- Deal Activity Slows for Asset-Based Lending, but Portfolio Performance Stays Strong

- Exploring the Future of Supply Chain Finance: Insights from SFNet's Inaugural Conference

- Navigating 2025: SFNet’s Asset-Based Capital Conference Returns to Las Vegas with Premier Insights and Networking

- Siena Lending Group Announces Leadership Transition Plan

- Celebrating the Achievements of SFNet Chapters

What Does The Second Year of Inflation Tell Us?

October 27, 2022

By Juanita Schwartzkopf

The US economy is now in its second year of inflationary pressures and businesses need to find new ways to analyze, adapt, and forecast business performance. The CPI first reached 5.0% in May of 2021 and exceeded 6.0% by October 2021. The PPI first reached 6.5% in April 2021. With the September CPI and PPI still at 40-year high levels, we are now looking at the second year of increasingly increasing costs.

What is the second year impact of inflation?

With the economy now in its second year of inflation above 5.0%, the year over year inflation rate may seem to be moderating in the 8% range after the CPI peaked at 9.1% in June 2022 and the PPI peaked at 11.2% in March 2022; however, that understates the serious economic impact inflation has had on the cost structures of businesses from 2020 to 2022.

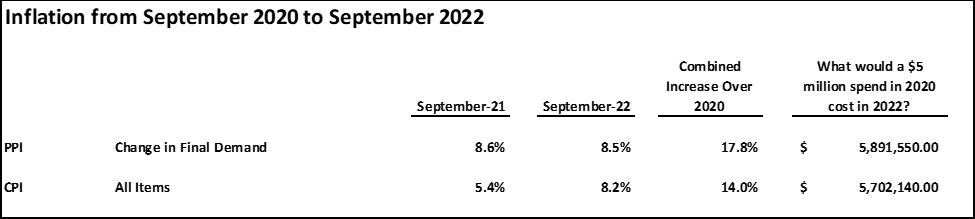

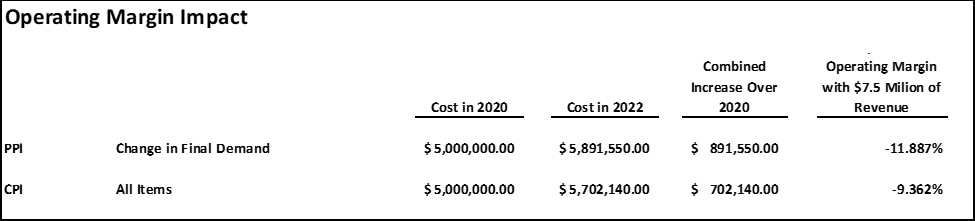

Looking at the combined impact of inflation from 2020 to 2022, the CPI tells us the overall increase in costs is 14.0% and the PPI tells us the overall increase in costs is 17.8%. This means a company with $5,000,000 of monthly expenses in 2020, may be looking at $5.7 million to $5.9 million of monthly expenses in 2022.

If the company has $7.5 million of monthly revenues, its operating margin will change from $2.5 million to between $1.6 million and $1.8 million, a reduction of 9% to 12% of revenues.

If that same company has term debt of $40 million amortizing over 15 years, at a 6.0% interest rate the monthly payment would be $340,000. The coverage ratio would change from 7.3x to 4.7x. If the company was more highly leveraged with term debt of $90 million, the monthly payment would be $760,000 and the coverage ratio would change from 3.3x to 2.1x.

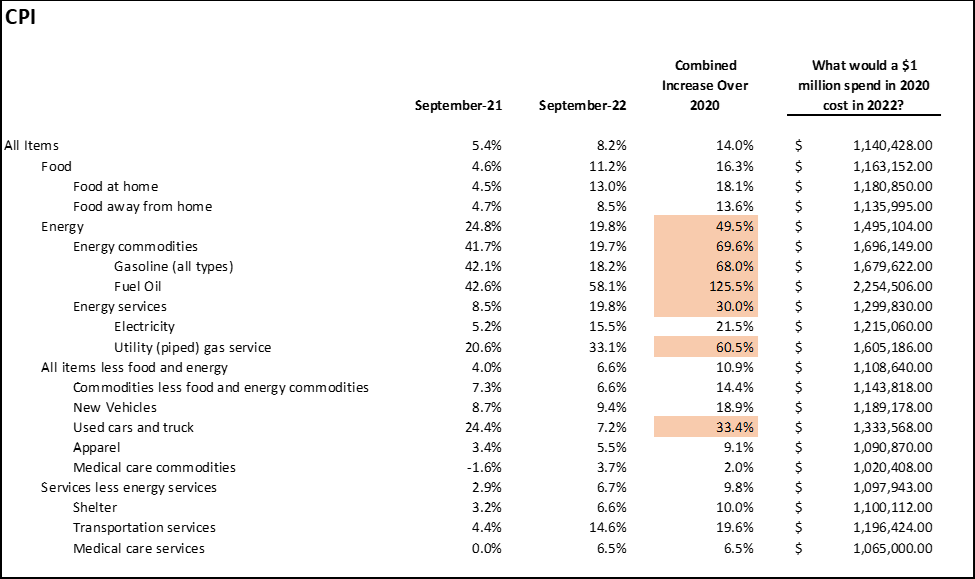

This analysis assumes the cost structure of the business moves with the overall CPI and PPI; however, there are certain categories of the CPI and PPI that impact businesses more severely. Within the CPI, the expense categories that have increased more than 30% include energy categories that directly impact every business.

