TSL Express Daily News

The Secured Lender

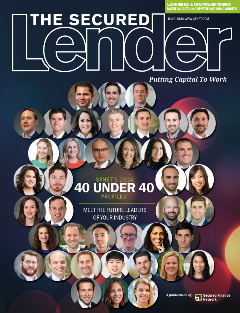

SFNet's 40 Under 40 Awards Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

June 12, 2024

Source: deVere Group

The Federal Reserve will almost certainly hold US interest rates steady at the current 23-year high on Wednesday and investors need to review their portfolios amid a divergence in global monetary policy.

This is the message from Nigel Green, the CEO of deVere Group, one of the world’s largest independent financial advisory and asset management organisations, as the latest Consumer Price Index (CPI) report shows no increase in inflation for May, a sign that inflation may be easing its grip on the US economy.

He comments: “With the annual CPI increase at 3.3%, markets might be hopeful for potentially more rate cuts, but there remains a real risk that the Fed’s cautious approach means that such a move may not come until 2025.

“The Labor Department's CPI report, a key gauge of inflation that tracks the cost of a broad basket of goods and services, remained flat from the previous month.

“This lighter-than-expected inflation data has led some market participants to price in the possibility of rate cuts.

“However, one positive data point is not enough for the US central bank to change course.

“We expect Chair Jay Powell will confirm our prediction in the press conference.”

Federal Reserve officials cite the robust labor market as a significant factor in their decision to maintain the current rate. The strength of the job market provides the Fed with the flexibility to keep rates elevated, contrasting sharply with recent actions by other major central banks.

Last week, the Eurozone and Canada both opted to cut their rates, and Mexico has also initiated rate reductions.

“This divergence in monetary policy presents a complex landscape for investors,” notes the deVere CEO.

“As the US central bank maintains a tighter stance, global markets are experiencing varying degrees of monetary easing. For investors, this scenario necessitates a reassessment of strategies and portfolios.”

With the Fed’s rates remaining high, sectors such as real estate and utilities, which are sensitive to interest rates, may face headwinds. On the other hand, financials might benefit from higher rates due to increased margins on lending.

As other central banks cut rates, opportunities may arise in international markets. For instance, the Eurozone and Canadian markets could become more attractive as their monetary policies become more accommodative.

Divergent monetary policies also typically lead to currency volatility. Investors should be mindful of potential impacts on their international investments and consider strategies such as currency hedging to mitigate risks.

The future path of Fed policy will be heavily influenced by upcoming economic data. Investors should keep a close eye on reports related to employment, inflation, and GDP growth to anticipate potential shifts in the Fed's stance.

Nigel Green concludes: “The Fed is almost certainly going to keep rates steady amid easing inflation which signals a cautious approach, prioritizing long-term economic stability over short-term market reactions.

“This stance contrasts with recent rate cuts by other central banks, highlighting a global divergence in monetary policy.

“For investors, this new environment requires careful consideration of interest rate impacts, global opportunities, currency risks, and inflation protection.

-ENDS-

e:george@priorconsultancy.co.uk

t: +44207 1220 925

Twitter: @PriorConsults

deVere Group is one of the world’s largest independent advisors of specialist global financial solutions to international, local mass affluent, and high-net-worth clients. It has a network of offices around the world, over 80,000 clients and $12bn under advisement.