- TSL Express Daily Articles & News

- DWS and Deutsche Bank Launch Private Credit Cooperation

- GemCap Partners With VION Investments in Low- and Middle-Market Commercial Funding

- Monroe Capital Closes on $4.8 Billion of Direct Lending Funds

- Armory Securities, LLC Serves as M&A Advisor to Universal Gaming Group (UGG) and Gaming Entertainment Management

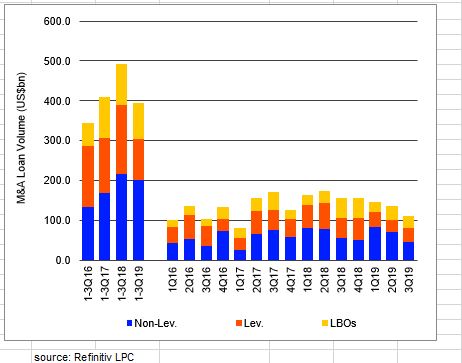

Refinitiv LPC: 3Q19 US M&A Loan Volume Down 28% Y-o-Y; I-Grade M&A Lowest Since 1Q17

October 7, 2019

Source: Refinitiv LPC

• At less than US$112bn, 3Q19 US M&A loan volume marked the lowest quarterly result in two and a half years, bringing total issuance for the year to less than US$395bn. Quarter-over-quarter M&A lending via the loan market has been eroding since 3Q18. Issuance for the first nine months of 2019 was down nearly 15% compared to the year-ago period.

• On a quarterly basis, non-leveraged M&A loan volume took the largest hit with issuance dropping nearly 35% in 3Q19 (US$46bn) compared to the prior quarter. Large high-grade deals certainly came to market, but lenders saw a limited pipeline of mid-tier and smaller transactions amid higher valuations. At just over US$200bn, 1-3Q19 non-leveraged M&A loan volume was just shy of year-ago totals.

• At the leveraged end of the spectrum, both corporate and private equity-backed transactions struggled in the wake of increased market scrutiny of credit quality and deal terms. Less than US$30bn of loan volume backed buyouts in 3Q19, bringing LBO volume for the first nine months of 2019 to less than US$91bn, a three-year low.

• Among leveraged corporates, almost US$36bn of M&A loan volume was completed in 3Q19, down nearly 30% year-over-year, but up slightly compared to 2Q19 totals. Nevertheless, at less than US$104bn, 1-3Q19 leveraged corporate M&A loan volume marked the lowest nine-month total since 2013.