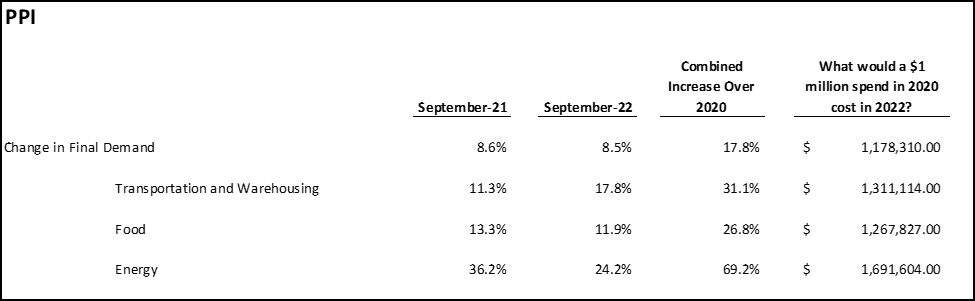

Looking at the PPI categories of transportation & warehousing, food, and energy, the 2020 to 2022 increases were 31.1%, 26.8%, and 69.2%, respectively.

These are expense categories that impact nearly every business today and are much higher increases than looking at the overall indices would indicate.

What can a business do?

The simple answers of cutting costs and raising prices are not sufficient. Today’s business managers need to employ more complex strategies and deepen their analysis capabilities and skills.

Price volume variance analysis. Because the per unit prices are changing, it is imperative that volume and price both be considered. For example, fixed and variable operating costs need to be evaluated based on current volumes and prices – not historical levels. A business could make the wrong decision on pricing or expense management if per unit activity is not considered.

Often, we use a “common size income statement” as the initial basis for this review. We might consider revenue and expenses per board foot, per pound, per bushel, or per some other unit of measure that is specific to the business. This helps gauge what categories of expenses are experiencing higher than expected changes.

Customer profitability. The contracts governing the customer relationship need to be reviewed for potential price increases, or for potential renegotiation at the next opportunity. Understanding the unique customer requirements and the costs associated with providing the product or service will help a business focus on the clients that are the most reliably profitable. A contract summary matrix is the basis for this analysis. Then identifying the unique customer requirements is key.

For example, if customer A requires mixed boxes of product and pays the same as a customer that accepts boxes of the same product, the costs to handle and mix the product must be attributed to the profitability of customer A.

It may be possible to select a third-party index, agreeable to the company and its customer, to flex at least a portion of the sales price. This does not need to be the overall CPI or PPI but could be a trucking or container freight index, or a specific commodity price index. Creative contract structuring can help protect profitability during these times.

Product profitability. The need to evaluate product and project profitability is critical. Emphasizing the more profitable products could shift the break-even performance of the business toward improved performance. The mix between various products that are produced from the same raw materials will also need to be evaluated. For example, chicken processors often say they wish they could purchase a bird with 20 wings to maximize profits. Dairy manufacturers may evaluate different mixtures of milk, cream, butter, cheese, etc.

Expenses in categories that are experiencing the highest price change need to be evaluated. If transportation and warehousing are up 31.1% and the business being analyzed has only experienced a 10.0% increase, it is important to know why the increased costs have not yet been experienced. On the other hand, if the business experienced a 50.0% increase that is also critical to expense analysis.

Energy prices have increased to date in October 2022, and the CPI and PPI may further increase when October and November results are published. For categories such as energy, it may be time to employ an expert in utility cost management and negotiation with alternative energy providers or approaches. In Florida 79% of the electricity is produced with natural gas, therefore, even though the electricity prices have not increased as much as natural gas has increased to date, that should be expected to change.

Expenses in categories that rely on providers who rely on transportation and warehousing, energy, or food need to be evaluated for price increases and potential further increases. For example, if a supplier is providing an energy intensive material to the business being evaluated, and the cost of the material has not increased at the level of energy increases, it may be time to consider the impact of further price increases.

Alternative supplier analysis. Businesses that rely on one or two key suppliers are at greater risk of price increases and service disruptions. The emphasis on analysis of alternative suppliers will need to be intensified. If the company being analyzed is a single source provider to its customer, the company may need to ensure its communication, pricing, and cost structure is not putting it at more risk of being replaced or down sized as a supplier.

Labor costs must be evaluated in terms of base pay, overtime, commissions, and other incentives paid to employees. Turnover costs must be considered. Remote work versus in person work requirements need to be evaluated on a person by person, department by department basis. With labor costs increasing, automation may be a better alternative than it would have been in prior years.`

Interest rates. The cost of money is increasing and should be expected to increase further. During the last period of high inflation, prime rate peaked in December 1980 at 21.5%.Today’s prime rate is at 6.25%, after a 0.5% increase in April 2022, and 0.75% increases in June, July, and September. Many are expecting continued rate increases as the Fed attempts to calm inflation. Fixed charge coverage ratios need to be reforecast based on current EBITDA performance and current interest rate expenses.

Who does this analysis?

Most business managers today have not been confronted with this type of price changing environment. While it may be tempting to ignore the need for detailed analysis or to say that it will be too costly to hire the right skill set, those views will be short sighted. An initial preparation of the analysis outlined above should be a three to four week project for skilled and experienced people. Once that initial analysis is prepared, all parties will be able to identify areas for further analysis and attention.

It may also be tempting to excuse preparing the analysis because there is either too much information or not enough information. Expansive ERP systems can be an excellent source of data for analysis, but they are not necessary to prepare the analysis outlined above. It is important to begin the process with the data available, and to identify areas that require further research and analysis.

Business managers today need to challenge their teams to prepare this analysis quickly. The likelihood of financial performance success will certainly increase if the management team identifies the information, prepares the analysis, and then uses that analysis to improve performance. Detailed financial performance is not a luxury today – it is a requirement.