TSL Express Industry Deals

Search results not displayed for crawlers

-

nFusion Capital Expands Lending Capacity with New $75MM Line of Credit

July 23, 2024nFusion Capital Finance, LLC, a leading commercial finance company to entrepreneurs, today announced that it has closed and funded a line of credit agented by Synovus Bank, through its Specialty Finance Division, for $75 million. This new facility will allow nFusion Capital to continue its exponential growth.

-

Tenet Secures Credit Facility of Up to $5M and Terminates Private Placement Financing

July 22, 2024Tenet Fintech Group Inc. (CSE: PKK) (OTC Pink: PKKFF) ("Tenet" or the "Company"), an innovative analytics service provider, owner and operator of the Cubeler® Business Hub, today announced that it has secured a credit facility of up to $5,000,000 from Petiana Capital Inc. ("PCI"), and has terminated its ongoing private placement of units of convertible debentures and warrants whereby the Company was looking to raise an additional $5,000,000 (the "Financing").

-

Gibraltar Business Capital Provides $12.5MM to Disruptive Consumer Goods Company

July 22, 2024Starco Brands (STCB), which has five brands under one company umbrella, has been actively expanding its offerings by inventing and acquiring behavior-changing brands and technologies, including Soylent Nutrition, Skylar Body, Art of Sport, Whipshots, and Winona.

-

Great Rock Capital Provides $25 Million of Liquidity to a Sponsor-Owned Pet Supply Company

July 22, 2024Great Rock Capital, an asset-focused commercial finance company specializing in middle market lending, today announced that it has provided $25 million of liquidity through a senior secured credit facility to Phillips Pet Food & Supplies (“Phillips”).

-

Stonebriar Commercial Finance Closes $25 Million to a Regional Lumber Company

July 22, 2024Stonebriar Commercial Finance (“Stonebriar”) today announced the closing of an incremental $25MM secured term loan to a major regional lumber company. The loan is secured by all production equipment and other assets such as rolling stock, real estate and timber tracts.

-

DataCore Secures US$60 Million in Funding to Accelerate Growth and Innovation

July 22, 2024DataCore Software, an industry leader in the data infrastructure and management space, has achieved a significant milestone by raising US$60 million in a financing round led by Vistara Growth, a provider of flexible growth capital to innovative technology companies.

-

NineDot Energy Closes $25 Million Revolving Credit Facility with NY Green Bank (NYGB)

July 22, 2024Dot Energy®, a leading developer of community-scale clean energy projects, today announced the closing of a new $25 million revolving credit debt facility provided by NY Green Bank (NYGB), a division of the New York State Energy Research and Development Authority (NYSERDA).

-

goeasy Ltd. Announces Increase to Revolving Credit Facility

July 22, 2024goeasy Ltd. (TSX: GSY), ("goeasy" or the "Company"), one of Canada's leading consumer lenders focused on delivering a full suite of financial services to Canadians with non-prime credit, announced today that it has completed an amendment to increase its existing senior secured revolving credit facility (the "Credit Facility"), including a term extension, borrowing enhancements and the addition of three new lenders.

-

Litigation Lending Services Announces a New $35 Million Credit Facility

July 22, 2024Litigation Lending Services (LLS), a pioneering force in the litigation funding industry for over 25 years, proudly announces the completion of a strategic $35 million credit facility with a leading Australian based global alternative asset manager. This credit facility further bolsters the Company’s robust financial structure in tandem with its existing fund and balance sheet.

-

Autoliv Secures $125 Million Revolving Credit Facility

July 22, 2024Autoliv (NYSE:ALV) Inc., a global leader in automotive safety systems, has entered into a $125 million revolving credit agreement with Standard Chartered (OTC:SCBFF) Bank, announced on Thursday. The five-year facility, which matures on May 23, 2029, will bolster the company's financial flexibility and support general corporate functions.

-

Wingspire Capital Agents $110 Million Revolver to Phillips Pet Food & Supplies

July 22, 2024Wingspire Capital agented a $110 million senior secured revolving credit facility to Phillips Pet Food & Supplies. The credit facility was used to refinance existing debt and provide enhanced liquidity as the business continues to grow and expand its brand offering.

-

TPG Angelo Gordon to Provide Exclusive Growth Capital for Andover Storage Lending

July 22, 2024TPG Angelo Gordon, a diversified credit and real estate investing platform within TPG, is excited to announce that it is serving as the exclusive financing partner of Andover Storage Lending, a recently launched platform that seeks to originate non-recourse financing for self-storage sponsors nationally. This partnership meaningfully expands TPG Angelo Gordon’s relationship with Andover Properties, a leading owner and operator of storage properties nationwide.

-

Cart.com Secures $105 Million in Debt Refinancing from BlackRock

July 22, 2024Cart.com (the “Company”), a leading provider of unified commerce and logistics solutions that enable merchants to sell and fulfill wherever their customers are, today announced it has secured a $105 million term loan facility provided by funds and accounts managed by BlackRock (“BlackRock”).

-

Slope, AI-Led B2B Payments Platform, Secures $65 Million Strategic Equity and Debt Funding Provided by J.P. Morgan and Others

July 22, 2024Following continued strong traction and robust demand, Slope has closed an additional financing round, taking total funding to $252M ($77M in equity and $175M in debt). The funding will be used to scale operations as the B2B payments platform continues serving many of the world’s largest enterprises. Alongside J.P. Morgan Payments, other participants in the round include Y Combinator, Jack Altman, and Max Altman’s new fund, Saga.

-

Health Catalyst Announces New Credit Facility for up to $225,000,000

July 18, 2024Health Catalyst, Inc. ("Health Catalyst" or the "Company") (Nasdaq: HCAT), a leading provider of data and analytics technology and services to healthcare organizations, today announced it has entered into a five-year term loan facility for up to $225,000,000 (the "Credit Facility" or the "Financing") with Silver Point Finance, the direct lending business of Silver Point Capital, L.P.

In This Section

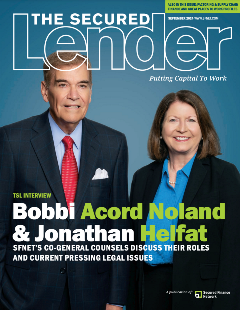

The Secured Lender

SFNet's Factoring & Supply Chain Finance And Great Places To Work Issue