) and rose to become one of the largest and most successful bank asset-based lenders in America. On December 31, 2016, after a purchase of over $20 billion in assets from GE, the Group’s total assets exceeded $50 billion. Foothill Capital was the largest and most successful subsidiary of The Foothill Group.

Schwab: I would describe the story of Foothill as a company who knew who they were and what they wanted to accomplish and did so through many challenges, but always understood that we were first and foremost a lender! We really emphasized doing “the deal,” but did not stray from the parameters of being an asset-based lender. Based on that simple philosophy, we were able to grow the company to one of the leading asset-based lenders in the country.

MacDonald: I joined Foothill immediately after the Norwest acquisition and participated in tremendous asset and profitability growth during my tenor. Foothill was expanding into major markets across the country and differentiating itself as a creative, nimble and effective lending partner.

Please click here to continue reading the interview.