TSL Express Industry Deals

Search results not displayed for crawlers

-

Sound Point Meridian Announces $100 Million “Net Asset Value” Credit Facility

July 10, 2024Sound Point Meridian Capital, Inc. (NYSE: SPMC), a closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, as amended (the “Company”), today announced that it has entered into a $100 million “net asset value” revolving credit facility with Canadian Imperial Bank of Commerce (“CIBC”), as a lender and administrative agent, which may be increased up to $125 million pursuant to the terms thereof (the “CIBC Credit Facility”).

-

Audax Private Debt Provides Financing to Support Macquarie Capital’s Acquisition of Kalkomey

July 10, 2024Audax Private Debt announced that, as Joint Lead Arranger, it provided a unitranche credit facility to support Macquarie Capital in their acquisition of Kalkomey (or the “Company”), a provider of online recreational safety education in North America.

-

Monroe Capital Supports PrecisionX Group’s Acquisition of National Manufacturing Co.

July 10, 2024Monroe Capital LLC (“Monroe”) announced it acted as sole lead arranger and administrative agent on the funding of a senior credit facility to support the acquisition of National Manufacturing Co. ("National" or the “Company”) by PrecisionX Group, an existing portfolio company of CORE Industrial Partners (“CORE”). PrecisionX Group was formed in 2023 following two previous CORE acquisitions, GEM Manufacturing and Coining.

-

Naked Wines Secures USD60 Million Facility to Invest in Quality Wines

July 9, 2024Naked Wines PLC on Tuesday said it secured a new credit facility as the company also announces plans to recruit a new chief financial officer. The Norwich, England-based online wine retailer said CFO James Crawford has declared his intention to resign and step down from the board later this year in the autumn period.

-

ACEN Secures $150 Million Five-Year Syndicated Green Term Loan

July 9, 2024ACEN, through its subsidiary ACEN Renewables International Pte. Ltd., has secured a $150 million five-year syndicated green term loan and revolving credit facility. Additionally, this transaction was well-received by a consortium of international financial institutions. The funds from this loan will support ACEN’s presence in the Asia Pacific.

-

TAB Bank Provides $7 Million Credit Facility to Fuel Transportation Company’s Growth

July 9, 2024TAB Bank has extended a $7 million credit facility to a family-owned transportation and brokerage company in the Southeast. The partnership will support the company’s growth and evolving working capital needs.

-

Tiger Finance Posts Strong Q2 Lending Growth in 2024

July 9, 2024

-

Tiger Finance Posts Strong Q2 Lending Growth in 2024

July 9, 2024Tiger Finance's lending platform continued to grow in the second quarter ended June 30, providing $90 million in financing to retail and other borrowers across North America.

-

Tiger Finance Posts Strong Q2 Lending Growth in 2024

July 9, 2024Tiger Finance's lending platform continued to grow in the second quarter ended June 30, providing $90 million in financing to retail and other borrowers across North America.

-

SLR Credit Solutions Agents Senior Credit Facility For Quantcast

July 9, 2024SLR Credit Solutions (“SLR CS”) announced the closing of a $65 million Senior Credit Facility for Quantcast Corporation (“Quantcast” or the “Company”), a leader in applying artificial intelligence (AI) to programmatic advertising.

-

Rosenthal & Rosenthal Closes Three California-Based Transactions

July 9, 2024Rosenthal & Rosenthal, Inc., the leading factoring, asset based lending, purchase order financing and inventory financing firm in the United States, today announced the completion of two asset-based lending transactions totaling $7.5 million and one collection factoring facility.

-

J D Factors Provides $8,625,000 in new Factoring Facilities During June

July 9, 2024J D Factors provided $8,625,000 in new factoring facilities to 37 new clients in the US and Canada during the month of June. Some of these facilities include: a $900,000 factoring facility for a transportation company in Alberta; a $1,000,000 factoring facility for a commercial relocation company in California, a $250,000 factoring facility for a truck repair and parts distribution company in Ontario.

-

J D Factors Provides $8,625,000 in new Factoring Facilities During June

July 9, 2024J D Factors provided $8,625,000 in new factoring facilities to 37 new clients in the US and Canada during the month of June. Some of these facilities include: a $900,000 factoring facility for a transportation company in Alberta; a $1,000,000 factoring facility for a commercial relocation company in California, a $250,000 factoring facility for a truck repair and parts distribution company in Ontario.

-

J D Factors Provides $8,625,000 in new Factoring Facilities During June

July 9, 2024J D Factors provided $8,625,000 in new factoring facilities to 37 new clients in the US and Canada during the month of June. Some of these facilities include: a $900,000 factoring facility for a transportation company in Alberta; a $1,000,000 factoring facility for a commercial relocation company in California, a $250,000 factoring facility for a truck repair and parts distribution company in Ontario.

-

J D Factors Provides $8,625,000 in new Factoring Facilities During June

July 9, 2024J D Factors provided $8,625,000 in new factoring facilities to 37 new clients in the US and Canada during the month of June. Some of these facilities include: a $900,000 factoring facility for a transportation company in Alberta; a $1,000,000 factoring facility for a commercial relocation company in California, a $250,000 factoring facility for a truck repair and parts distribution company in Ontario.

In This Section

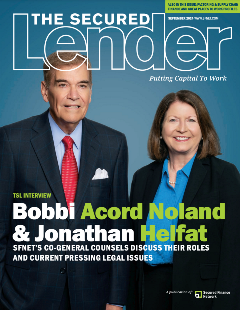

The Secured Lender

SFNet's Factoring & Supply Chain Finance And Great Places To Work Issue