TSL Express Daily News

The Secured Lender

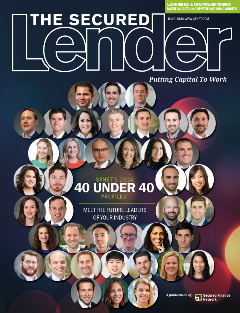

SFNet's 40 Under 40 Awards Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

June 12, 2024

Source: Bloomberg Law

• Delay comes as US continues to wrangle over the rules

• EU lenders fear being disadvantaged by early implementation

The European Union is set to delay key parts of global bank capital rules by a year, so that the bloc’s lenders will not be disadvantaged by continued wrangling over the standards in the US, according to people familiar with the matter.

The EU was due to implement the wider package starting Jan. 1, some seven years after the measures were agreed by regulators on the Basel Committee on Banking Supervision as the final part of rule-making designed to prevent a repeat of the 2008 financial crisis.

The EU now plans a later implementation for rules that affect banks’ trading businesses, since those activities are global in nature, said the people familiar with the matter, who asked not to be named because a decision hasn’t yet been announced.

“Given the uncertainty around the implementation of the standards in other jurisdictions, the Commission monitors the international developments and stands ready to act if necessary in specific areas,” said a spokesperson for the Commission.

The development is the latest blow to a landmark package that was already running two years behind schedule, prompted by the pandemic and demands by banks for an additional year of preparations. Some regulators now fear that political backlash in the US, coupled with a European agenda that’s focused more on growth, could lead to a wider rowing back of the measures.

The EU has been under increased pressure over the so-called finalization of Basel III in recent months, with leaders including French President Emmanuel Macron arguing that Europe would disadvantage its banks by moving first. Deutsche Bank AG Chief Executive Officer Christian Sewing had also called on the Commission to act, citing the “fierce” international competition that European banks face.

Implementation of the full package would increase capital requirements for banks in the EU by 9.9%. In the US, they would go up even more, according to initial plans there.

The topic has since become a political flash-point, and US authorities are still fighting over what version of the wider package of measures, known in that country as Basel III Endgame, to agree on. They won’t implement the new rules before the middle of next year at the earliest. The UK has set a start date of mid-2025.

The EU hasn’t made a formal decision about a partial delay, but could do so in the coming weeks, with an announcement possible this summer, the people said.

The European Commission’s hard-fought package includes a provision for the EU’s executive arm to delay the portion that deals with banks’ trading businesses without going back to the European Parliament or governments. Those rules on so-called ‘markets risk’ account for 1.1 percentage points of the EU’s 9.9% increase in capital requirements, the EU’s impact analysis shows.

While implementation of the wider package remains scheduled for the start of next year, the Commission “has the power to delay or tweak the application of certain market risk provisions,” the spokesperson said. “The exercise of this power would not delay the implementation of all new Basel rules, but only the rules on market risk.”

Regulators have warned against a delay. Most recently, European Banking Authority chair Jose Manuel Campa told Bloomberg that the EU should push ahead with its timetable even if the US set a later date.

(Adds context on capital rules from fifth paragraph.)

To contact the reporters on this story:

Laura Noonan in London at lnoonan6@bloomberg.net;

Sonia Sirletti in Milan at ssirletti@bloomberg.net;

Steven Arons in Frankfurt at sarons@bloomberg.net;

Nicholas Comfort in Frankfurt at ncomfort1@bloomberg.net

To contact the editors responsible for this story:

Tom Metcalf at tmetcalf7@bloomberg.net

© 2024 Bloomberg Industry Group, Inc. All Rights Reserved. Terms of Service

// PAGE 2

Europe Poised to Delay Basel Bank Trading Rules by a Year (2)

Christian Baumgaertel

© 2024 Bloomberg L.P. All rights reserved. Used with permission.

• EU lenders fear being disadvantaged by early implementation

The European Union is set to delay key parts of global bank capital rules by a year, so that the bloc’s lenders will not be disadvantaged by continued wrangling over the standards in the US, according to people familiar with the matter.

The EU was due to implement the wider package starting Jan. 1, some seven years after the measures were agreed by regulators on the Basel Committee on Banking Supervision as the final part of rule-making designed to prevent a repeat of the 2008 financial crisis.

The EU now plans a later implementation for rules that affect banks’ trading businesses, since those activities are global in nature, said the people familiar with the matter, who asked not to be named because a decision hasn’t yet been announced.

“Given the uncertainty around the implementation of the standards in other jurisdictions, the Commission monitors the international developments and stands ready to act if necessary in specific areas,” said a spokesperson for the Commission.

The development is the latest blow to a landmark package that was already running two years behind schedule, prompted by the pandemic and demands by banks for an additional year of preparations. Some regulators now fear that political backlash in the US, coupled with a European agenda that’s focused more on growth, could lead to a wider rowing back of the measures.

The EU has been under increased pressure over the so-called finalization of Basel III in recent months, with leaders including French President Emmanuel Macron arguing that Europe would disadvantage its banks by moving first. Deutsche Bank AG Chief Executive Officer Christian Sewing had also called on the Commission to act, citing the “fierce” international competition that European banks face.

Implementation of the full package would increase capital requirements for banks in the EU by 9.9%. In the US, they would go up even more, according to initial plans there.

The topic has since become a political flash-point, and US authorities are still fighting over what version of the wider package of measures, known in that country as Basel III Endgame, to agree on. They won’t implement the new rules before the middle of next year at the earliest. The UK has set a start date of mid-2025.

The EU hasn’t made a formal decision about a partial delay, but could do so in the coming weeks, with an announcement possible this summer, the people said.

The European Commission’s hard-fought package includes a provision for the EU’s executive arm to delay the portion that deals with banks’ trading businesses without going back to the European Parliament or governments. Those rules on so-called ‘markets risk’ account for 1.1 percentage points of the EU’s 9.9% increase in capital requirements, the EU’s impact analysis shows.

While implementation of the wider package remains scheduled for the start of next year, the Commission “has the power to delay or tweak the application of certain market risk provisions,” the spokesperson said. “The exercise of this power would not delay the implementation of all new Basel rules, but only the rules on market risk.”

Regulators have warned against a delay. Most recently, European Banking Authority chair Jose Manuel Campa told Bloomberg that the EU should push ahead with its timetable even if the US set a later date.

(Adds context on capital rules from fifth paragraph.)

To contact the reporters on this story:

Laura Noonan in London at lnoonan6@bloomberg.net;

Sonia Sirletti in Milan at ssirletti@bloomberg.net;

Steven Arons in Frankfurt at sarons@bloomberg.net;

Nicholas Comfort in Frankfurt at ncomfort1@bloomberg.net

To contact the editors responsible for this story:

Tom Metcalf at tmetcalf7@bloomberg.net

© 2024 Bloomberg Industry Group, Inc. All Rights Reserved. Terms of Service

// PAGE 2

Europe Poised to Delay Basel Bank Trading Rules by a Year (2)

Christian Baumgaertel

© 2024 Bloomberg L.P. All rights reserved. Used with permission.